I’m a big fan of Marc Faber, and not just because we share a great surname. I especially enjoy reading his Barron’s roundatable interviews – he always seems to have quirky picks that are usually spot on (sometimes spectacularly so). Seriously, how many other market gurus do you know that have a lifestyle tab on their webpage?

One of his picks this year was volatility. The VIX is up roughly 15% today, and nearly 100% for the year. (I also like that he picked farmland – can you see Cohen making such a pick?)

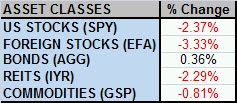

In February I penned a post titled, “Got That Sinking Feeling?“. The equity markets were down 3-4% on the day. We experienced a fairly similar scenario today, and here is how five general asset classes performed:

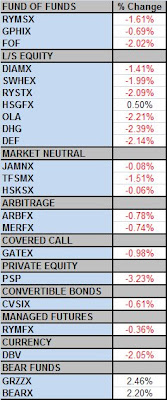

Not so good. How about the listed alternatives? Below you can see that the majority of these funds don’t do a good job of hedging on a down day. The market neutral funds had a pretty good showing. Hussman had a (relatively) good day, but he has been bearish and underperforming for quite some time. I have yet to witness the Sabrient Defender ETF defend against anything on a down day so far this year. Managed futures did OK, currency harvest did awful, and of course the bear funds had a stellar day.

Still, it looks like most of these funds are heavy in the equity risk department. (By the way, if anyone can poke a hole in this nice-looking liquidation play, let me know.)