Below is an example of what might be covered in the upcoming launch of our monthly newsletter. If you haven’t done so, sign up here!

Any trading system that uncovers alpha must have a justification for why the strategy works. If you cannot explain why the inefficiency exists then you are likely just data mining and exposing your portfolio to unintended risks with uncertain outcomes. Ray Dalio, Founder of the world’s largest hedge fund Bridgewater Associates states

“Because I believe that all criteria for investing (that is, good betting strategies) should have a logic that isn’t time specific, I believe that the alpha generators that make up the ultimate alpha generator should be timeless and universal. By that I mean that they should have worked over very long time horizons and in all countries’ markets.”

There are countless strategies, indicators, and systems that are mentioned in the popular press with such catchy names as The January Indicator, Dogs of the Dow, Elliot Wave theory, Dow Theory, Sell in May and Go Away, and The Fed Model. As a responsible investor that is risking hard earned cash when investing, it is of utmost importance to validate any indicator or system of investing (and yes I include buy and hold based on Modern Portfolio Theory here too!). Even with reams of supporting data it is vital to step back, employ some common sense, and ask why a tendency (because some are just that, tendencies) may work.

Two such anomalies are setting up for a favorable year end and start to 2011. The first is what is known as the Presidential Cycle. This theory goes that equity returns during the third and fourth years of a President’s term are more favorable than the first two years. The fundamental justification is that the President tries to force any difficult legislation into law during the first two years of his presidency. Historically the President’s political party loses power in the midterm elections (as we saw this past November). After the first two years, the task of re-election takes hold and the President is consumed with securing a second term of office or campaigning for his party’s potential replacement. The data bear out that monetary and fiscal policy have historically been easiest during these periods as the President moves the machinery of the Federal Government in order to promote economic growth and lower unemployment.

The historical data support this theory – -there are even studies that go back to the early 1800s (although data are a bit spotty pre-1900). Median returns have been 5% in Year 1, 5% in Year 2, 22% in Year 3 and 11% in Year 4 since 1927. Since World War II the S&P 500 has not had a down Year 3 at all with gains averaging 18% per annum. The fourth quarter of Year 2 (the one we are in now ending December 31, 2010) is the best performing quarter followed by Q1 and Q2 of Year 3 (January – June 2011). Can you be certain that Year 3 will be positive? No, of course not as evidenced by the awful 1931 bear that lost 44%. Some critics of this approach argue that the recent stimulus of the past two years front loaded and distorted any potential ramp in 2011 and 2012. But there are reasons to believe that more often than not it will be.

A second market bias is the large outperformance of small cap stocks in January. Historically small caps outperformed large caps in 80% of all Januaries by 3 percentage points per year (small caps being defined as the bottom 30% of stocks market cap weighted). So-called microcaps (the smallest of the small caps) historically produce even better results. The fundamental reason for this tendency is tax sensitive investors (mostly individual retail investors) sell small caps to lock in year-end tax losses, then reinvest their portfolio in the New Year. An academic paper by Haug and Hirshey called “The January Effect”, examines this property all the way back to 1800 with supporting results.

Some analysts have argued that the January Effect has moved into December as investors look to front run this tendency. This is a classic example of traders adjusting to market inefficiencies and an example of their behavior having a direct influence on market inefficiencies.

What about combining of these two factors, The January Effect in small caps and the Presidential Cycle? Historically across the 48 months in the four year cycle the January of Year 3 is the single biggest outperformer with median returns since 1927 of nearly 8% a month for small caps. Does this mean that January is guaranteed to be great? Again, nothing is guaranteed – Year 3 Januaries have varied from 27% to down 10%. While many of these tendencies are just that, investors can view them as head or tailwinds that could give bulls and bears pause. The easiest method to take advantage of this effect is to go long a small or microcap ETF (IWC, PZI) or mutual fund (BRSIX). For a more market neutral approach, go long a microcap ETF and short a large cap ETF (VTI, SPY). Derivatives such as options could also be used to gain cheap exposure while limiting downside losses.

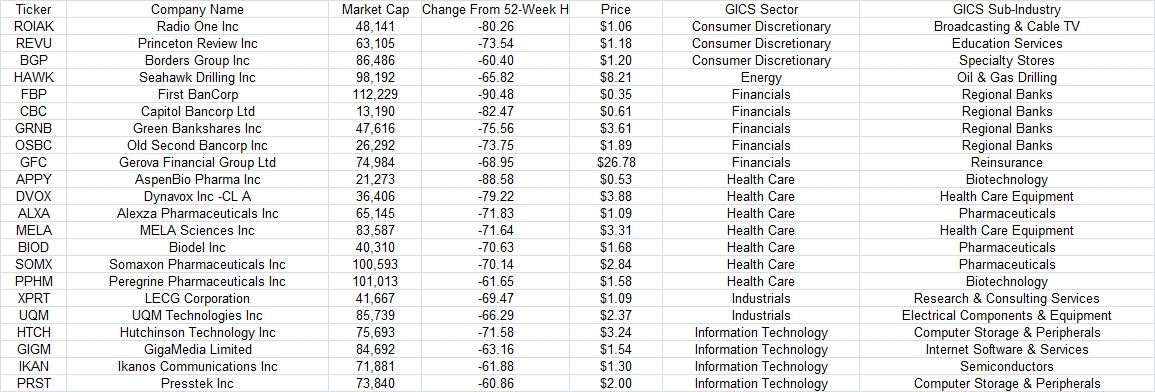

Research has also shown that screening for small caps down significantly from their highs in mid-December respond the best to the January Effect. A simple screen could include stocks trading above a minimum market capitalization (say, $30mm) and below a level considered small or microcap ($100 to $300mm). The smaller the stocks the higher the risk as well as the higher the potential reward. Two sample screens are below courtesy of the Ned Davis Stock Screener ($ required) but one could use any of the dozens of stock screeners that are free or paid (like Portfolio123). Other potential fields to add could be insider buying and fundamental factors including earnings, etc. :

Small (Market Cap > $50mm & < $300mm, down at least 70% from the 52-Week High)

Tiny (Market Cap > $10mm & < $120mm, down at least 60% from the 52-Week High)