Long time readers know that I am a big fan of simple rules based portfolios, heck that’s behind most of everything I do, from the buy and hold and 13F portfolios of The Ivy Portfolio to the trend portfolios of a QTAA, to shareholder yield approaches to income. Frankly most all of the 2&20 world can be deconstructed for next to nothing. For example, the book Following the Trend: Diversified Managed Futures Trading was actually really good – and I feel like it is pretty rare to say that these days. It basically lays out how to replicate the vast majority of the managed futures industry with a simple system(s). (Covel’s book is great too.) It reminds me a bit of that Bridgewater piece on replicating basic hedge fund strategies with rules based investing : Hedge Fund Returns Dominated by Beta – May 3, 2012

I was going to lay out a simple model, one very similar to the one we published back in 2010: Relative Strength Strategies for Investing. This paper was a domestic expansion of work we published way back in 2007 in our Quant Approach to TAA.

I thought I would demonstrate the utility of another relative strength approach from F-Squared, a $15b shop that a lot of RIAs use to outsource their tactical allocations. (Note: this post is updated at F Squared’s request to only use their 2008 forward index data. )

You can find their construction rules here:

- When fully invested, the model index all nine of the U.S. equity sectors: At the point of rebalancing in a fully-activated mode, the strategy is equally weighted in each sector at 11.1%.

- The critical process, executed on a weekly cycle in the AlphaSector Premium Index, is the model’s review of each of the nine sectors to be either included or excluded from the portfolio based on likelihood of forward-looking positive return.

- The decisions are generated through a sophisticated analytical engine that evaluates “true” sector trends while adjusting for market noise and for changing levels of volatility in the market.

- The key model inputs (driving the decision-making process of the algorithm) are data on total return movements, volatility, and rate of change in volatility for the subject equity sector.

- The model output is a binary decision. If a sector receives a positive signal for investing, it is included in the index portfolio. If a sector receives a neutral or negative signal, it is removed. All sectors represented are equal weighted, with a maximum allocation capped at 25% of the Index at the time of rebalancing.

- If there are three or fewer sectors represented at a given time, the remainder of the portfolio (reflecting the 25% maximum cap per sector) is invested in the Short-Term Treasury ETF, representing cash. The Index can be 100% invested in the cash equivalent if all sectors receive a neutral or negative signal for investing.

- The presence of a cash equivalent position in the index portfolio during bear markets is a clear illustration of the F-Squared’s philosophy of “client-centric not benchmark-centric.” Conventional U.S. Equity investment strategies would continue to track to the S&P 500 during a bear market, seeking to achieve only relative outperformance. Investors are subject to potentially severe drawdowns, even while their traditional manager is perceived as “beating peers.” In contrast, the AlphaSector model breaks the correlation to the S&P by deploying the cash equivalent. Delivering downside risk controls is our approach to meeting client needs.

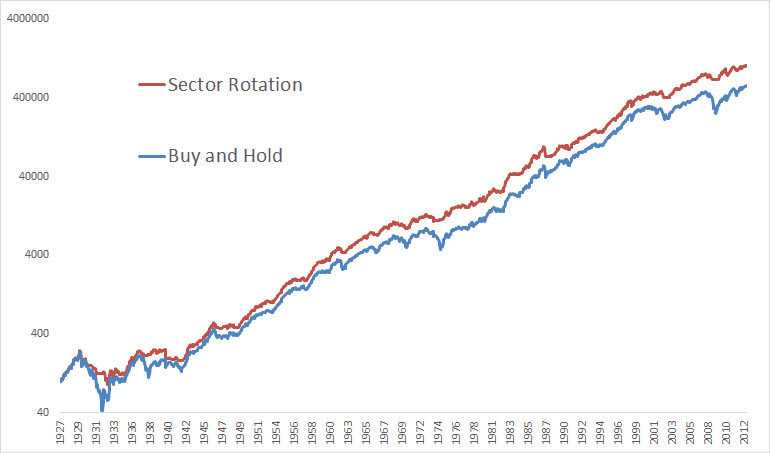

My guess was that a simple system, similar to many we have published in our white papers, would capture what F2 is trying to do. Below we examine 9 sectors, equal weighted if above 10sma. If less than 4 sectors then 25% in cash if 3, 50% cash if 2, 75% cash if 1. We used the French Fama data that goes all the way back to the 1920s…The first chart is the test back to 2001 , the second chart is FF all the way back to the 1920s.

Note that the system does a good job of capturing what F2 does through their public index. Also note the strategy does a good job of reducing risk through vol and drawdown back to the 1920s. Note those looking for outperformance should consider a more concentrated portfolio that only owns the top 2-4 sectors, and we will follow this piece up in a week with another killer momentum system published by another multi-B shop out of Europe…stay tuned!