Gold is universally loved as far as I can tell (when Pratt and the hipsters like it that makes me nervous). Can anyone leave a comment on money managers that are currently short or bearish on gold? I don’t know any.

—-

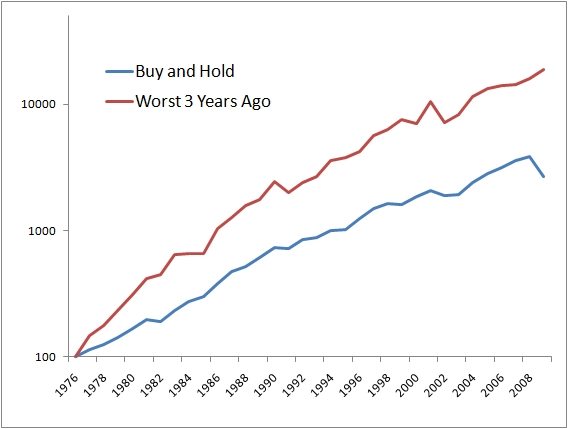

It is pretty well established that markets mean revert from returns of 2-4 years prior. While I am writing a much longer and thorough research piece on mean reversion, I thought I would pass along this little study in the meantime (I know I know blogging has been very light lately). With the GTAA ETF coming out next month some research has been put on the backburner.

All this study does is look at the worst performing asset class from 3 years ago and buys it for a one year hold. Repeat again next year. Beats buy and hold by 6% a year. And guess what asset class was the worst 3 years ago? Yep, that would be REITs up a whopping ~20% YTD.

(Data source: Global Financial Data)

US Stocks – S&P 500

Foreign Stocks – MSCI EAFE

Bonds – 10 Year US Govt

Commodities – GSCI

REITs – NAREIT