We did a fun post a year ago on a particular bombed out stock sector – coal stocks.

Why You Should Ask For Coal (Stocks) In Your Stockings This Holiday Season

It was meant as a light hearted holiday themed example of how investing in big drawdowns can be rewarding. I wasn’t quite expecting coal stocks to double in 2016, but they did.

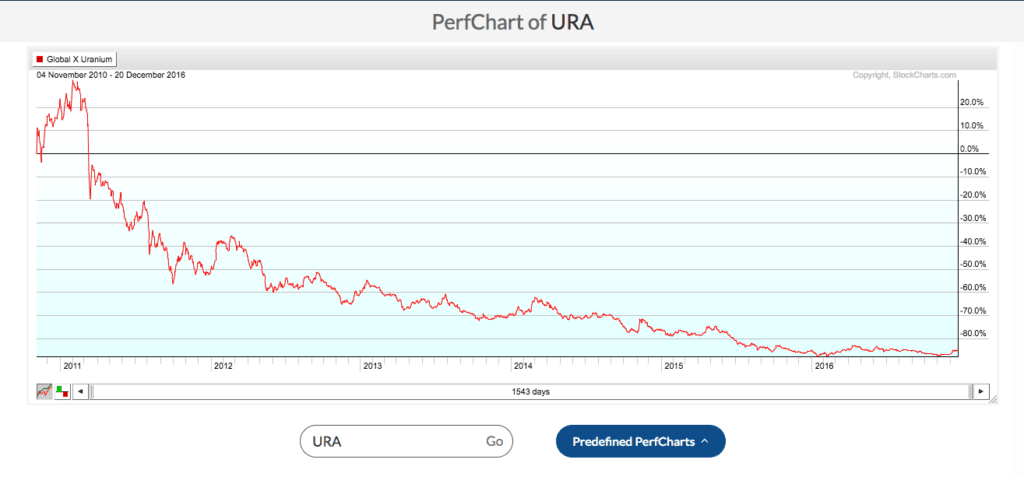

For fun, I was screening for some other sectors and industries that have printed lots of down years in a row. And lo and behold we found one down a whopping six years in a row….uranium stocks!

Since 2010 they are down about 90%! Ouch!

Lots of ways to play trades like this…some examples:

- Buy a position, sell after 3 years.

- Buy a position, sell a third after 1, 3, 5 years.

- Buy a position, double the position if it declines 30% (50%? etc) sell a third after 1, 3, 5 years.

- Buy a position when it crosses long term moving average, sell on downward cross.

The exact rules are not that vital. The important part is to write down your trading rules ahead of time (same as your asset allocation rules) so you stick to them!