This excerpt is from the book Global Asset Allocation now available on Amazon as an eBook. If you promise to write a review, go here and I’ll send you a free copy.

—-

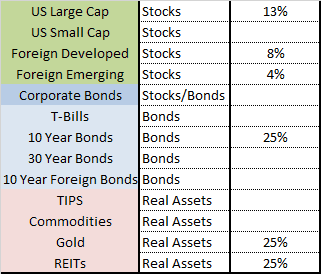

Marc Faber is a Swiss economist and fund manager, living in Asia, who writes the Gloom, Boom, and Doom market newsletter. And before you ask, no we’re not directly related – although my father’s side is from Germany and France and so there is a chance we have some shared blood somewhere.) While he often contributes long and short investment ideas to the Barron’s Roundtable, he has stated numerous times his rough asset allocation is 25% each in gold, stocks, bonds and cash, and real estate. Marc probably holds some bonds and real estate in foreign markets, but the simple portfolio will do for a general discussion. While he doesn’t explicitly say that he would split his stocks into U.S. and foreign, we assume that to be the case.

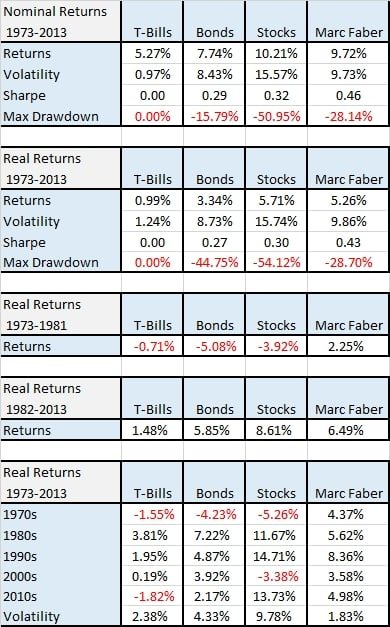

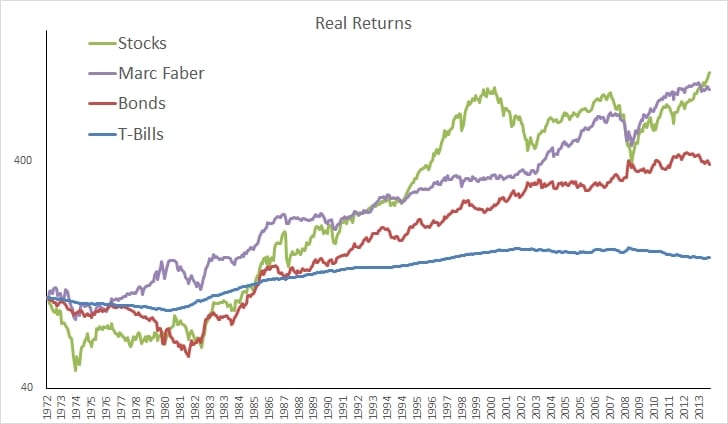

This was a surprise to me, but Marc’s simple allocation is one of the most consistent we have reviewed. The portfolio is one of the few that had positive real returns in each decade. Figure 35 displays the Marc Faber Portfolio.

FIGURE 35 – Marc Faber Portfolio

Source: CNBC

FIGURE 36 – Asset Class Returns, 1973-2013

Source: Global Financial Data