The post below is very important, and is something most investors never really grasp. I used to consider writing a book on this topic, and still might, but condensed it into a really short post below. Let me know what you think.

I remember hearing about the magic of compounding in high school. The example was that if you started saving now, and compounded your money at 9.4% a year (US returns since 1900), you could retire a millionaire! Granted, this sounded pretty awesome to all of the students in the class.

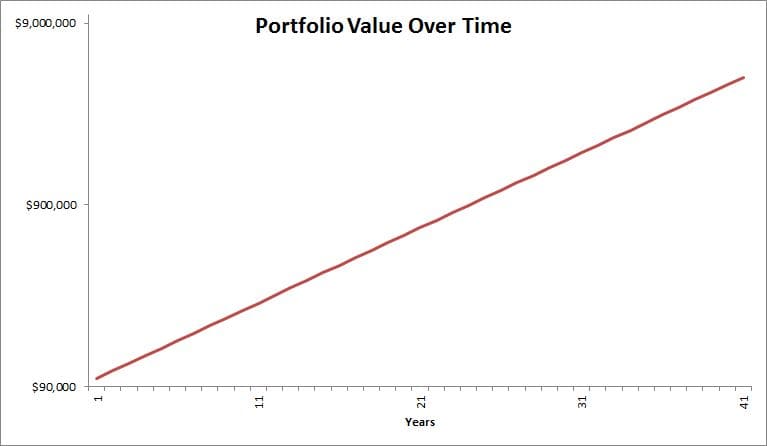

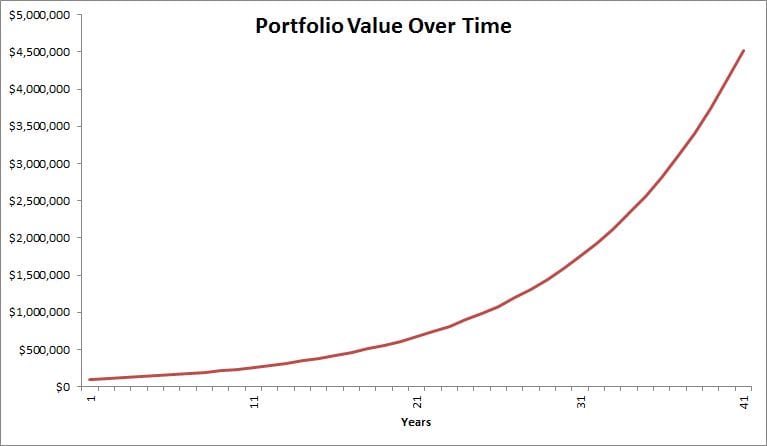

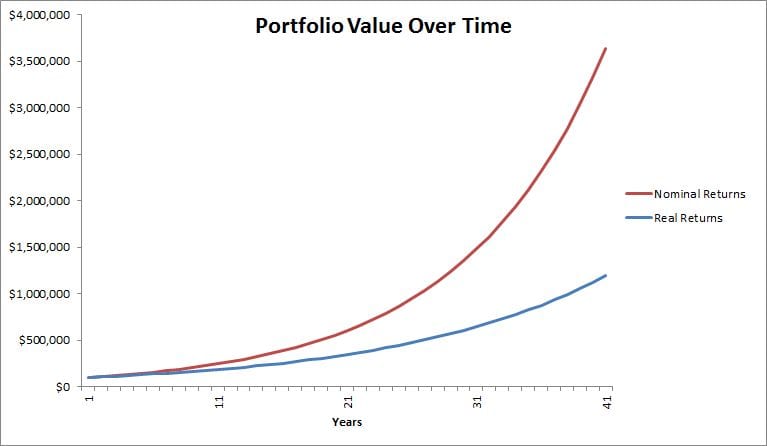

In this example, a $100,000 account that had a 9.4% return would be worth $3,600,000 after 40 years! They would then show a chart like the below (although I include the more correct log chart after). They of course are the exact same chart:

So what is the problem here? Well, these returns simply don’t exist.

They are nominal returns, or returns before the effects of inflation. To demonstrate what I mean, the US experienced about 3% inflation over the period. So, the returns to an investor were not 9.4% but closer to 6.4%.

This has the effects in our example of reducing the final balance from the $3.6 mln to a more modest $1.2 mln. Respectable for sure, but a final value that is 70% less than the nominal amount, a big difference!

The Coke that costs about $1 now will cost over $3 in retirement (funny how this example would have been $0.25 and $1 from my parents generation).

That is the good news. The bad news is that there was wide variability in the returns for different countries, with some countries performing significantly worse. Australia and South Africa were the standouts with around 7% real returns, whereas Italy only did about 2% a year.

All countries experienced big losses at some point, including 90% losses in Germany and the US and 100% losses in China and Russia.

Bonds and bills did even worse. The BEST real returns per year for bonds was a measly 3% a year in Denmark with the worst being a -1.7% a year in Italy. Short term bonds (like T-Bills) were even worse at 2.3% for Denmark and -3.6% for Italy. Losses for bond holders in countries such as Italy, Japan, and Germany ranged from 70-100%. Investing in bonds and bills are certainly not wealth building strategies (ie example in the US now where bills yield zero with inflation ~3%), and can and have exposed investors to very large losses.

Even investing in a 60/40 portfolio is only expected to return around 3% a year in real terms while STILL exposing investors to 70% losses. These strategies should all be seen as simply strategies to keep up with inflation. That is depressing of course, but true. The worst outcome is the cash under the mattress strategy which will expose the investor to anywhere from 2% to 7% losses per year. You may not notice the effects, kind of like a boiling frog, but at some point you look back and say, “wow, I remember when a Coke cost 25 cents….”

(Data source: Triumph of the Optimists / Credit Suisse Sourcebook)