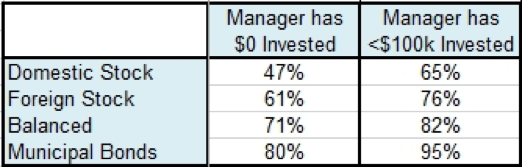

What percentage of mutual fund managers have $0 invested in their own fund?

According to Russ Kinnel at Morningstar FundInvestor, the answers will surprise you. Below is the percent of managers that have nothing, zero, zip, invested alongside the client money they manage:

If you’ve followed my blog for a while, you know where I’m headed. This is absurd. But I guess it shouldn’t be surprising. The mutual fund industry has long been an area dominated by high fees, sales loads, 12b-1 fees and other investor unfriendly practices. Maybe these fund managers are actually smart enough to not invest in the funds they manage…

I believe it’s critical that fund managers have skin in the game. After all, if we don’t believe in our funds enough to invest our own money in them, why should anyone else?

Given this, I put all of my investable net worth into Cambria managed strategies. I also post my specific investment allocation so readers can see exactly where my money is. Here’s my February 2016 post, my January 2015 post, and a few months earlier, an October 2015 post.

I’ve just recently changed my allocation, so I’m publishing the update for anyone who’s interested. Specifically, I’ve reallocated all my investable net worth into our new offering, the Cambria Digital Advisor.

For anyone who’s unaware, my company recently launched this managed account service. Offered at a 0% management fee, Cambria Digital Advisor features six different portfolios, each of which contains a diversified basket of low-fee, global ETFs, invested in both passive and active strategies. Plus, we chose Betterment to provide the technology platform for our service, so the user experience is simple, intuitive, and beautiful. There’s a 15 basis point fee pass-through fee that goes to Betterment for access to this platform. So again, no management fee and no trading commissions, just the 0.15% to Betterment along with the underlying fund fees.

As just mentioned, I’m allocating my investable net worth into Cambria Digital Advisor accounts. Specifically, I’ve opened a handful of different Trinity accounts (“Trinity” is the name of the investment framework upon which we design each client’s account).

The blended risk average of my four Trinity accounts is approximately 3.5. As our portfolios range from “1” (conservative) to “6” (aggressive), this “3.5” average gives me a moderately aggressive portfolio. It’s similar to the portfolio highlighted in our Trinity whitepaper. If you’d like to compare the asset mixes of the six different Trinity portfolios, just click here.

Going forward, providing these asset allocation updates is going to be far simpler as I don’t anticipate making any changes for at least five years. That’s because while the various underlying assets in my Trinity portfolios will rotate in and out based upon our Trinity framework rules, all of that will be done for me, enabling me to focus on everything else on my plate.

As you think about your own investment strategy, ask yourself if you are using a low cost, automated, commission free, tax efficient approach. And if not, perhaps ask yourself, “why not?”

So there you have it, my latest asset allocation. If you have any questions, or are interested in learning more about a Cambria Digital Advisor account, you can either visit Cambria’s newly revamped website, or feel free to email us at info@cambriainvestments.com.

©2016 Cambria Investments, L.P. is a Registered Investment Adviser.

Information and recommendations contained in Cambria’s market commentaries and writings are of a general nature and are provided solely for the use of Cambria its clients and prospective clients. This content is not to be reproduced, copied or made available to others without the expressed written consent of Cambria. These materials reflect the opinion of Cambria on the date of production and are subject to change at any time without notice. Due to various factors, including changing market conditions or tax laws, the content may no longer be reflective of current opinions or positions. Past performance does not guarantee future results. Where data is presented that is prepared by third parties, such information will be cited, and these sources have been deemed to be reliable. However, Cambria does not warrant the accuracy of this information. The information provided herein is for information purposes only and does not constitute financial, investment, tax or legal advice. Investment advice can be provided only after the delivery of Cambria’s Brochure and Brochure Supplement (Form ADV Part 2A&B) and once a properly executed investment advisory agreement has been entered into by the client and Cambria. All investments are subject to risks. Investments in bonds and bond funds are subject to interest rate, credit and inflation risk.