I look forward to meeting a few readers at the conference in Sydney tomorrow, and I’m chatting a bit about active ETFs. The active ETF space is still relatively small (about $5billion in the US), and is dominated mostly by currency and bond funds (about 50 funds). But if McKinsey is right, that is going to change and change quick (The Second Act Begins for ETFs – this is really a great PDF read from last summer):

“Consider that if active ETFs were to follow the same growth pattern that passive ETF products followed, they would constitute approximately 10 percent of all actively managed U.S. long-term mutual fund assets within a decade and exceed $1 trillion in AUM”

The new Gross fund out next week should do a bit to stir up the industry, and I think in general people are still slow to realize the tax benefits of the ETF structure, and possibly more importantly, the benefits of not following an index (and avoiding front running costs, up to 1.8% for small caps see Chen (2005) and Petajusto (2010).) which makes the active ETF structure perfect for active managers. (Also see ‘Indexing’s Dirty Little Secret.)

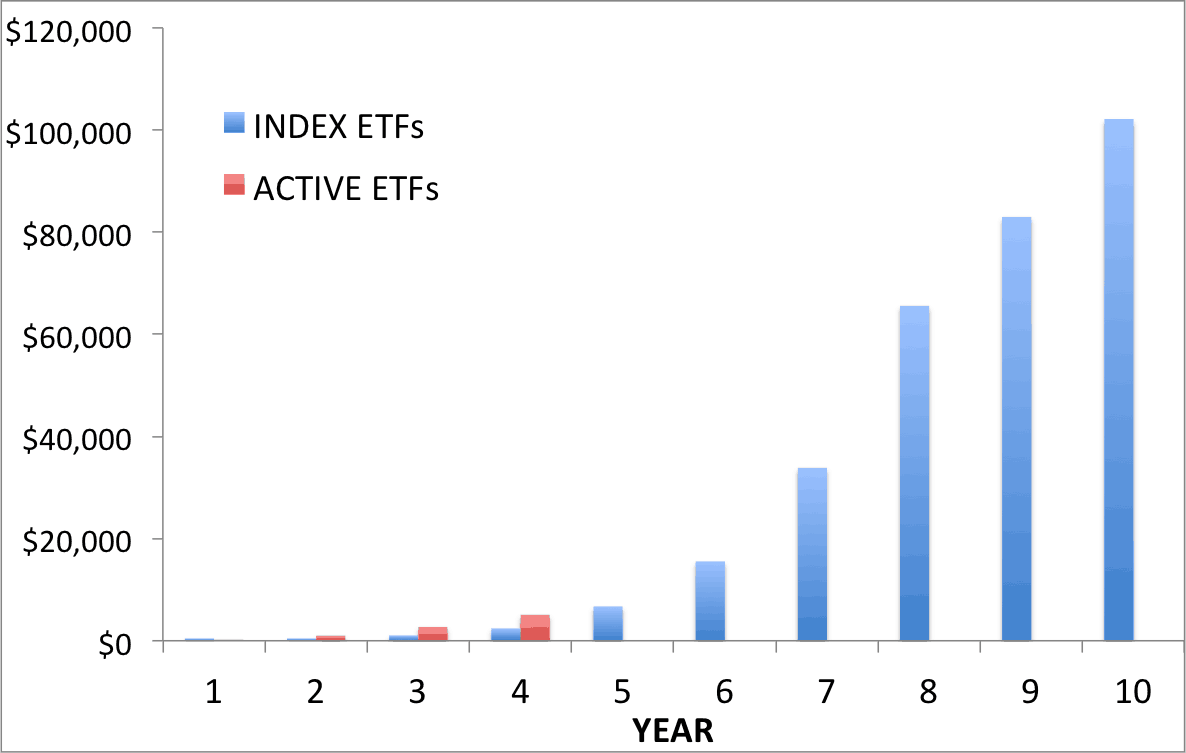

Chart below from my talk, Y-axis is millions of $.