The three biggest questions most investors face are 1) How much of their portfolio they place in risky assets, and 2) how they allocate their portfolio across those assets, and 3) if they use risk management or other active strategies. (Well, #1 is really how much they pay in fees and taxes but let’s ignore that area for now.)

I got a ton of emails asking me “what do you think of XXX allocation?”. Everything from Swensen, to Tobias, to the Texas Double Down.

Some popular allocations (or “lazy portfolios”) are here and here. I typed up a few of the more famous ones at the end of the post.

Anyways, I get a lot of emails asking what I think of the Permanent Portfolio (25% US Stocks, 25% Cash (T-Bills), 25% US Long Bonds, 25% Gold) and what I think of applying risk management or market timing to the portfolio.

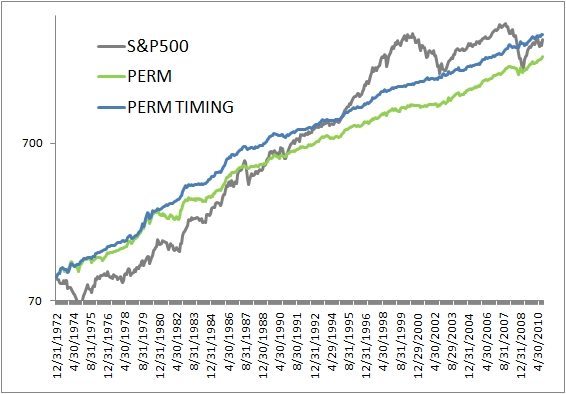

Below is the equity curve of the buy and hold, timing on the portfolio, and the S&P500 (all total returns rebalanced monthly). Even though PERM is 50% in bonds and cash the timing helps due to the highly volatile gold and US equity components.

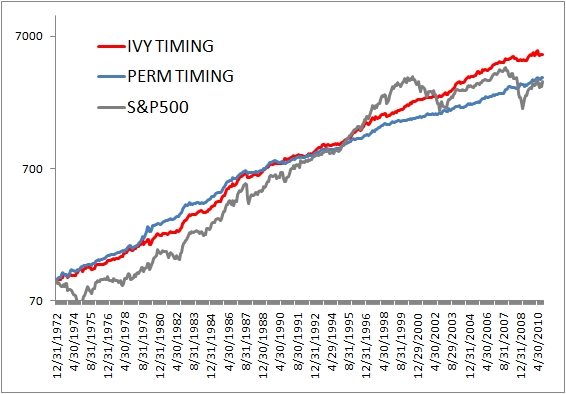

And because I know I am going to get the question, here is the IVY allocation with timing compared to the PERM allocation with timing. The point of this post is not that there is an ideal allocation (well there is of course but it is unknowable as the future is inherently uncertain), but rather that risk management has worked across various allocations. One of the difficulties with the PERM portfolio, certainly today, is that there is a very high allocation to cash (yielding 0%) and long bonds (yielding 3.8%) – which implies that half of your portfolio is targeted to return less than 2%!

Some other famous allocations:

Swensen Portfolio (Source: Unconventional Success, 2005)

30% US Stocks

20% REITs

20% Foreign Stocks

15% US Govt Short Term

15% TIPS

El-Erian Portfolio (Source: When Markets Collide, 2008)

15% US Stocks

15% Foreign Developed Stocks

12% Foreign Emerging Stocks

7% Private Equity

5% US Bonds

9% International Bonds

6% Real Estate

7% Commodities

5% TIPS

5% Infastructure

8% Special Situations

Arnott Portfolio (Source: Liquid Alternatives: More Than Hedge Funds, 2008)

10% US Stocks

10% Foreign Stocks

10% Emerging Market Bonds

10% TIPS

10% High Yield Bonds

10% US Govt Long Bonds

10% Unhedged Foreign Bonds

10% US Investment Grade Corporates

10% Commodities

10% REITs

Permanent Portfolio (Source: Fail-Safe Investing, 1981 )

25% US Stocks

25% Cash (T-Bills)

25% US Long Bonds

25% Gold

Andrew Tobias Portfolio (Similar to Bill Shultheis & Scott Burns’s 3 Fund portfolios)

33% US Stocks

33% Foreign Stocks

33% US Bonds

William Bernstein Portfolio (Source:The Intelligent Asset Allocator, 2000 )

25% US Stocks

25% Small Cap Stocks

25% International Stocks

25% Bonds

Ivy Portfolio (Source: Ivy Portfolio, 2009)

20% US Stocks (S&P 500)

20% Foreign Stocks(MSCI EAFE)

20% US 10Yr Gov Bonds

20% Commodities (GSCI)

20% Real Estate (NAREIT)