I don’t like to mix my work side of the business with the blog, which is meant to be more about strategies and ideas. I also can’t mention the performance of our private funds unless you are on our accredited email list (although that may change in a few months depending on the laws). But I can mention the simple leveraged portfolio strategies from our book and white paper (which we are updating and writing a ton of new material in the coming weeks/months – starting in February! when I get back from Colombia and Miami, promise).

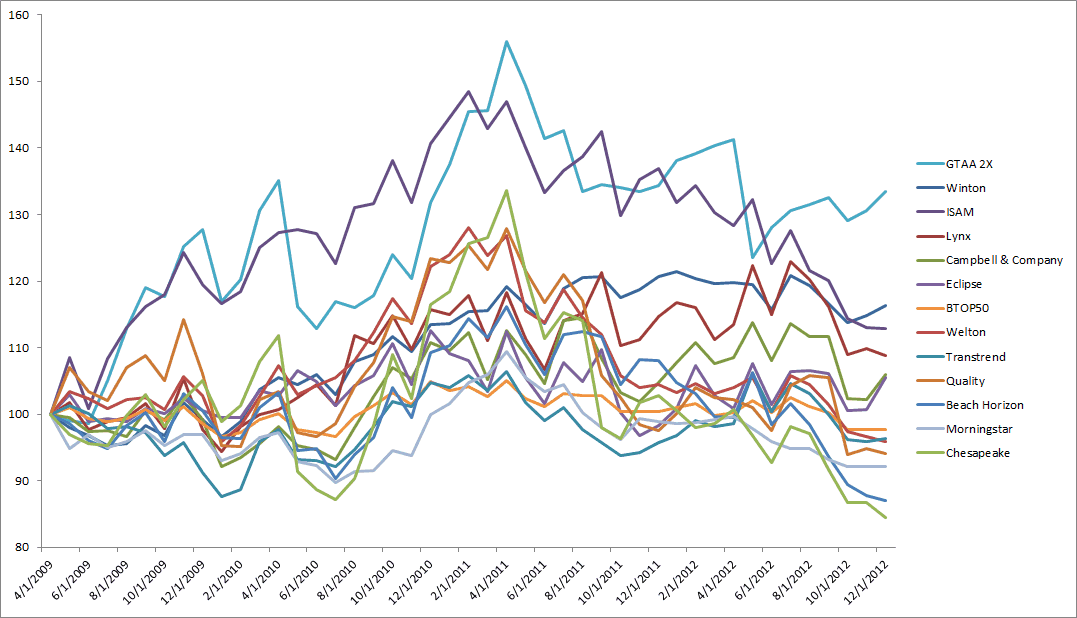

So, I took the top ten funds by AUM labeled as trendfollowing from the site IASG. This list includes some of the top names in the business such as Winton, Campbell, and Transtrend. I examined performance since 5/2009, and compared these ten funds to a simple 2X leveraged version of the basic strategy published in our white paper in 2006 and book in 2009. I also deducted 1.50% in fees per annum from the GTAA 2X basic strategy.

What trendfollowing fund performed the best over this time horizon though 2012?

The simple GTAA 2X strategy did. Likely reasons why are that the strategy from the book/paper is heavier in equities than most of these funds, and also has a much larger REIT allocation.

While this update is for an extremely short time horizon, it just goes to show that a simple strategy can be very effective. Also note that the unleveraged version would have also outperformed all of the other trend funds, and that all of the trendfollowing indexes were even worse at the bottom of the barrel. But also note how similar all of these funds are in general direction and the zigs and zags.

However, the best performing trend strategy of all would have been to simply bought stocks or even a “buy and hold and then go on vacation for three years” allocation! (This reminds me of the famous bet between Buffett and Protege where the zero coupon bonds and beating both managers…).