Are option selling funds a blowup waiting to happen?

For the past few years there has been a proliferation in option selling CTAs. These funds, while wildly different in their trading methodology, generally sell options on the US stock indices. This tactic produces very strong risk adjusted numbers – as evidenced by these funds dominating the Sharpe rankings of CTAs. They are very consistent, earning ~1-2% per month and achieving roughly 80% profitable months. That is, until they don’t.

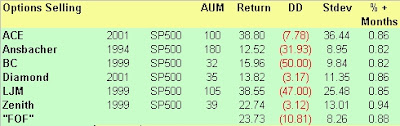

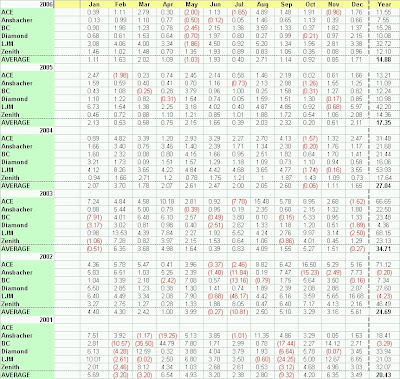

Below is a table of 6 option selling funds I have tracked for the past few years, and at the end of the article is a summary of their returns since 2001 from IASG. I am sure there are many more, as well as dozens that have gone out of business. Ansbacher is the grandfather of options selling, and has the longest track record.

The biggest problem with these funds is the blowup risk, especially in the current low volatility environment. I am anxiously awaiting the returns for February for these funds to see how they withstood the downdraft last week. The returns have declined from the mid-20’s in the past few years to an average in 2006 of 15%.

I wouldn’t invest in one of these funds, but if I HAD to, I would examine 2 ways to gain exposure.

1. Create a FOF of option sellers. This should help to minimalize impact of any one fund blowing up. However, since most funds only trade one market, large risks remain. The performance of a an equal-weighted basket of these funds is in the above table as “FOF”.

2. Sell options on a broad portfolio of world futures markets. Only one fund to my knowledge (and only recently) has persued this strategy (ACE). Selling options on a broad basket of uncorrelated futures markets makes more sense to me than one single market. I did a simple backtest of this strategy a few years back, and the results were promising. There is a brokerage in Florida that exists in this niche, and they have a book out on the subject.

I would speculate that these funds booked an average -5 to -10% decline in February. . .