I have examined a few different ways of cobbling together portfolios from hedge fund 13Fs:

1. Consensus – Putting together a portfolio of names that are owned by multiple funds.

2. Replication – Replicating a single fund with its top 10 holdings.

3. Conviction – The Morgan Stanley study that bought companies with a high %age of their shares owned by a small number of hedge funds.

Granted, there is *very likely* survivorship bias due to the universe of funds currently in existence. How much this biases the results it is hard to gauge. Possibly the returns will settle closer to the HFR L/S category average, but I think the best value managers will achieve returns that outpace that.

One of the problems I had with my Consensus portfolio was the idea of herding. Just because a number of funds own a stock does not necessarily mean it is their best idea. . .

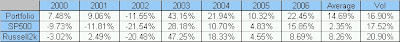

I went back and examined what a “Best Ideas” Portfolio would look like. In this case I simply took the top 2 holdings from 9 value hedge funds, and updated it quarterly. The results are below.

They are highly correlated with the Consensus Portfolio ( ~ .85), but less volatile, and with slightly better returns. This strategy makes more intuitive sense to me than the Consensus.

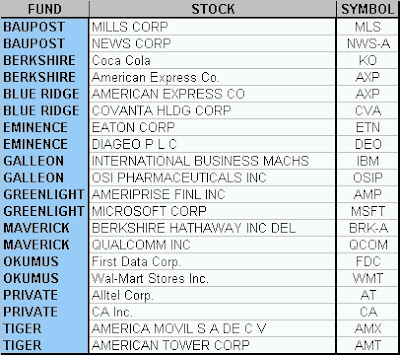

A current portfolio we will track on Stockpickr could include these stocks from the following funds:

Other funds that readers submitted that could be included are:

Gotham

Glenview

Alson

Pabrai

Perry

Lone Pine

Tontine

Relational

Defiance

Appaloosa

Thames

Witmer

Libra

Feinberg

MLF