Mark Hulbert takes a look at trendfollowing in his recent article Making the Trend Your Friend. In the post he backtests the 200-day SMA back to the late 1800’s and finds that it beats buy and hold. (Although he does not mention the reduction in volatility and drawdown which are the two main benefits of a moving average strategy – they are NOT absolute return enhancers even though they often beat buy and hold by a few percentage points – many people miss this…however for a more apples-to-apples comparison one can use momentum or relative strength to outperform by 3-4 percentage points with similar vol.)

He goes on to test the system over the past two decades and comments that the system didn’t work on an absolute basis (again no mention of vol or drawdown). Oddly he ignores cash returns – Tbills yielded 3.7% over this period which is not nothing. He also ignores transaction costs which would have penalized the timing system depending on the account (some accounts have transaction and friction free trading, etc).

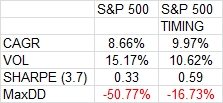

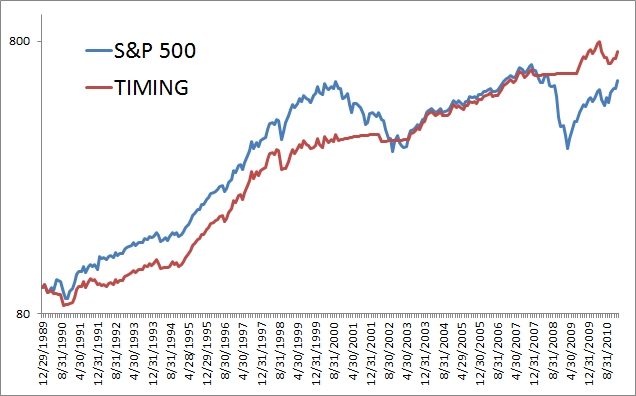

Anyways, below is the same system (on a monthly level using the 10 month SMA) since 1990 on the S&P 500 total return (not sure why he used the Dow which is priced based and very very few people invest in). I included the return on cash when out of the market. As you can see, the trendfollowing system beat buy and hold across every metric – compounded return, volatility, Sharpe Ratio, and maximum drawdown. (If you are new to the site you can find more info on the topic in a couple white papers “A Quantitative Approach To Tactical Asset Allocation“, and “Relative Strength Strategies for Investing“.)

LeBaron also mentions currency trend systems no longer working which contradicts the work I have done internally (will get the paper out soon, promise!)