Normal market returns are extreme. Listening to the media and following the comments on Twitter one would think the world is ending every 1% move in stocks and bonds. Makets are volatile, and that is “normal”.

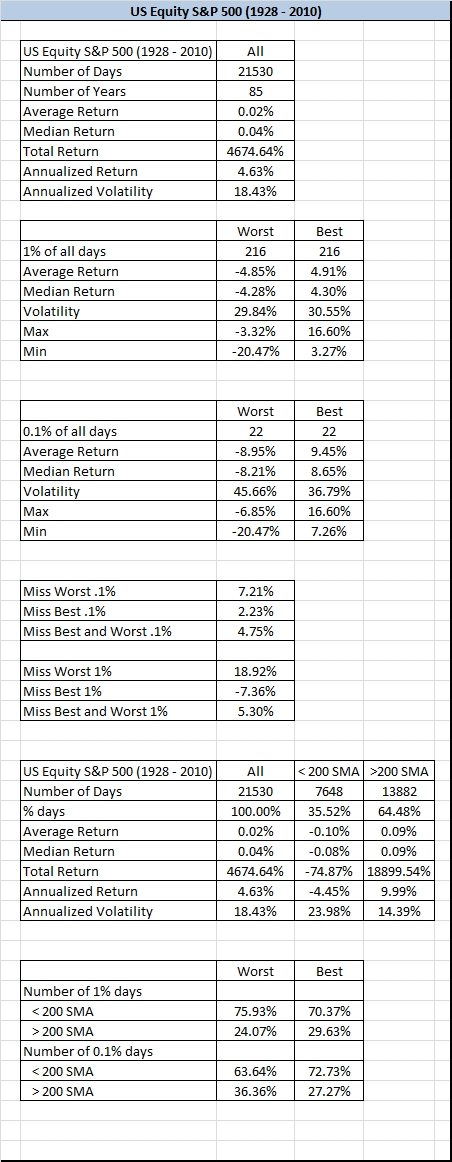

Outliers have a big impact on performance, and below are charts of the Worst/Best days since 1928 in the US stock market. As you can see, you should have about two or three days every year that are around -4 to -5% (as well as +4 to +5%). And every few years you will have some -9 or -10% days (as well as +9 or +10%). Since volatility tends to cluster, and that tends to happen after markets have begun declining, you usually see the most volatile days when markets are below long term moving averages. On average about 70% of the best AND worst days occur below long term moving averages simply because markets become more volatile.