This seems to be the question many people are asking in today’s markets. Most commentators and media focus only on equities (even though the bond market is bigger than the stock market). While bonds have had a fantastic run (the long bond is up about 14% YTD), equities are down around 5% (although with current vol that # could be anywhere by the time this gets published).

Many investors are also nervous and wringing their hands about the day to day volatility. While most of my systems and approaches are on a much longer timeframe (weeks to months), it is interesting to see how markets have responded to similar down days such as yesterday. I looked at all -5% down days in the US back to the 1920s as well as all -5% days in Japan to the 1950s.

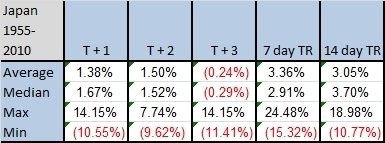

Below is a table of the average, median, max, and min summaries for T +1 (ie today), T + 2 (Monday), T+ 3 (Tuesday), and the 7-day and 14-day total returns. While you can see that there is a little bit of outperformance for buying after these down days (which represent about 1% of all days as mentioned in my last post), there is such wide variability (plus or minus 20% in two weeks) that it is impossible to forecast with conviction what may happen in the ensuing days even though that short term outperformance annualizes to about 30-50%. That is some solid alpha, but you are taking on the risk of a much worse outcome as well. (We’ve replicated this for 15 countries with fairly similar results.)

As always, have a plan and be prepared going in to every market situation while realizing all of the possible outcomes, both good and bad as well as the strengths and weaknesses of any approach. Especially so that you are not asking yourself, “What do I do now?”