I often say there isn’t a whole lot new in investing. Charles Dow was using trendfollowing approaches over 100 years ago, and Ben Graham was using valuation metrics for security selection as well. Robert Shiller created the CAPE ratio to look at stock market level valuations, and this was based on some of Ben’s work on smoothing earnings over longer periods to reduce the noise.

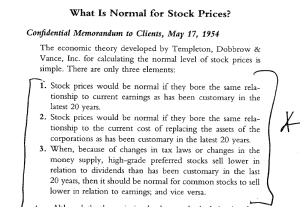

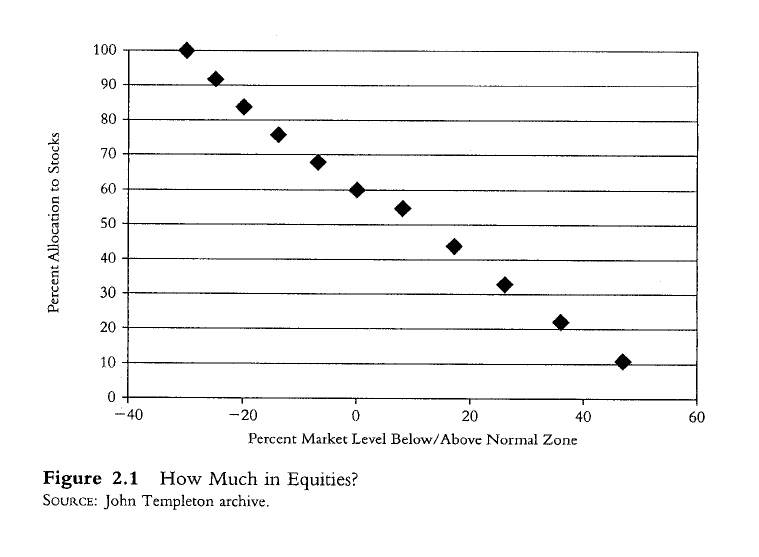

I had not seen this book before – Templeton’s Way with Money: Strategies and Philosophy of a Legendary Investor – published in 2012 (hat tip to reader KH). The book describes some of the memorandums to clients from Templeton, including a few below on valuation the stock market as a whole (DOW). Funny to see they were using the equivilent of the Shiller CAPE (20), Tobin’s Q, and the Fed-model to value the market and adjust their equity exposure….

Needless to say, he wouldn’t have too much in US stocks these days….now foreign….charts from dShort