I will be in Chicago next week at the M* ETF Conference Wed Sep 15th – Fri Sep 17th. Drop me a line if you want to meetup.

I will also be in South America in mid to late November (Santiago, Buenos Aires, and possibly a few other cities TBD). Again, drop me a line if you are around!

There are a few more trips lined up (NYC, Denver, Florida) and I will update the blog with dates when confirmed.

—-

I have recently gone back and reviewed nearly all of the 800 odd posts on WB over the past few years. I’ll be writing some longer form analysis on some of the topics in our upcoming research newsletters, but below are a few idea I came across that I could be updated short form…

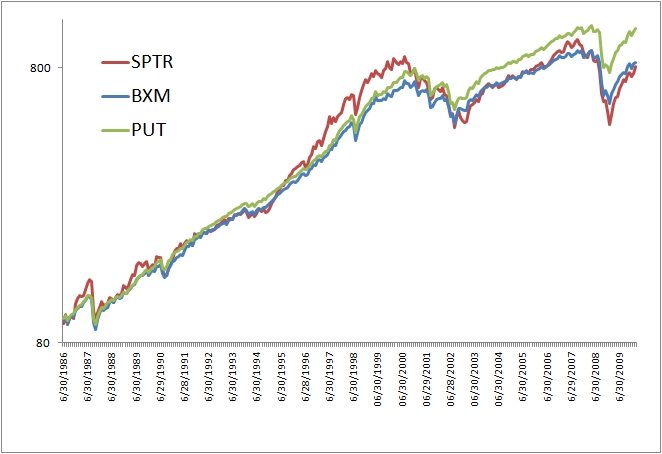

When S&P originally constructed their BuyWrite and PutWrite Indexes they did so with a 1988 start date. I thought that was a little odd, and you can see some of the conversations I had with them back in 2007. They have now since included data back to 1986.

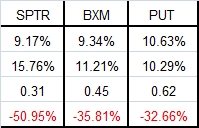

Below is a table and equity curve with data over the whole period FWIW.

Forgot labels:

SPTR = S&P500 Total Return

BXM = BuyWrite Index

PUT = PutWrite Index

CAGR

StDev

Sharpe

MaxDD

(And by the way, if you REALLY want to get interesting start playing around with these different indexes and some basic timing and volatility trading rules…)

—-

Another recent post was one on mean reversion after really bad months (like the one in May). More background here, as well as subsequent performance below:

ETF, May Returns, July-Aug Returns, Annualized

VTI, -7.89%, 1.98%, 12.48%

VEU, -10.90%, 6.96%, 49.71%

VWO, -9.18%, 7.40%, 53.44%