Great stuff as always from the O’Shaunessey crew illustrating a few key points I agree with (my summary points):

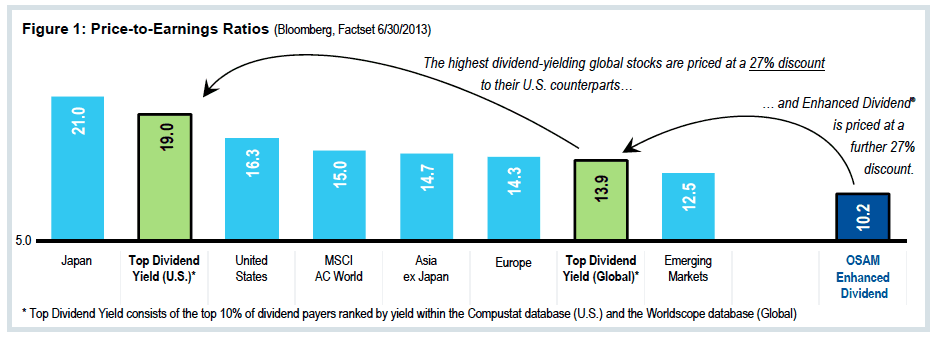

1. US stocks are more expensive than most global markets (largely agrees with our CAPE work)

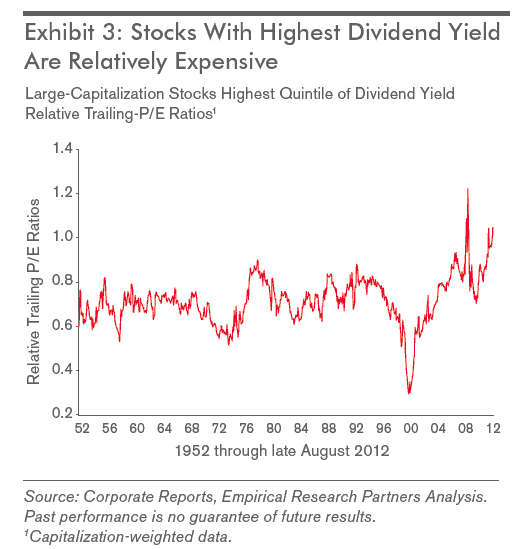

2. US dividend stocks, priced historically at a discount to the broad market , now trade at a premium. (see chart #2 from Janus / Empirical – it is a year old but conclusion remains). This is really important – remember when everyone hated dividend stocks in the 1990s? Remember how much they have outperformed since then and all of the money that has flowed into the dividend space? That tailwind is now a headwind…so be careful with your dividend stocks!

Larry Swedroe also has a great post on a similar phenomena with low vol stocks…

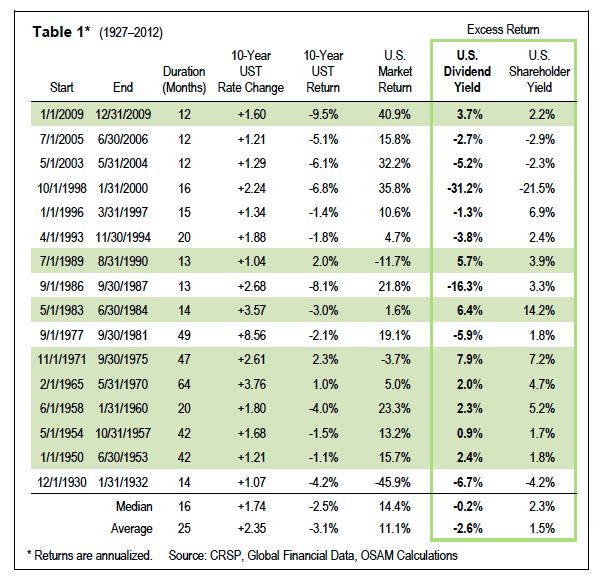

3. Dividend strategies have not generated alpha during rising interest rate markets since 1927, but shareholder yield strategies have done much better – on the order of 2.5-4%!

“Whereas the results for dividend yield in the U.S. in Table 1 suggest underperformance, shareholder yield historically produces positive excess returns on average more consistently across rising rate environments back to 1927. Shareholder yield outperformed in 12 of the 16 rising rate environments in Table 1 by on average +1.5 percent, making it the more consistent performer of the two yield factors during rate increases.”