I’m pretty sure this ideas below came from SocGen (who does a ton of great momentum work) but I’m on a plane watching the Red Sox game and for the life of me can’t recall where I saw this.

One of the biggest challenges for a market neutral strategy is your shorts ripping when a market bottoms and all of the (expensive/low momentum) stocks rip straight up. That is why most factor based long short portfolios rarely survive – they are long and short the wrong things at market bottoms.

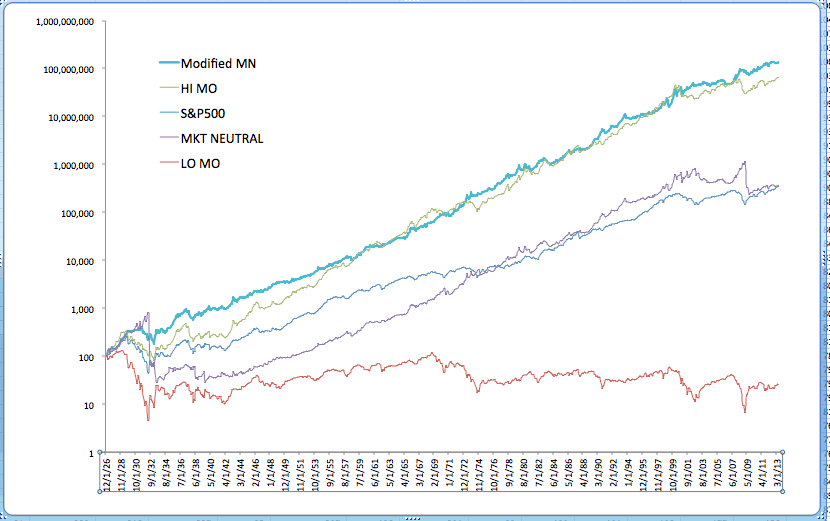

Below is french fama momentum data that shows high and low momentum stocks back to the 1920s. Hi mo beats both the market and low mo. One would think a market neutral portfolio would be really low risk, but in reality it has massive drawdowns in the 1920s and 2009.

One way to rectify this situation is to simply short less the more the market goes down. Kind of makes sense as you think about it and is probably just prudent risk management. So the modified strategy below starts 100% market neutral, and depending on the drawdown bucket will reduce the shorts all the way to zero once the market has declined by 50% (in 20% steps for every 10% decline in stocks).

Pretty cool, huh?