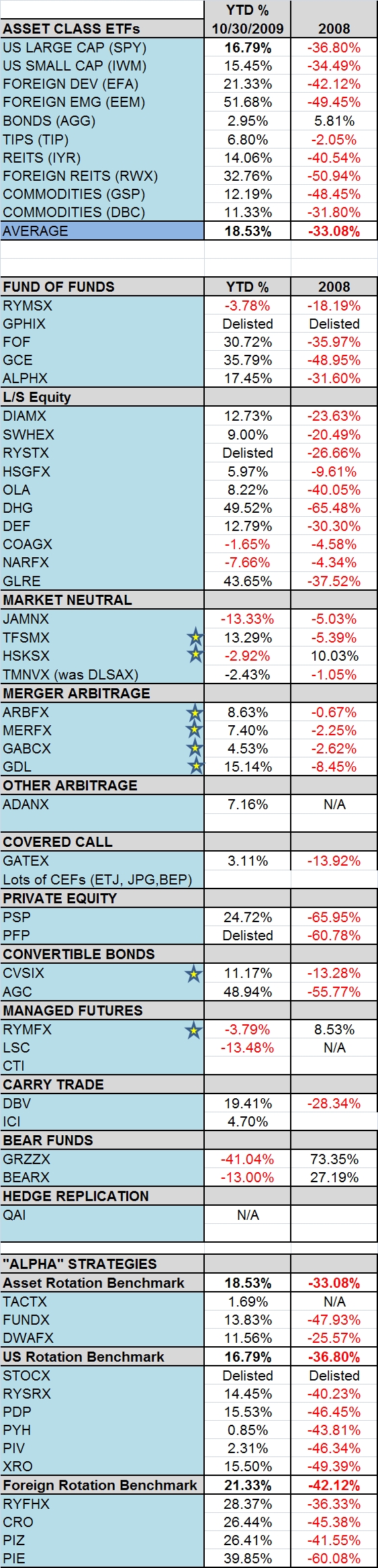

This is an update we do every once in awhile that lists some of the the alternative mutual funds and ETF/ETNs. Most really fail to deliver any value, but a few do a good job. I long ago gave up talking about the foreign listed hedge funds, there didn’t seem to be much interest.

We had an ETN that was going to launch with one of the top media groups in the world (which also would have gotten around the PFIC issues (which is also why PFP shut down)), but last Fall happened and they pulled the plug. Shortsighted and a major shame. (Not to mention the OTHER ETF we had a NYSE launch date for, I’m guessing you can figure out what strategy that was on?)

If there are any I am missing leave a comment and I’ll add to the table (I realize I’m probably missing a ton of the L/S guys…any good ones?).

I fixed one or two errors, then added gold stars to the funds that did well – mostly in market neutral, merger arb, and managed futures. Note how poor long/short funds did… :