Long time readers know that I talk a lot about two ancient investing strategies – value and momentum/trend. Often I will mention that my favorite setup is when the two align, although that only happens about a third of the time for any given market. (Old post here).

So we’ve been preaching foreign stocks markets are cheaper, they haven’t really overtaken the momentum category until recently. Emerging markets are having a great year (as is the cheap CAPE ratio bucket of countries), and even foreign developed is leading since this summer. You get the most explosive returns when cheap markets catch some momentum.

We’ll see if it lasts!

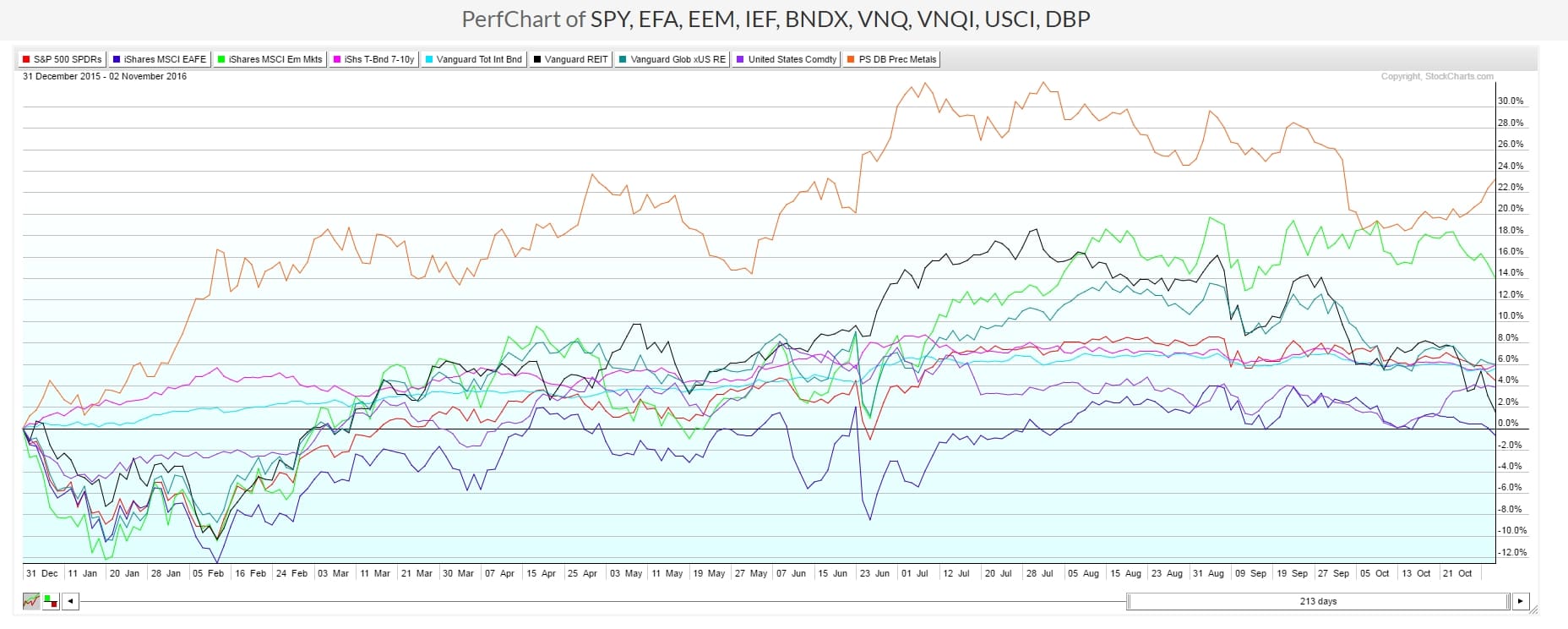

Here is YTD with some main asset classes showing precious metals and emerging markets leading the way:

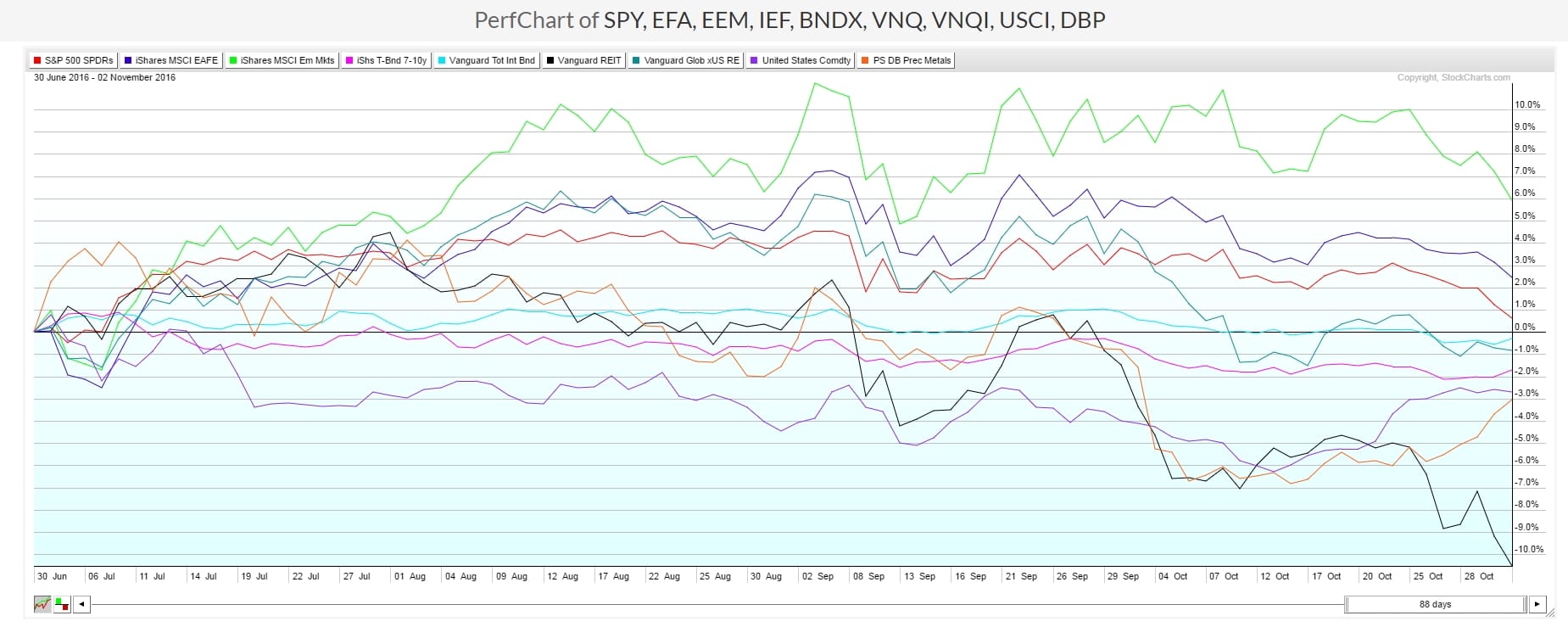

and here is since July 1 with emerging and developed leading the way (and REITs falling out of bed):