This is an older post but I had a reader asking about a similar topic so I thought I would repost…

Here are some long term charts based on the data from Morningstar / Dimson Marsh Staunton.

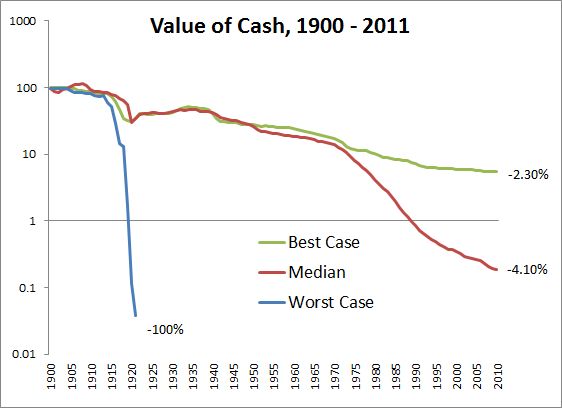

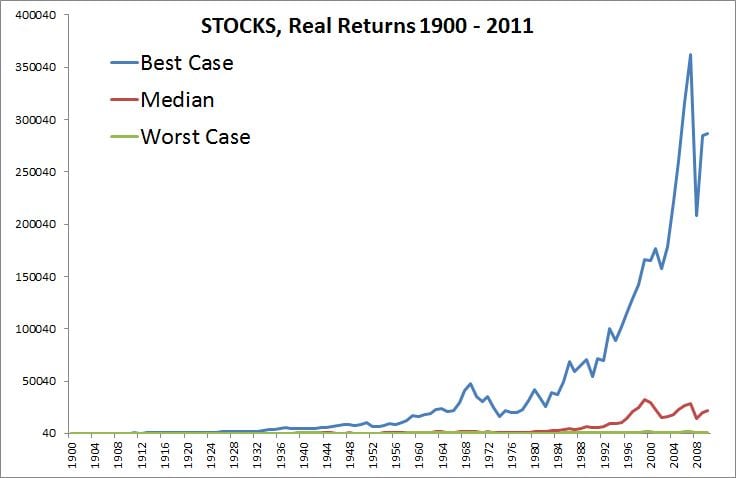

Below are the best, middle, and worst case scenarios for the main asset classes of sixteen countries from 1900-2011. All are real return series on a log graph (except the last one).

First, here are the best cases for returns on your cash. This chart goes to show that leaving cash under your mattress is a slow bleed for a portfolio. I excluded Germany after the first series as it dominates the worst case scenarios (in this case hyperinflation).

Best Case: -2.30% per year

Middle: -4.10%

Worst Case: -100%

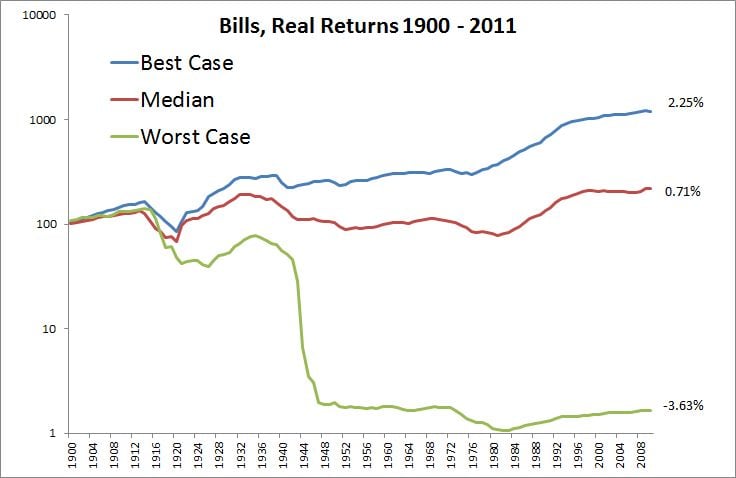

Next up is real returns for short term bills.

Best Case: 2.25% per year

Middle: 0.71%

Worst Case: -3.63%

(Real Worst Case, Germany -100%)

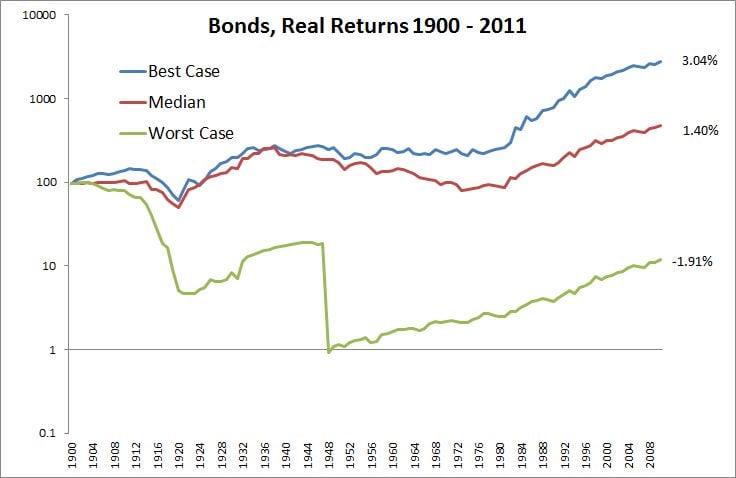

Followed by the real returns for longer dated bonds.

Best Case: 3.04% per year

Middle: 1.40%

Worst Case: -1.91%

(Real Worst Case, Germany -100%)

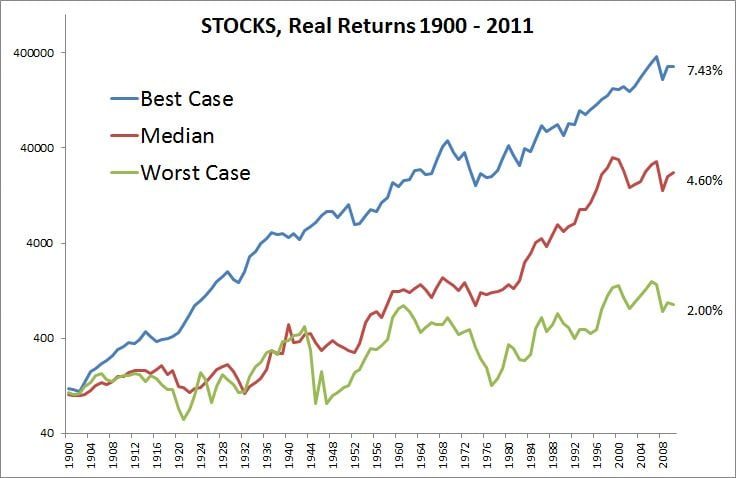

And finally, the real returns for equities.

Best Case: 7.43% per year

Middle: 4.60%

Worst Case: 2.00%

(Real Worst Case, China, Russia -100%)

And the same chart presented non-log…