I spend a lot of time talking about our industry (and all the warts and snake-oil that is sold) with the boys at BlackStar Funds. Below is a summary of a back and forth where we discuss survivor bias, as well as just how rare a Sharpe Ratio of 1 is over long periods of time.

In this case, we’re talking about Commodity Trading Advisors (CTAs). The 25 largest CTA’s with at least 10 years of performance history:

Avg CAGR: 13.2%

Avg Volatility: 14.9%

Avg Max DD: -18.1%

Avg Sharpe: 0.66

These number are AFTER the fact, and do not include the results of funds that have disappeared (and this effect is HUGE). They are the largest CTA’s because they’ve had the best returns (or the best marketing).

We have a done a ton of posts in the past that show how survivor bias misstates returns by 4% or more per year.

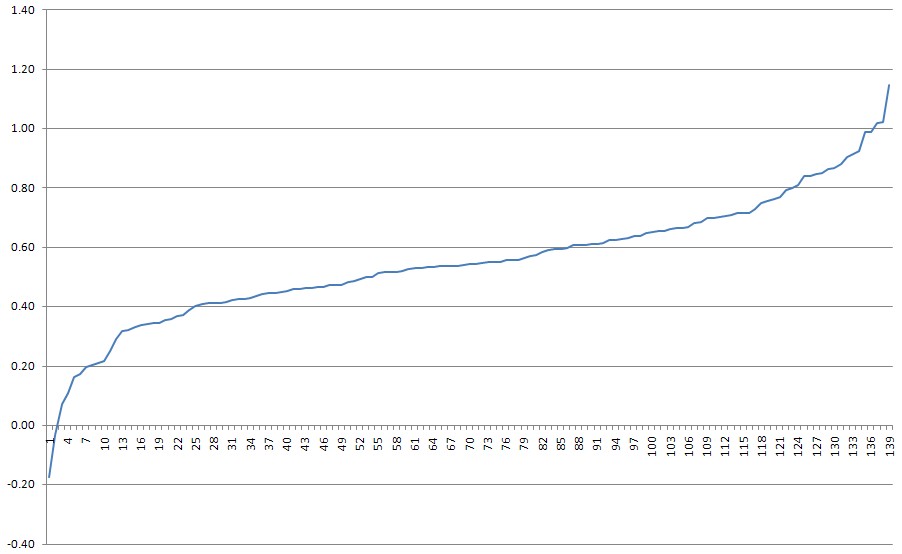

Out of 140 CTA’s with 10+ years of track record (regardless of assets), only 3 have Sharpe ratios greater than 1.

For some great background reading on professionals and Sharpe Ratios check out this old post. Also here is a nice old post of mine on hedge funds and survivor bias. This great white paper shows that CTA’s do indeed add value, but they capture most of it in their fees.

The biggest of these is AAA Capital Management, a discretionary Energy trader with $640 million AUM. The second is Newton Capital Partners, a global macro fund that trades stock indexes, currencies, and government bonds with $178 million AUM. The third is Capricorn Advisory Management, a dedicated currency manager with $62 million AUM.

Even with survivorship bias almost nobody has been able to sustain a Sharpe ratio above 1.

Below is the cumulativeve distribution of the Sharpe ratios for the 140 CTA’s with the longest track records. Look familiar??? Remember, this is with all the funds that disappeared because they blew up.