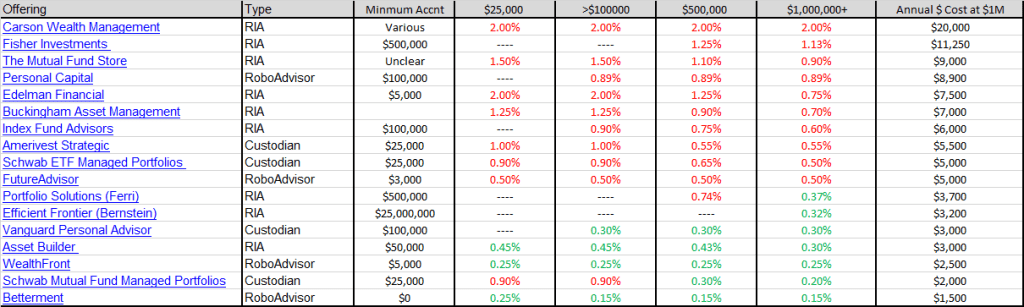

I was updating an old table I used to post on the blog called “A Survey of the Money Manager Space”. It examined a lot of the online and offline offerings from various providers – RIAs, roboadvisors, custodians, etc.

My prior quote from 2012:

Investors shouldn’t pay much for buy and hold portfolios. Honestly they shouldn’t pay anything on top of the 0.30% in fees one would pay for a portfolio of indexed ETFs or mutual funds (we detailed a few of these in our book The Ivy Portfolio). Now, if you have a killer advisor that is doing tax harvesting and/or adding alpha that is different but not the topic of this post. (Although if I was one of these software sites I would perfect the tax harvesting algorithm that would be huge differentiator.)

Anything more than 0.5% or so on top of fund fees is either paid a) out of ignorance, which is not always the investor’s fault or b) as a tax for being irresponsible. For the latter I mean a fee to keep you out of your own way of chasing returns and doing something stupid, much in the same way someone pays Weight Watchers or any other diet advice program when you know what you should be doing (eat less, exercise more). Some broad generalizations here but trying to get to the data below. That fee is worth a lot if you cannot keep out of the way of your own emotions, and the evidence is massive in favor of that being the case. We have a great research piece coming up on the topic here soon.

I made the dividing line 0.5% for a $100,000 account. Anything more is labeled in red (ie charge as much as you can get away with model), anything below in green (charge as little as possible model). I can’t understand why the custodians charge anything at all considering they likely just load the accounts with their own funds (double dipping on fees). I actually applaud some of the lower fee entrants and their fees (Betterment, Wealthfront), though I will say I think this is a very difficult model to differentiate yourself compared to simply buying a few ETFs and rebalancing that once a year.

Not too much has changed in the two years since I wrote this post. More and more roboadvisors have entered the space, raised a TON of VC money while raising AUM as well. Huge congrats to the companies raising the money, though I think the VCs have lost their mind at these valuations. I think it is a great trend and will include Schwab in the table once they launch. For the most part we are are on the same side of the ball as the roboadvisors versus the old school high fee offerings (though some roboadvisors are not low fee).

I decided to update the table with some famous RIAs, and I was actually shocked how much most of them charged. You can find all of this information for free on the SEC website – click on “Brochure” on the left side of the screen to get an easy reading summary of fees, etc. Some of the most famous RIAs like Ken Fisher, Ron Carson, and Rick Edelman, charge fees much higher than I would have expected. Some offer additional services such as estate planning, trusts, etc.

Anyways, email in with any suggestions and I’ll add to the table…(Note: I excluded Fidelity’s Portfolio Advisory Service as I couldn’t get a straight answer out of them on fees – it ranges from 0.63% to 1.7%.) Any mistakes are my own and I will update with corrections if you see any…

CLICK ON THE CHART TO EXPAND