Investors shouldn’t pay much for buy and hold portfolios. Honestly they shouldn’t pay anything on top of the 0.30% in fees one would pay for a portfolio of indexed ETFs or mutual funds (we detailed a few of these in our book The Ivy Portfolio). Now, if you have a killer advisor that is doing tax harvesting and/or adding alpha that is different but not the topic of this post. (Although if I was one of these software sites I would perfect the tax harvesting algorithm that would be huge differentiator.)

Anything more than 0.5% or so on top of fund fees is either paid a) out of ignorance, which is not always the investor’s fault or b) as a tax for being irresponsible. For the latter I mean a fee to keep you out of your own way of chasing returns and doing something stupid, much in the same way someone pays Weight Watchers or any other diet advice program when you know what you should be doing (eat less, exercise more). Some broad generalizations here but trying to get to the data below. That fee is worth a lot if you cannot keep out of the way of your own emotions, and the evidence is massive in favor of that being the case. We have a great research piece coming up on the topic here soon.

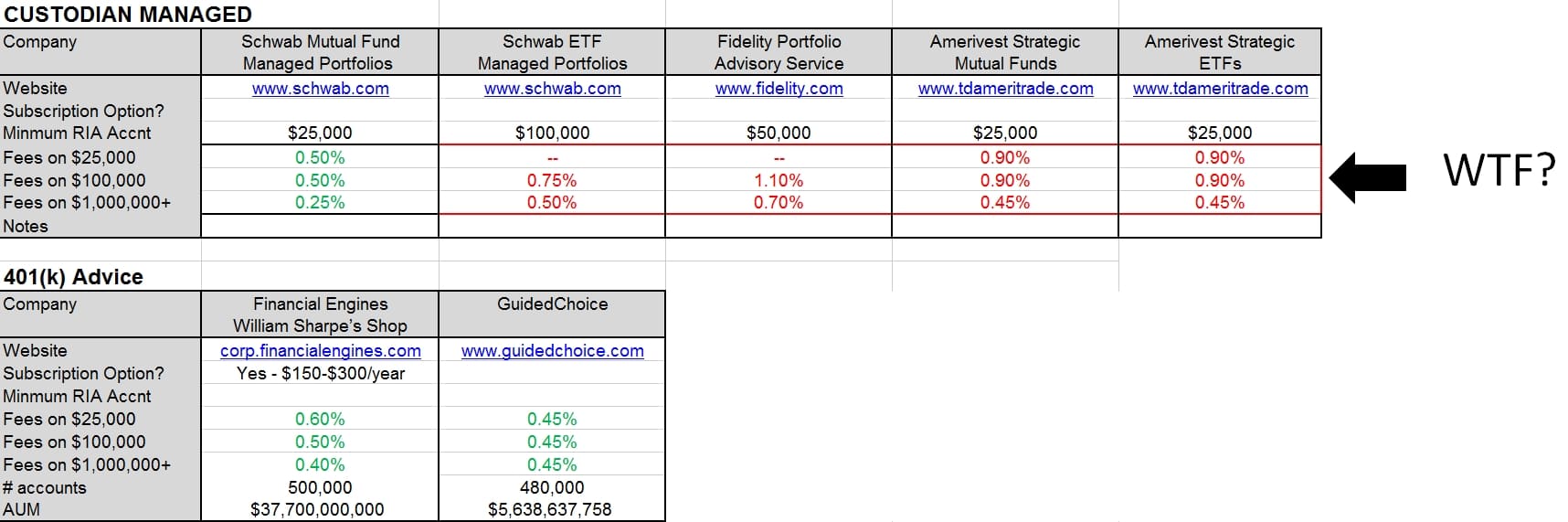

There is an enormous amount of VC money chasing financial startups, and there has long been a disconnect here for some reason. Anyways, below is a summary of the buy and hold advice world. I left out the really high fee advisors where the fee is variable by advisor since it is hard to make generalizations there other than that it is a dying model and you’re a predator if you’re charging 2% commissions and or 2%+ fees for doing nothing. I pulled most data from the SEC.

I made the dividing line 0.5% for a $100,000 account. Anything more is labeled in red (ie charge as much as you can get away with model), anything below in green (charge as little as possible model). I can’t understand why the custodians charge anything at all considering they likely just load the accounts with their own funds (double dipping on fees). I actually applaud some of the lower fee entrants and their fees (Betterment, Wealthfront), though I will say I think this is a very difficult model to differentiate yourself compared to simply buying a few ETFs and rebalancing that once a year.

If there is any errors or other sites I have missed let me know.

Click to enlarge: