I did a post a few months ago about an ongoing study we are working on that looks at various macro variables and how they affect asset classes. While we are almost done, a lot of the findings are really cool and we hope to share once we can write them up.

We showed that at the time a steep yield curve and negative real interest rates were especially good for gold and REITs. What about now, where do we stand?

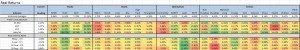

Below is the same table with returns from what is currently negative real interest rates and a flatter yield curve. Granted this is only two factors, but gold and small cap stocks look best, REITs look decent, and commodities look awful (using GSCI so that is mostly energy) with everything else as mixed.

We will be adding more variables as well as more indices so stay tuned…

CLICK TO ENLARGE