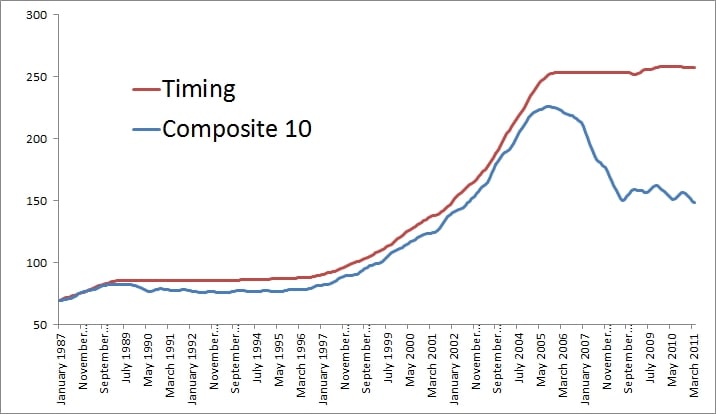

Back in September 2007 and October 2008 we talked a bit about applying a simple timing rule to the housing markets. We found that using a simple trendfollowing approach to the housing indices would have worked nicely if someone could “time” the housing market. While the housing market is illiquid (and unfortunately, and surprisingly to me, the housing futures never caught on), I think it is instructive as a possible indicator of when to get back in. Or, if you are a potential first time buyer in no hurry like myself, when to dip your toe in the water for the first time.

Out of the 20 markets Shiller tracks, only 6 are on buy signals (Phoenix, Denver, Washington, Charlotte, Minneapolis, and Dallas) while the others are still on sell signals including both composites. And all 6 have generated buy signals within the past few months. I did not include interest on cash balances…