Many people are attracted to investing (rather, trading) largely due to the excitement. Also, a lot of people like to have a position one way or another so they can cheer for the position, much the same way they cheer for a sports team or their home country. ie I’m long gold! I’m short Tesla! Go Broncos!

So, the act of scaling in and out of a position is boring and emotionally difficult for many investors. I can’t tell you how many investors I’ve talked to that have said, “I don’t know what to do, should I buy or sell? Do I own too much gold?”.

My response is usually, “If you are unsure or it is making you uncomfortable, sell 1/3, or 1/2.” That way you don’t look back and regret your decision. However that is boring for many investors. Once you’ve bet $100 on a football game, likely betting $1 will not generate the same ‘excitement’. You will also feel much more regret when the reduced bet wins than you will when the reduced bet avoids loss.

Anyways, this also applies to to asset allocation strategies. One question I often get, especially from advisors, is mentally committing to a tactical (market timing) system (like our global tactical models). My advice: why not just go halfsies? ie Why not allocate half to your old buy and hold system, and half to whatever new system you are contemplating?

You no longer risk being completely wrong, and you still potentially look brilliant in a 2008 or other bear market.

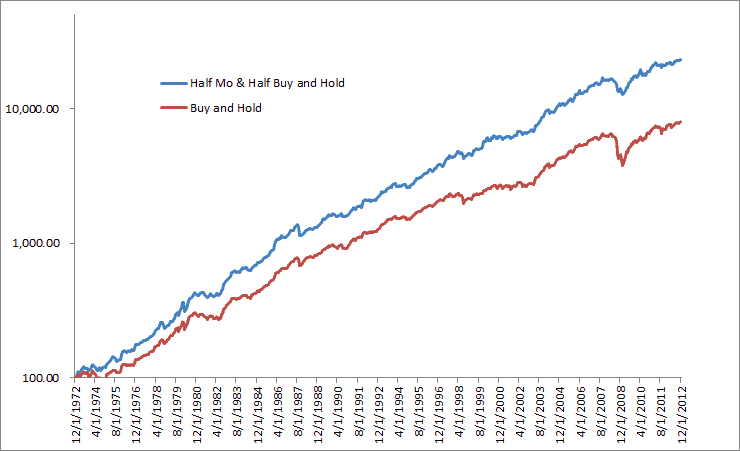

Below is a look at a simple buy and hold, then the effect of 50/50 buy and hold in a GTAA Aggressive strategy from our paper. As you can see it still helps, and avoids the “all-in” problem many people have.

Maybe it is not as much fun, but it could help build your portfolio and business.