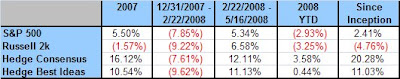

Looks like another great quarter for the hedge fund tracking strategies. My previous observation that the funds exhibit similar downside volatility and much higher upside volatility looks like the right take away from this Q. Historical testing showed a FOF approach outperforms by about 6-12% a year, and out-of-sample results in 2007 (roughly 10% outperformance) and 2008 (roughly 5% YTD) is a good indication that the model is working.

I sat down with Mark Yusko from Morgan Creek the other week, and he commented that the top holding for many of these funds on their 13F is likely not their best idea, but rather was their best idea and has simply appreciated the most. I reserve judgement until I see most of the data from lots of funds, which is why alphaCLONE is going to be such a cool software app (I’m starting to get really excited, the behind the curtains look so far is awesome). Sign up to keep abreast of the launch, targeted for this Summer.

On to the 13fs!

Bespoke takes a look at the hedge fund sector bets here. Taking the top three sectors from each manager below, I find the top sectors are Services 39%, Tech 37%, and Financial at 14%.

Hedge Fund Consensus – Top holdings owned by 15 value hedge funds, ranked by # of funds with the same position. Mastercard was the standout performer, and America Movil (AMX) was the only laggard. Everyone still loves Qualcomm.

AAPL (3)

AMX (4)

AXP (3)

COV (3)

EMC (3)

GOOG (3)

MSFT (3)

QCOM (5)

WMT (3)

The list of double repeats is at the end of the post.

Hedge Fund Best Ideas – Top two holdings from each of 10 value hedge funds listed below. Mastercard (MA) and Southwestern Energy (SWN) were the standout performers, and America Movil (AMX)was the worst.

AAPL

AMT

AMX

AXP

CA

CDNS

CSX

GOOG

HPQ

KO

MHP

MSFT

NWS

ORCL

QCOM

RIMM

ROST

TGT

WFC

WLP

—-

Baupost Group

Klarman doubled down on his top three holdings News Corp (NWS), Wellpoint (WLP), and Exterran (EXH). He sold out of his SLM position. New positions include Theravance (THRX), Sapphire Industrials (FYR). and Borders (BGP).

Top sectors in the portfolio include:

Financials 30%

Services 21%

Energy 22%

Top 10 holdings are:

NWS

WLP

EXH

LINE

UFS

THRX

APL

ELOS

HRZ

FYR

Blue Ridge Capital

Griffin runs a pretty diversified portfolio, and he was added to his top name American Express (AXP). New positions include Google (GOOG), Apple (AAPL), and Wyeth (WYE).

Top sectors in the portfolio include:

Services 30%

Financials 22%

Technology 25%

Top 10 holdings are:

AXP

GOOG

CVA

AAPL

SCHW

MIL

DISCA

TV

WMT

MLM

Warren Buffett

Top 10 holdings are:

KO

WFC

PG

AXP

BNI

KFT

JNJ

WSC

USB

BUD

Eminence Capital

New position in Cypress Semi (CY), sold out of Comcast (CMCSK).

Top sectors in the portfolio include:

Services 28%

Technology 40%

Conglomerates 10%

Top 10 holdings are:

ROST

AXP

ORCL

PHG

FISV

SAI

MSFT

ZBRA

DGX

CSCO

Greenlight Capital

50% of Einhorn’s portfolio is in his top three holdings, and he was adding to all three – Target, Microsoft, and Ameriprise, and selling some Helix. New positions include Patriot Coal (PCX), Echostar (SATA), and Energy Partners (EPL).

Top sectors in the portfolio include:

Services 27%

Financial 17%

Technology 17%

Top 10 holdings are:

TGT

MSFT

AMP

HLX

MDC

URS

COV

HMA

BAGL

MIM

Lone Pine Capital

New positions in XTO Energy (XTO) and Monsanto (MON), sold out of Coach (COH).

Top sectors in the portfolio include:

Services 16%

Technology 43%

Energy 16%

Top 10 holdings are:

GOOG

QCOM

AMX

AAPL

XTO

SD

FAST

SWN

INFY

V

Maverick Capital

Ainslie was adding to his largest holding Research in Motion (RIMM), and added new positions in Starbucks (SBUX) and Wyeth (WYE).

Top sectors in the portfolio include:

Technology 30%

Services 25%

Healthcare 15%

Top 10 holdings are:

RIMM

AAPL

QCOM

AMD

MRVL

BK

TXT

AZO

GME

AVP

Okumus Capital

Okumus’s top holding is a new position – Cadence design System (CDNS). He added to McGraw Hill (MHP) and initiated a position in CA. He sold out of Bed Bath and Beyond (BBBY).

Top sectors in the portfolio include:

Technology 52%

Services 46%%

Top 10 holdings are:

CDNS

MHP

LTD

ODP

ARB

PZZA

MHP

SHOO

CA

QSFT

Private Capital

Top sectors in the portfolio include:

Services 32%

Technology 35%

Financials 22%

Top 10 holdings are:

CA

HPQ

MGM

SYMC

RCL

INTS

RJF

EK

JWA

S

Tiger Global

New positions in Apollo (AINV) and Cree (CREE). Sold out of

Top sectors in the portfolio include:

Services 33%

Technology 28%

Financial 14%

Top 10 holdings are:

CSX

AMT

AMX

MA

GOOG

MELI

BIDU

TDG

SBAC

PCLN

List of double repeats:

BRK

CA

CSCO

CTV

DFS

ETN

INFY

MA

MDC

MHP

ODP

ORCL

PCLN

SAI

SBAC

TGT

TMO

TT

TXT

UTX

WLP