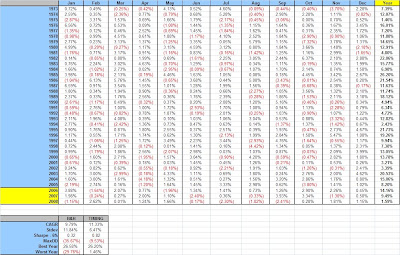

Results are below for 2008, frictionless (no fees or trading costs are deducted), and monthly and yearly rebalances. The model is out-of-sample since 2006. I will be doing an update to the white paper by the end of the month, so stay tuned!

S&P 500: -36.77%

TIMING: 1.33%

EAFE: -43.06%

TIMING: -8.17%

10 YEAR: 21.51%

TIMING: 21.51%

GSCI: -46.49%

TIMING: 1.08%

REITs: -37.33%

TIMING: -9.67%

Monthly Rebalance, equal-weighted:

B&H: -29.76%

TIMING: 1.59%

Yearly Rebalance, equal-weighted:

B&H: -28.43%

TIMING: 1.22%

That’s 36 profitable years in a row for the timing model (just barely thanks to bonds ripping in November and December!).

Click on table to enlarge: