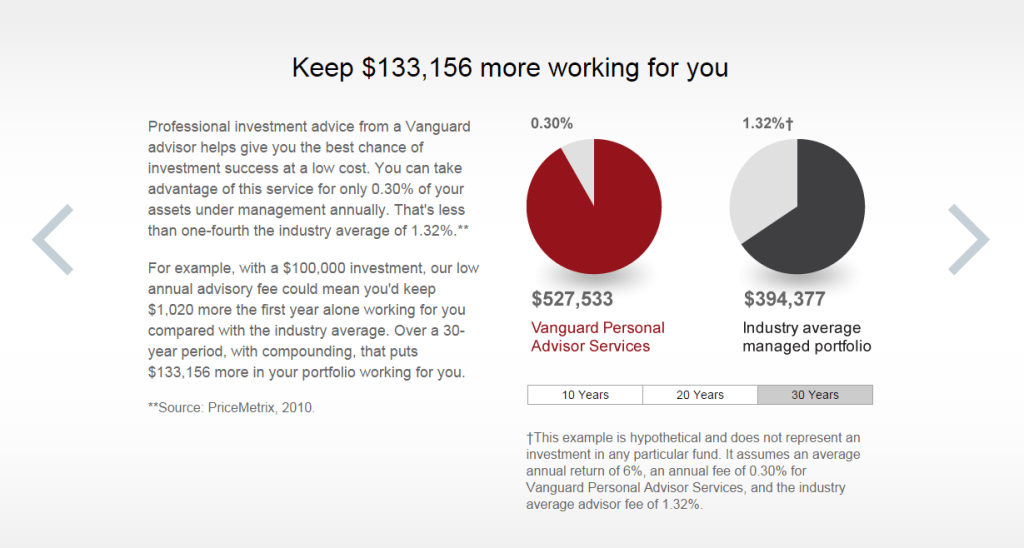

Vanguard, like many of the robo-offerings, markets the fee difference as a big reason to use their automated investment service. (Though as Kitces mentions, Vanguard isn’t quite a robo since they employ lots of CFPs.) They compare the difference between their fees (0.30%) and the industry average (1.32%) which sounds high to me, as I think it is around 1% although average mutual fund is 1.25%.

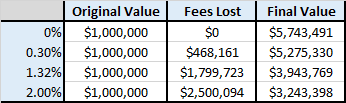

If you assume a $1M portfolio, let’s look at how much fees eat into your returns over time at 0%, 0.3%, 1.32%, and 2% advisory fees. We will ignore the underlying ETF costs to try to compare apples to apples, and assume all use low cost index ETFs. Lest you think there are not people charging 2% to manage a buy and hold portfolio let me remind you otherwise with the chart at the end of the post with a fee summary. 0% is achievable either by investing on your own or using something like our 0% management fee ETF or Schwab’s upcoming offering.

30 bps in fees costs a portfolio only $3k per year, but 1.32% ($13k) and 2% (20k) are much more dramatic. 20k is basically a new Tesla every few years. This doesn’t mean of course an advisor isn’t worth their fees, I’ve said a million times on the blog that they can we worth their weight in gold if they offer value added services like tax planning, estate planning, insurance, wealth management, etc. (Or keep you from doing something even dumber on your own.) But $20k per year is a really high bar to justify. Mentally visualize carrying a briefcase of $20,000 every year to your advisor instead of it being automatically deducted from your account.

For a buy and hold asset allocation portfolio you want to be paying as little as possible.

So, for an investment lifetime of 30 years, assuming 6% returns, how much did the various fee levels cost the investor?

Now think about that for a second. Over your lifetime, if you started with $1M in assets, you transferred anywhere from $240,000 to $1.1 million to your advisor. (The above table also shows in the fees lost column the difference you lose by not compounding the lost fee assets.) 2% a year means you end up paying your advisor your entire initial investment amount. When you sit down with your advisor that you choose to have for the next 10 years ask yourself – “Is this advice worth $240k in total (nearly a third of total starting portfolio value) if you’re paying 2%?”

What if markets actually returned 10% per annum? The figures get even more gross since your portfolio grows to a much higher balance. At 2% the original $20,000 you paid 30 years ago is now a whopping fee of $200,000 per year. Even at the average advisor fee of 1.32% that is $160,347 per year.

Maybe your New Years resolution should be to not buy someone a new Tesla this year?

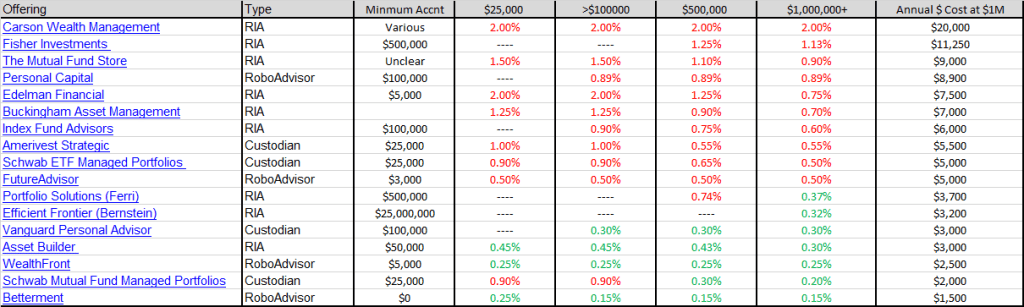

People in red below are over .50%