I’ve given a speech on global stock market valuations about 20 times over the past few years. Usually, if the crowd is small enough, I’ll pass around a piece of paper and ask people one question:

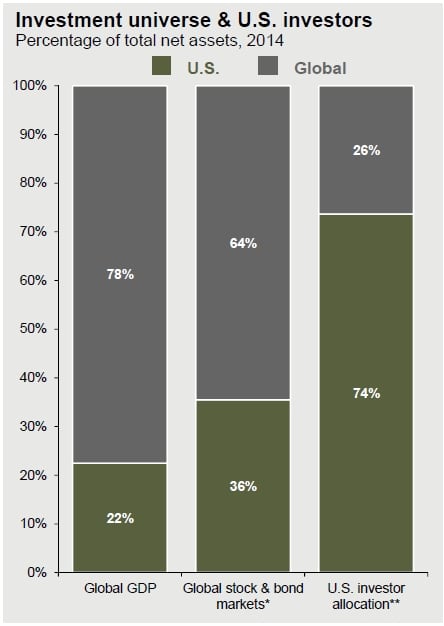

“How much of your global stock portfolio is in US stocks?”

The answer always varies a few percentage points, but almost always right around 70%. It should be around half (at most) as a starting point. Don’t feel bad though, as every country in the world suffers from this “home country bias”. We believe it matters even more now as the US is the 2nd most expensive stock market in the world out of 44 countries. Granted, it’s not that expensive, but there are much better opps elsewhere. Below charts are from the JPMorgan Guide to the Markets.

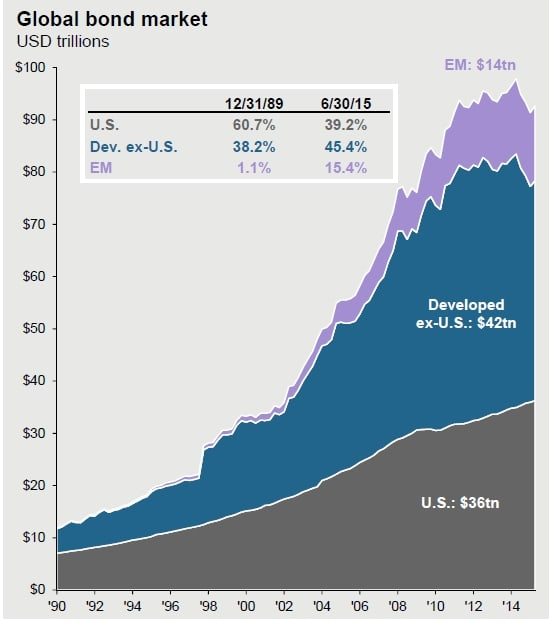

Home bias is even worse for bonds, where almost everyone has a 0% allocation when it is, in fact, the largest asset class in the world. As far as the global market portfolio, you “should” have about a third of your portfolio in foreign bonds.

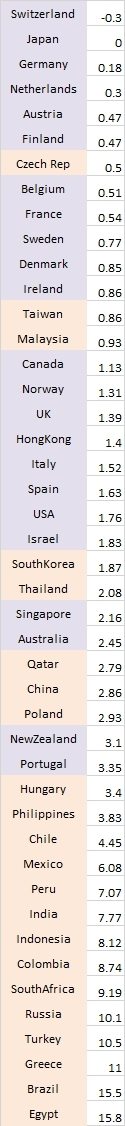

People are not that attracted to sovereigns that have low and negative yields, and they shouldn’t be. Most all of the bond benchmarks hold US, Japan, UK, Germany, and France where the average yield is about 0.5%!

But that shouldn’t scare investors away from applying a value approach to foreign bonds as we outline in our white paper “Finding Yield in a 2% World“. One could easily cobble together a sovereign portfolio that yields 5-8%. Here is a broad summary of bond yields around the world.

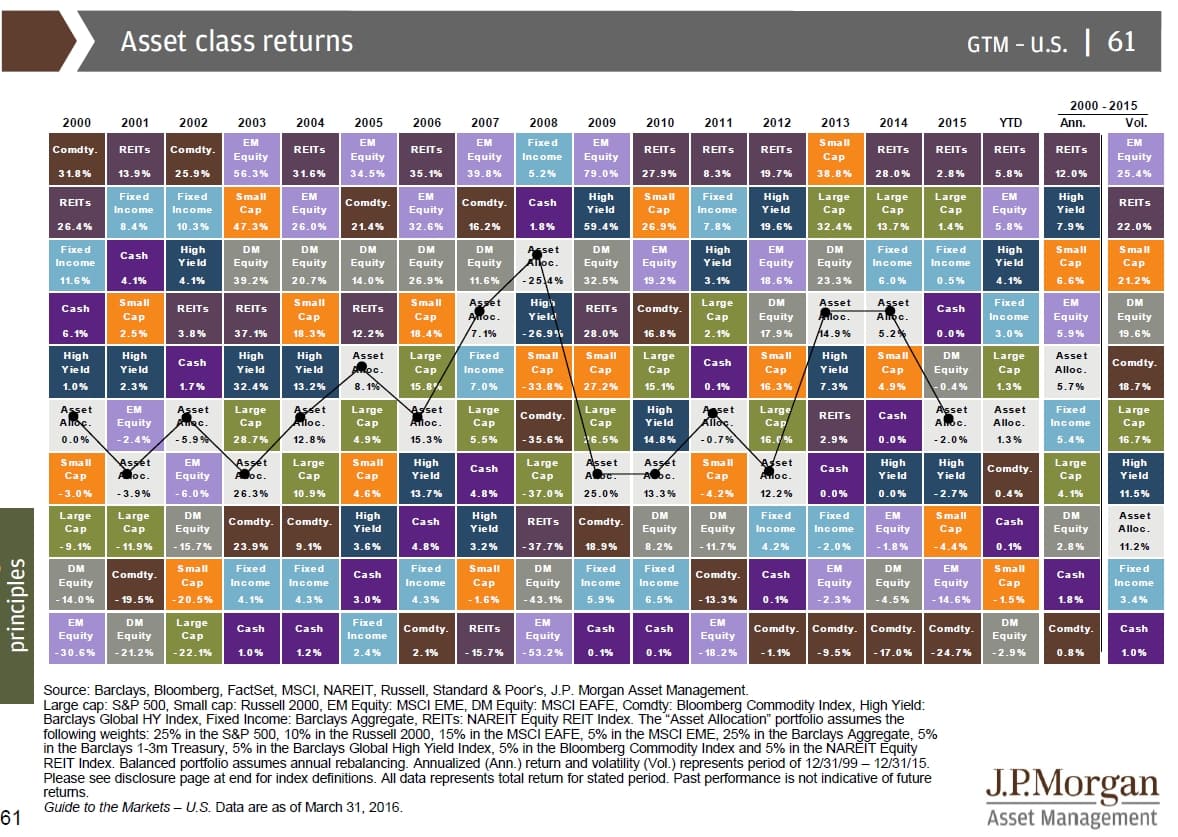

And lastly, a fun periodic table of returns from the same JPM report.