The stock markets are very close to bear territory (one more day like today and it will be an official bear market in the S&P 500). I love this Bev Doolittle painting so I had to repost it.

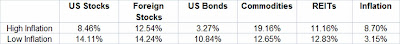

Long time readers know I am a big fan of commodities. After today’s dump in stocks (and run up in commodities indexes) I thought I would write a very brief post that is similar to the post I did a few weeks ago on asset allocation and interest rates. I think this table speaks for itself.

It shows the average return to five indexes over two periods. 1972-1981 is characterized by rising interest rates and high inflation. 1982-2007 is characterized by falling interest rates and low inflation. Note the only asset class that performs better in the latter. In periods of low inflation and declining interest rates stocks, foreign stocks, bonds and REITs all performed better which makes intuitive sense because they are all capital assets and benefit from lower interest rates. Commodities on the other hand, turn in much higher returns when interest rates are going up, which makes sense due to their correlation with inflation and unexpected inflation.

If you don’t have commodity exposure (or your portfolio manager doesn’t), why not? That is probably a hard question to answer right now. Some example ETFs are: DBC, GSP, GSG, DJP, RJI, DBA, DBB, DBE, DBP.

Click on the table to enlarge.