Great new piece from the folks at RA – “King of the Mountain (PDF)“. It takes a look at how PE Ratios respond to real interest rates and inflation.

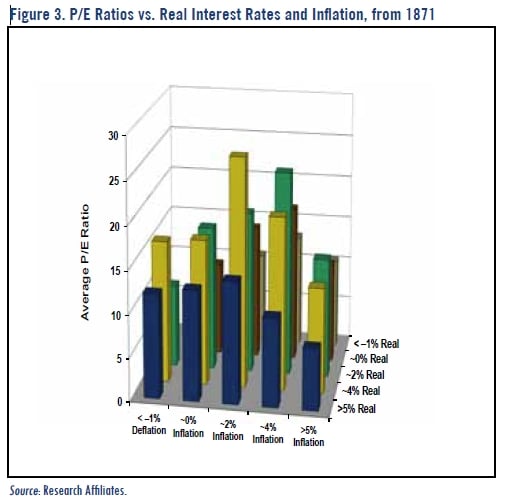

Quick summary: There is a sweet spot with moderate real yields (2-5%) and moderate inflation (2-3%). When conditions move outside of these bands (ie, now), PE Ratios tend to be much lower.

With real negative yields likely negative now, PE ratios fall to 11 (nearly half of current levels). Ditto for inflation over 4%. (This depends on the timeframe and method used to compute inflation which could be anywhere from 1%-7%, depending. One year CPI is around 4%, while trailing three year is around 1%, both of which are 3-4% understated relative to the ShadowStats/old method of measuring inflation. )

There is a nice chart at the end that looks at the combination of both factors on a 3-D graph.