Long time readers will know why I really liked this paper by Mauboussin from Legg Mason. (HT: Research Puzzle)

Share Repurchase from All Angles

- The prime responsibility of a management team is to invest financial, physical, and human capital at a rate in excess of the opportunity cost of capital.

- Executives should always seek to allocate capital to the opportunities with the highest returns.

- Buybacks can be more attractive than investing in the business.

- If the company of a stock that you own is buying back shares, you must recognize that doing nothing is doing something.

- The media must stop with the canard that investors deem buybacks to be good because they increase earnings per share (EPS).

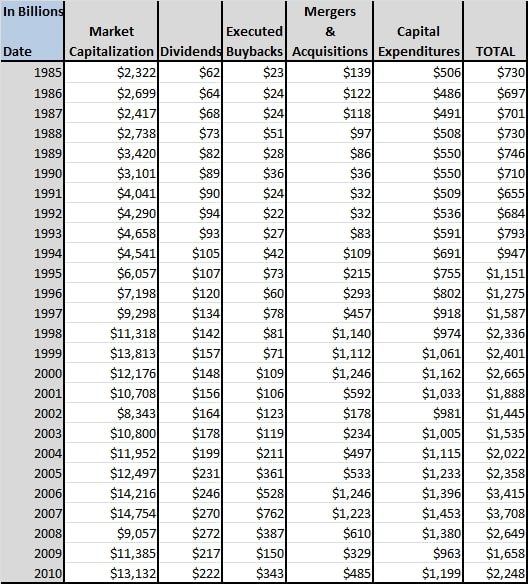

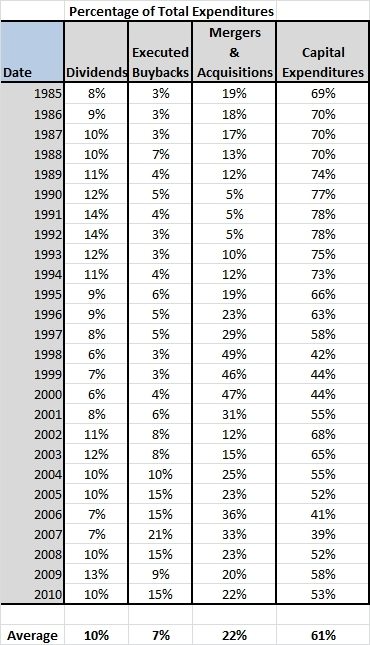

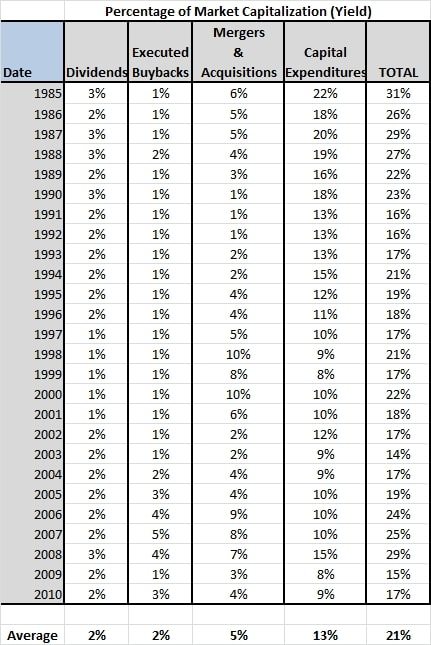

There was a nice chart in the paper that shows how companies have spent their cash over the past 25 years. Interesting to note is that they spend on average, about 60% of their total spend on capital expenditures, 20% on M&A, and about 10% each on dividends and executed buybacks. The total amount of spend bounces around a bit but is a fairly consistent 20% of market capitalization. Note that buybacks exceeded dividends in 7 out of the past 10 years.

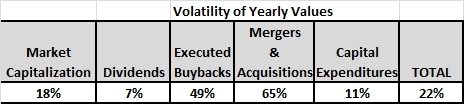

The author notes that dividends and capex are much more consistent, and that CEOs view dividends differently than buybacks which are often seen as a way to spend extra cash. Volatility of market cap, dividends, and capex are all in the range of 7 to 18%, but buybacks and M&A are at a whopping 49% and 65%, respectively.

Source: Birinyi Associates and FRB Z.1. Past performance is no guarantee of future results. The table above is for illustrative purposes only and is not

reflective of an actual investment.