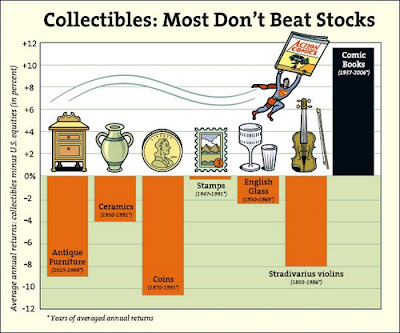

“A savvy collector who purchased a first edition of a Fantastic Four comic book for 10 cents and kept it in pristine condition over the past 45 years could sell it today for $36,000. That comes to a compounded average annual return of 32 percent” – Kevin Hassett, American Enterprise Institute, posted on American.com

American.com takes a look at historical returns for comic books, and found that since 1937 they have outperformed equities and all other collectibles by over 10%. Unfortunately my brother signed every comic we have from the Golden Era with magic markers, so I am guessing our returns will be slightly less. Any comic book collecting hedge funds out there?

I just finished a quick scan of “Quantitative Equity Portfolio Management“, a great primer set at the MBA/grad level. It covers all the basics in setting up stock screens and factor based ranking models.

They beat out the boys at Panagora, who share the same title, “Quantitative Equity Portfolio Management“. . .Nevertheless, I have it on pre-order.

Another book on shelf is “Way of the Turtle” by Curtis Faith which chronicles the famous “Turtle” experiment of Richard Dennis and William Eckhardt. Curtis also just joined us in the blogoshpere, welcome Curtis! He also runs the quality Trading Blox software – and I recommend the forum for some engaging trading discussions.

“The Dhandho Investor: The Low- Risk Value Method to High Returns” by Monhish Pabrai. Pabrai is one of the funds we follow in the hedge space, and since its inception in 1999, the fund has annualized returns of over 29%. I have high hopes for this book, although I am nervous it will be another Buffett cheerleading book. I have not read his other book,”Mosaic: Perspectives on Investing“.

Lastly, the Free Cash Flow Book mentioned in my previous Payout Yield post.

Oh, and if anyone wants to sell me a copy of “Margin of Safety” under $100, let me know.