I wanted to illustrate a point I was trying to make to a friend about asset allocation. Most people approach it with the “more is better” mentality, when in reality you can achieve a a nice, simple base case portfolio with only a handful of assets. However, most people just don’t feel diversified with only a few funds for whatever psychological reason that may be.

Below is a nice well diversified portfolio. It is a bit equity heavy, but it holds:

10% US large cap stocks

10% US small cap stocks

10% foreign developed stocks

10% foreign emerging stocks

10% US 10 Year bonds

10% Corp bonds

10% Commodities

10% Gold

20% Real Estate

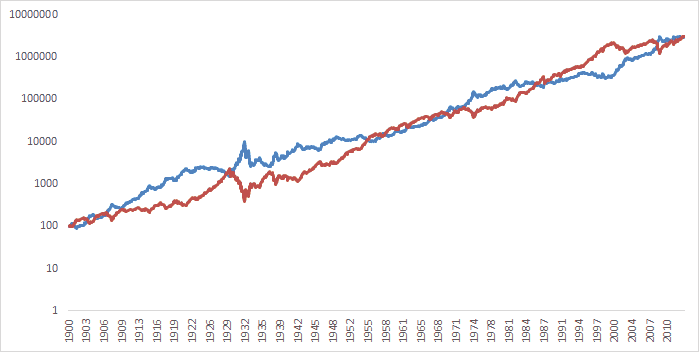

I wanted to design a truly awesome hedge for this portfolio. Kind of the “perfect asset class” or a hedge fund’s dream. It would have the same return as US stocks, but a totally negative correlation. You can see a chart of the asset below since 1900.

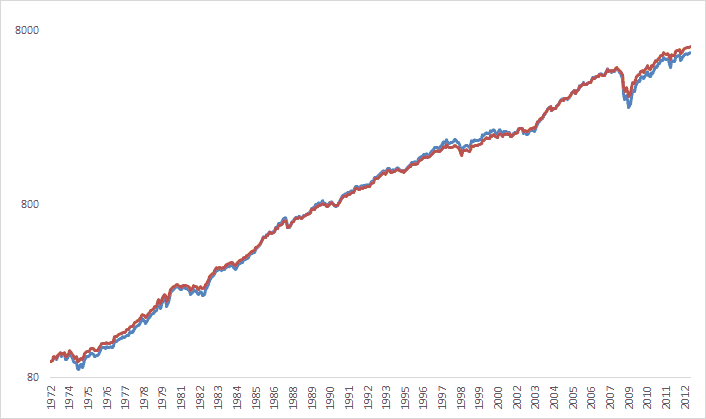

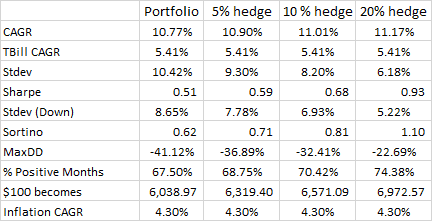

So, what happens when you allocate a whopping 10% to this amazing hedge? It should really juice your portfolio’s value right?

As you can see, the effect on total returns is almost imperceptible. It does however reduce the vol and drawdown noticeably. My points are twofold:

1) when you allocate to a new asset don’t bother unless you are going to allocate AT LEAST 5-10%. Otherwise it does nothing.

2) If you are looking for return enhancing, a non correlated asset isn’t really going to help. You need to add something with higher CAGR.

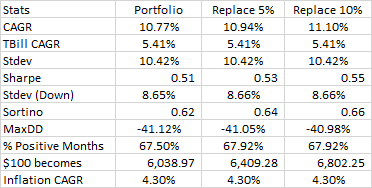

Now, what happens if you add the ultimate equity alpha fund? In this case lets find a alpha substitute for the S&P that adds 300 bps per year. Even though you replace the S&P with a better fund, it only adds 30 bps of total performance.