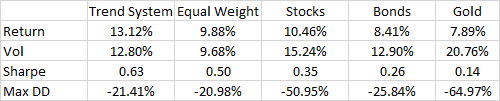

My readers know I am a trendfollower at heart. I originally sent this to The Idea Farm but received so many questions I figured I would post here too. This study was completed by Ned Davis Research, and could not be more simple. (Similar in theory to our old QTAA paper from 2007, as well as systems by Cambria, Dorsey among many others.)

Three asset classes: Stocks, bonds, gold.

Invest equally in whatever is going up (defined as 3 month SMA > 10 month SMA).

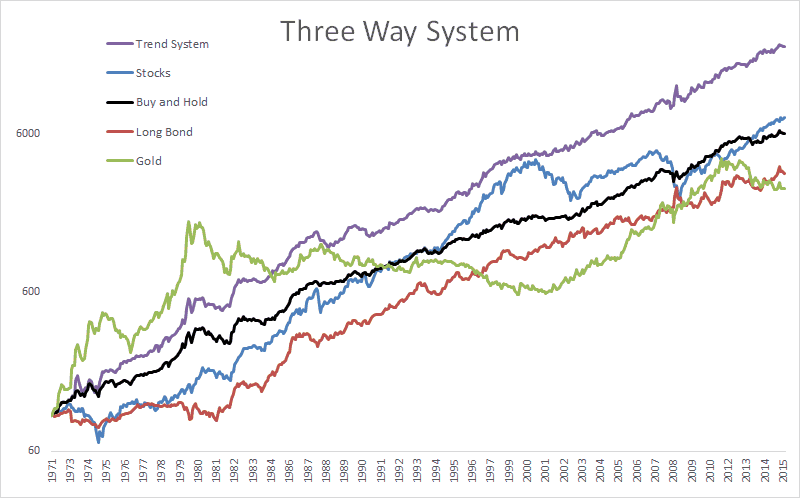

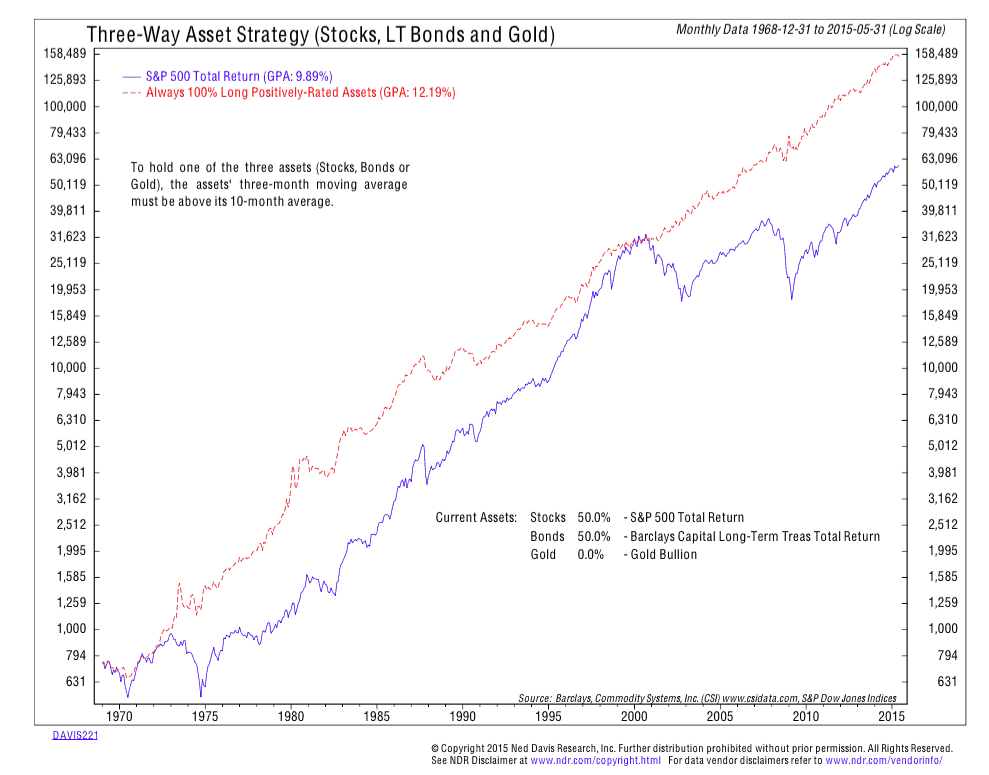

That’s it. Thumps the stock market with less risk. I went and re-created it on my own for fun and you can see the results below. Before you email me a gazillion questions, realize that momentum and trend are nothing new (been around over 100 years), and many allocations and systems have similar properties. I’d suggest reading our white papers, 4 books, and searching the blog archives for momentum or trend. Idea Farm members also get an Excel sheet to go play around and backtest simple mo and trend strats on their own.

People love trying to boil the ocean (what about investing in foreign? Should I invest my cash in TIPS instead of bonds? What about shorting? etc etc) but much like our new book, the specifics don’t matter much. What does matter in this case is you are investing in what is going up, and not what is going down.

Click to enlarge.

Original inspiration from NDR

Copyright 2015 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved.

See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/.