The equity markets took a big whoosh down today, and many other asset classes suffered as well:

That’s what market pundits talk about when they say that all correlations go to 1 when the market is declining. Bonds were up on the day, but that’s not much solace when your equity funds are down 4%. As taken up by Nelson Freeburg in the recent issue of Formula Research, most of the risk in a typical 60/40 allocation is concentrated in equity risk. Not just 60%, but closer to 90%. What is an investor to do when structuring optimal portfolios? Risk-parity is a topic I am very interested in, and one of the reasons I originally started writing on this blog. My very first post linked to risk parity discussions from the best of the best institutional managers. (Highly recommended reading).

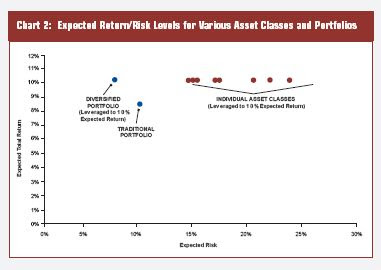

A quick summary – there is no reason to accept asset classes pre-packaged the way they come now – ie 100% long. An investor can either lever up or down his exposure to an asset class (many confuse risk with leverage) to achieve desired levels of risk and return. An investor could place more in bonds (or other low vol instruments like some hedge funds) and then leverage up the entire portfolio – resulting in a superior allocation than the previous portfolio.

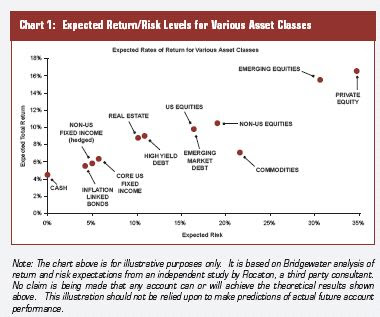

The Bridgewater has two charts that include risk and return expectations from a Rocaton study. The first has the expected return/risk levels for various asset classes:

The second has the same asset classes (de)leveraged to the same expected return:

Confusing? Yes, but take a look a the previous links for a much more thorough discussion of the topic. A better allocation than the simple 20% equal weighted in my example would be to leverage up the bonds to 40-60% while keeping the other asset classes at 20%. . .But I want to focus on something else – the Bridgewaters of the world do a better job of explaining the topic than I do.

Many funds have rolled out alternative mutual funds and ETFs recently, and it is instructive to examine how they have performed on this down day. One in particular, the Claymore Sabrient Defender Index (DEF), was designed to “Defend” against down days. The specifics of the methodology are proprietary, but in general terms, the fund is rebalanced quarterly by looking back at the last quarter and seeing what did well on the down days. So how well did it play D today?

An awful -3.00%.

Below is a chart of other funds that track alternative strategies including fund of funds, long/short equity, market neutral, arbitrage, covered calls, convertible bonds, private equity, and currency harvest. All are publicly traded in the US as mutual funds or ETFs.

Most of the funds performed as expected, namely, the lost less $ than the equity indices. There are a couple exceptions. Hussman gets the gold star for the day as the only fund that was up (he has been notably bearish for some time). Geronimo’s Absolute Return FOF mutual fund (GPHIX) lost a staggering -6.2%. They must have a levered exposure to the HFR Indices, otherwise I cannot fathom how they lost that much in a day being an Absolute Return FOF.