Sounds like a Harry Potter title doesn’t it?

ORB actually stands for “Opening Range Breakout”, and is part of the title for an out of print book by Tony Crabel – “Day Trading With Short Term Price Patterns and Opening Range Breakout”. This book can be had for the bargain price of $500 on Amazon.com. Here is a description:

“Explains the importance of detailed studies on price patterns. Attempts to find forecastable events based on the relation between opening, closing, high and low prices. Includes computer-tested answers to many common short term trading questions. Consists of 5 sections: 1) opening range breakouts, 2) short-term price patterns, 3) patterns of expansion and contraction, 4) combination of price patterns with expansion and contraction patterns, and 5) openings and closings that occur in various segments of a price bar; includes the results of computer analysis for each topic. “

A list of some of the patters mentioned in the book is at the bottom of the post (many software vendors have the patterns coded/bundled into their software). Personally, I would just shell out the $30 and buy the bundle of eight articles he wrote for the magazine “Technical Analysis of Stocks and Commodities”. I read these articles years ago when I was working on stat arb systems. There are also free file sharing sites abound that have digital versions of virtually any book. (A more recent treatment of short term trading strategies can be found in the voluminous work of Larry Connors.)

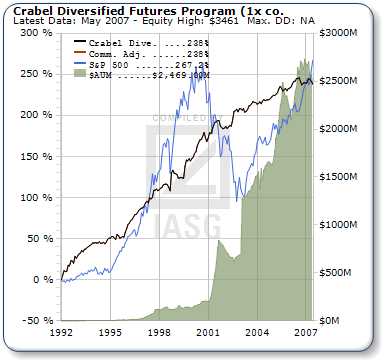

How has Crabel actually performed? (He worked with Vic Niederhoffer at one point.) He has four programs listed on IASG with AUM over $3 billion. Below is an equity curve for his longest running program, diversified futures:

Average returns of 8.7% with vol of around 6%. Pretty decent low vol performance.

It is interesting to note that Brett Steenbarger over at TraderFeed even goes on to mention that “less well appreciated is that Crabel’s book is explicitly founded on the base of Ayn Rand’s epistemology.”

Other expensive titles include:

“Margin of Safety” – $1,000

“Mosaic” – $400

“Being Right or Making Money” – $800

—-

CRABEL ORB Setups:

NR; Narrow Range – Today’s trading range was narrower than the previous days range.

NR7; Narrow Range 7 – Similar to the NR. The range was the narrowest compared to the last 7 trading days.

WS; Wide Spread – Exact opposite of the NR. Today’s trading range was wider than the previous days range.

WS7; Wide Spread 7 – Similar to the WS. The range was the widest compared to the last 7 trading days.

Inside Day – Price bar in which the high is lower than the previous days high AND the low is higher than the previous days low.

Outside Day – Price bar in which the high is higher than the previous days high AND the low is lower than the previous days low.

IDnr4 – An inside day with the narrowest trading range in the last 4 trading sessions.

Bear Hook – NR with Open < Previous Low and Close > Previous Close.

Bull Hook – NR with Open > Previous High and Close < Previous Close.

Stretch – The 10 period SMA of the absolute difference between the open and either the high or low, whichever difference is smaller.