Episode #160: John Huber, Saber Capital Management, “Stock Prices Fluctuate Much More Than The Underlying Businesses”

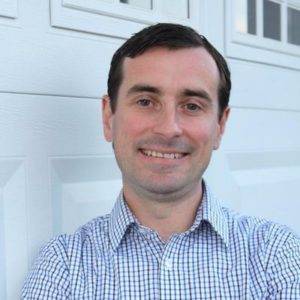

Guest: John Huber is the portfolio manager of Saber Capital Management, LLC. Saber manages Saber Investment Fund, LP, an investment partnership modeled after the original Buffett partnerships. Saber’s objective is to compound capital over the long-term by making concentrated investments in undervalued stocks of great businesses.

Date Recorded: 6/4/19 | Run-Time: 1:11:37

Summary: John begins with some background on his approach to investing, and the framework he relies on at Saber Capital Management. John modeled his strategy after the early years of Warren Buffett’s partnerships. At Saber Capital Management, he focuses on good businesses that are poised to do well over time, and a tactical approach to portfolio management.

Next, Meb asks about the portfolio approach. John discusses his portfolio being concentrated and long only. He mentions he thinks diversification can be had in fewer positions than is commonly thought. He tends to have 5-6 stocks representing 80% – 90% of his capital.

The conversation then shifts into details about what he looks for when researching companies for potential investment. He talks about compounders, and how looking for them has changed since the days of Graham and Dodd to now, where the focus on intangible aspects is much more important.

John then gets deeper into his process. He reveals that he sees the investment landscape in two buckets. 1) companies increasing intrinsic value over time, and 2) companies eroding value over time. He tries to avoid companies that erode value over time. He notes that focusing on key variables can get him most of the way there, then he covers his final step, figuring out how much the company is worth, and how much to pay for it.

Comments or suggestions? Email us Feedback@TheMebFaberShow.com or call us to leave a voicemail at 323 834 9159

Interested in sponsoring an episode? Email Justin at jb@cambriainvestments.com

Links from the Episode:

- 0:50 – Welcome John Huber, of Saber Capital Management, and Base Hit Investing

- 3:01 – Family background and John’s path to working in finance

- 3:39 – The Warren Buffett Way: Investment Strategies of the World’s Greatest Investor (Hagstrom)

- 7:13 – Episode #119: Tom Dorsey, “Fundamentals Answer the First Question ‘What Should I Buy?’ The Technical Side Answers the Question ‘When?’”

- 7:23 – Start to John’s career in real estate

- 11:28 – Why Warren Buffett’s styles and partnerships were attractive to John

- 14:06 – John’s investment strategy

- 14:24 – Some Thoughts on Investment Strategies and Buffett’s 1966 Disney Investment (Huber)

- 20:37 – General structure of John’s portfolio

- 25:44 – How to find investments

- 25:54 – The Greatest Investor You’ve Never Heard Of: An Optometrist Who Beat The Odds To Become A Billionaire (Forbes)

- 32:15 – John’s technique for evaluating companies

- 36:30 – How companies’ intrinsic value is always changing

- 36:44 – China Thoughts and the Circle of Competence (Huber)

- 43:25 – Specific names and indexes that highlight what John sees as good opportunities

- 50:20 – Homeruns vs big successes

- 53:30 – Other investments in the portfolio

- 57:43 – Sell criteria

- 1:00:52 – Market cap scale

- 1:04:14 – Favorite letters from shareholders or companies that John finds insightful (Norbert Lou, Allan Mecham)

- 1:06:40 – Most memorable investment

- 1:10:23 – How to connect with John – SaberCapitalMGT.com

Transcript of Episode 160:

Welcome Message: Welcome to the “Meb Faber Show,” where the focus is on helping you grow and preserve your wealth. Join us as we discuss the craft of investing and uncover new and profitable ideas, all to help you grow wealthier and wiser. Better investing starts here.

Disclaimer: Meb Faber is the co-founder and Chief Investment Officer at Cambria Investment Management. Due to industry regulations, he will not discuss any of Cambria’s funds on this podcast. All opinions expressed by podcast participants are solely their own opinions and do not reflect the opinion of Cambria Investment Management or its affiliates. For more information, visit cambriainvestments.com.

Meb: Hey, podcast listeners, we got a great show for you today. Our guest is the portfolio manager, founder of Saber Capital Management. He manages the Saber Investment Fund as well as separate accounts, modeled after the original Buffett partnerships. Also author of the blog “Base Hit Investing.” Welcome to the show, John Huber.

John: Thank you, Meb. Appreciate you inviting me on.

Meb: Yeah, man. So you’re live from Raleigh. By the time this comes out, listeners, FYI, I’m going to be doing a quick trip through Grand Rapids, Cleveland, Louisville, and then North Carolina for a week. So if you’re in North Carolina say hello, and John, we’ll have to hang out. I love that part of… Aare you from Carolina originally?

John: No, I grew up in the Buffalo, New York area. I went to school down here at North Carolina State and had been down here since 2000. So I’ve been down here 19 years, roughly half my life. Now officially…I guess I can officially be considered North Carolinian at this point.

Meb: Go pack. I spent many a day, I was a Virginia grad, and so Virginia always started about a week or two after Carolina and state did. So I’d go visit all my friends, check them into their dorms, hang out, before going back to school. It’s kind of a nice dual exposure. So I spent plenty of time down there. And this just brought back a really odd memory. Sorry, podcast listeners, for the diatribe. But growing up, we went to this little, tiny beach North Carolina, which I’ll be at this summer, sort of near Wrightsville, called Topsail Island. And the house that we…

John: We have a condo on Topsail Island. Yeah, I know it well. It’s a great place to be.

Meb: [inaudible 00:02:17] is world famous. And there’s now a trailer bar there, which is in a trailer. But I have a very seared memory, which I probably haven’t told anyone. So, podcast listeners, probably the first time I’ve ever admitted this. I was deathly afraid of on our toilet growing up in our house in Topsail Island. We had a wolf pack logo like the really scary one. I don’t know if you know which one I’m talking about, listeners. And I was like horrified to ever use the bathroom. I wouldn’t go in there by myself. That scarred me for life. So I’m sorry for the diatribe.

John: So you went to Virginia instead?

Meb: Yeah, exactly.

John: You stayed in the ACC, but…

Meb: You know, I was an engineer and NC State’s got plenty good engineering, but I was scarred. Anyway, you come from a family of engineers. Did I read that right? Your old man was an engineer as well?

John: Yeah, my dad was an engineer. When I went to school, I wasn’t sure what I wanted to do. I actually, I guess just a brief background, I got into business sort of in a roundabout way. I went to school originally thinking possibly following in those footsteps going into engineering. And then I decided…I really wanted to…I went to school for journalism. That’s what I was going to do. And then I picked up a book at the library one day called “The Warren Buffett Way,” which is one of the standard biographies of Buffett. And that was really the first time I had ever read anything on Buffett. And this was, I think, my senior year of school. I was very interested in investing at that point. My dad was a very avid investor for his own account. He was an engineer by trade, but he invested very actively in his personal account. And so I always thought I would sort of follow that playbook and invest, have a career and invest my savings. I thought it would be a hobby. It became more than a hobby, more of a passion at a certain point. And I realized I wanted to, instead of going into journalism, I thought I was going to be a journalist or a reporter or a writer of some sort. I decided I wanted to go into business, and so that’s kind of how I got into investing and sort of into the business. I spent quite a few years in real estate before I set up my fund. But that’s sort of a roundabout explanation of how I got from there to here. But, yeah, my dad was an engineer.

Meb: Mine was too, and it’s funny, he was kind of dual skills. He was really good at the sort of the Peter Lynch, aerospace engineering side of the investing world. But he also passed on all of his genetic behavioural biases to me as being overconfident, chasing returns, all the good stuff. So we learned a lot of lessons together there. What was your dad’s style? Was he a dividend guy? Was he a mutual fund guy? Did you guys kind of rap about that growing up or in college and thereafter?

John: Yeah, I mean, he invested in a way that is completely unrelated to the way that I invest now, but he was very active. I mean, he did invest in mutual funds. I think he probably read a lot of the… I remember going to the library with him as a kid and he would look through value lines. And he would look…he had this really simple observation. And this is probably 30 or 35 years ago…well, I guess it wasn’t 35 years ago, but it was probably 30 years ago, that he worked for GM at the time. And so he spent his career at Delphi, which is a part supplier for GM, and for many years was part of GM. And so he would look at the 52-week high and the 52-week low of General Motors stock. And he would notice that the stock would fluctuate between the high and the low.

There’d be a 50% gap between the high and the low, or some number in that ballpark. And so he just figured that there was an opportunity in there somehow. And so he was actually really adept at buying GM low and selling it high, essentially, and then other securities like that, that he felt like he knew. And the one thing I took away from him is he was extremely concentrated. And again, this was when I was a kid, I knew nothing about Buffett. I don’t even think I had heard of Buffett at that time. This is just sort of the way he invested. So there’s some principles there that I sort of picked up along the way. But he was just doing this in his own account. This was his 401(k). This was his after tax money that he had saved and so forth.

Meb: It just brings back a lot of memories. I remember looking through a lot of my father’s files, saved for many decades, and found some old hand-drawn mutual fund and stock charts on engineering paper from, God, who knows how many, 50, 60 years ago.

John: Yeah, it’s funny. He had these spreadsheets, you mentioned the handwritten stuff, I mean, he had these spreadsheets. I call them spreadsheets. It was really like an investment. It wasn’t really an investment diary, because it was more just numbers. So he had tracked out different fundamental data and different stock price data and all kinds of numbers on these sheets, and he kept them in a folder. And so, yeah, I think I still have some of those. But, yeah, it’s fun to look through those every once in a while.

Meb: Everyone today just take it for granted. You can pull up your phone or website and have stock charts everywhere. But, man, you talk to some of the old school guys who used to do these by hand every day. We had Dorsey on the podcast a while back, and he talked about how much time was spent doing hand charting. Anyway. All right, so you started out, you did a little bit of real estate, which I think in many ways is pretty good, similar, tangential sort of education and experience for investing and has a lot of the same dynamics. Was that the sort of path leading you to kind of have the time and interest to be able to eventually start your own shop?

John: Yeah, I spent 10 years in real estate and I really… The goal the whole time, so from the very first time I mentioned that book I read at the library, that led me to a lot of the classic investing texts that everyone often cites. And I started to pour over those and read through a lot of the old letters that Buffett wrote. I really started to kind of my education, so to speak. But real estate was a way for me to leverage the limited capital that I had. It was very limited at that time. And we set up a few small real estate partnerships, where we would buy single family homes, we would buy small multifamily properties, we bought some apartment buildings, and we had a small portfolio of properties that we managed. And we really lucked out because it was, frankly, a great time to be in that business.

This was 2004, 2005 is when I got into it, which sounds like a bad time because it’s sort of in the middle of the boom. But by the time I had cobbled together any capital, it was really 2006, 2007. And at that point, it was really the beginning of the end of the real estate market, more or less. I mean, the foreclosure, the default boom really started in 2007. And so, if you are a small investor, like we were, my partner and I, we had an enormous number of opportunities to capitalize on small banks that were unloading properties, completely price insensitive. They had liquidity issues, and there were all sorts of bargains to be had. If you could cherrypick the best deals, which we could because we were small, that’s sort of what we did.

And so we really ran like almost like a grandma and dad type investment strategy in the real estate market where we would buy these properties, lease them up and sell them, some of them we kept for cash flow, some of them we sold. And then we would just sort of recycle the capital and do it again. And so we did that for a number of years. And the whole goal for me the whole time was to set up a partnership along the lines of what Buffett had in the ’50s. And so I had this goal in the back of my head. And my goal was to save enough capital to where I could see the firm, and then also have enough of a nest egg to where I could survive any sort of a downturn.

So by the time I had enough capital…and by the way, this was not the fastest. I did some soul searching early on, “Should I go get an MBA? Should I go to Wall Street? Should I go work at a fund?” And I really determined that I loved the autonomy that I had. I felt like I could come into work, and work on what I wanted to do, and learn a lot, read what I wanted to read. And so I really enjoyed the flexibility and the unconstrained time. And so I just decided to stick with what I was doing. And it took me a little bit longer than…again, I probably could have made more money doing something else more quickly but I really valued this thing that I had. And I felt like my learning curve as an investor was maximized doing what I did. And so it took a while, but I had saved up enough to where I felt like I had plenty of reserves to survive any sort of a bear market.

And this was at the end of 2013. So this is after 8 or 9 years, almost 10 years of real estate investing. And then what’s interesting is, at the end of 2013, I had, if you remember, I’m sure you remember this, Meb, 2013, the market was up 33%. So, in the back of my mind, it’s not the best time to start an investment fund. But at that time, I had enough to where I felt like I could launch the firm and survive any sort of a three, four, or five-year bear market if we had that. And, lo and behold, the market has continued to do fairly well over the last five years. But by the time we were coming off of a five-year stretch, 2009, ’10, ’11, ’12, ’13, and ’12 and ’13 were pretty big years. So it wasn’t necessarily the ideal time to start, but that was when I had enough faith to where I felt like I could launch the firm and survive any sort of a downturn.

Meb: Talk to me more about Warren Buffett other than the fact he’s one of the world’s greatest investors in history, and he tells great folksy jokes. What was it about kind of either his style? And then you also mentioned you modelled kind of what you’re thinking after his partnership. Do you want to walk us through the structure what the thinking is there?

John: Yeah, and the partnership structure, I really loved… Again, this is going way back when I first started reading about Buffett, this was in college. So this was at a time many years ago, where I really knew nothing about the investment management business, I knew nothing about hedge funds. I’d heard of all these things. Buffett had this partnership. I actually found the partnership letters online and I really loved the structure he had, I loved the lifestyle. So meaning…what I mean by that is just freedom to…again, the autonomy I mentioned, the freedom to work on what you want to work on. He really was running his own small business. And so I really liked a lot of those components that I saw in his structure. And then also the fee structure, which I have recently adopted, his fee structure is unique. His fee structure is no management fee and a 6% compounding hurdle, and then he took 25% of the profits over 6%.

So I really thought that was a fair fee structure. It basically meant that he wasn’t making any money unless he was earning over 6% for his investors. But he got rewarded handsomely, if he did perform over 6%, which he clearly did. And, obviously, things worked out quite well for him. But I thought it was just a really fair fee structure. So that’s sort of the reason why I decided to adopt that. I’ve always thought of my company as sort of my own family partnership, where I wanted to use it as a vehicle to invest my own capital, my family’s capital. I had my parents invested, my in-laws. And so it’s sort of a…you know, the way it started was almost like a family partnership over the initial investors.

I think we have 60 or 70 different families now, but it’s since obviously expanded outside investors. But I’ve always viewed it as a family partnership, where outside investors get to invest alongside me. So I hope to be doing this for many years to come. I think of it as like-minded investors can sort of invest alongside me.

Meb: It’s interesting. It’s a structure that very few investors have actually implemented. There’s only a handful of funds that do, to my knowledge, maybe there’s a bunch, but to my knowledge, Buffett’s structure, which seems like such an obvious structure and aligned incentives. I imagine you say 6% hurdle to people, and you’re going to get the deer blinking and headlights, but it’s an obvious structure in my mind. So, all right, let’s talk a little bit about strategy. I want to hear a little bit about your focus. And you were talking about in one of your… By the way, listeners, John has a great blog, a lot of writing on there, too. But you got a piece, and we were talking about some thoughts on Buffet’s 1966 investment letter, which is a long time ago, predates us. But you talked about is that there’s a strange dichotomy in the value investing universe, those who buy so-called compounders and those who buy so-called cheap stocks, then you go on and describe kind of some thinking there. Walk us through your framework for how you think about investing and what you’re looking for.

John: Yeah, so my favourite thing about investing, and I should say there’s no right or wrong way to skin the cat, Buffett had a…that he operated in this partnership that was really completely different than the strategy he’s now most famous for, which is the one that the good business at good prices strategy, I’ll call it, that he has adopted, let’s say, starting in the late 1970s, early 1980s because of his capital. In the early years, he was doing lots of special situations. He was investing in a lot of different types of securities. And we can talk about some of that later on. And we can talk about edge and so forth. And one of my favourite things about investing is the simple concept, I guess, of providing a business with capital. So the simple idea that you provided business with capital then uses that capital to generate a return on your behalf.

So I’ve always loved the passive nature of compounding. I like the idea of the business doing the work for you, the heavy lifting, so to speak. I get to invest capital, and then other people actually do the hard work of operating the business. And so this is obviously very fundamental stuff. But I’ve always thought that this concept of exchanging capital for the effort, time, and ingenuity of other people is a really great train from my perspective. So the idea of latching onto a business, letting it do the work, for me, has always been an idea that I’ve liked. And so I say all this to say I prefer investing in the good companies, because the good companies are the ones, as simple as it sounds, the good companies, over time, are the ones that generate wealth for owners.

And so Saber’s philosophy is really simple. It’s rooted in the simple truth that stocks of good businesses do well over time. And I really do think it’s as simple as you know, Meb. I mean, from a quantitative approach, there’s a lot of reasons why stocks go up and down in the near term or in the course of any given year. There’s value factors, there’s momentum factors, there’s sentiment shifts, and all kinds of reasons. But over the long-term, wealth is created by owning a stake in a business that can grow its earning power over time, which means the intrinsic value is growing over time. And stock prices generally follow those fundamentals in the long run.

So my approach is…the way I think about it is my approach is to analyse and build a watch list of businesses that I think will be earning more money in the future than they are today. And then the key to making the whole thing work is to wait, to be very patient, and to wait for an opportunity to buy them when they’re undervalued. So I think the approach fits my personality. I feel like you get a margin of safety by investing in good companies. I do believe that more errors are made in investing by picking the wrong business than picking the wrong valuation. I think there is truth to be ubiquitous saying that, “Time is the friend of the good business.”

And so I think you may make mistake on valuation work, but a good business, if you’re right about the business, Buffett has this quote that he said in 2001, I think it was at the University of Georgia, and this quote has always stuck in my mind, “If you’re right about the business, you’ll make a lot of money.” And so as simple as that is, that’s really at the root of my personal philosophy. And again, there’s no right way to skin the cat. And this approach really begs the question, well, this is not a unique approach. So everybody knows it’s a good idea, buy good business at a good price. I think it begs the question, how do you actually implement that approach?

And so, if the first pillar of my approach is focusing on good businesses, the second pillar, which is just as important or maybe even more important, is the tactical approach to portfolio management. And I really think that’s what separates good results from mediocre results over time. In this type of an approach, you really have to be opportunistic, especially in this day and age where there’s not a lot…I don’t think there’s really any informational edge anymore in the U.S. markets, for the most part, even in small caps. And some people might disagree with that, but I think in general, there’s very little informational edge. So I think you really have to take advantage of the fluctuations in the market and the natural opportunities that come up just through sentiment changes, but you really have to be patient, and you really have to be opportunistic, and you really have to be concentrated.

So I think, sort of throwing some of the traditional portfolio management tactics out the window. And again, this is if you run this type of approach. There are quantitative approaches. If you’re Renaissance Capital, and you’re operating more like a grocery store, you’re making lots of trades and lots of small profits on each trade, and you’re turning your capital over frequently, you can do that. Peter Lynch, I think, did 50% a year in the Magellan Fund from 1977 to 1980 or ’81. He was having incredible returns early on, but he was turning his portfolio over 300% a year, which means 4 times a year, which means his average holding time was 3 months. And so…which is ironic, because Peter Lynch was famous for this idea of having 10 baggers… In the earlier years, he was really, if you do the math, he was averaging 10% to 12% profit on each individual security selection, and he was just turning his portfolio over very fast.

To do that now, you have to have some sort of an edge. And I don’t think the way that Buffett had an edge in the ’50s or the way that Peter Lynch had an edge in the ’70s is there anymore. And so I think you have to think a little bit differently about portfolio management if you run this approach. So those sort of a long-winded explanation of my approach, but the two pillars are focus on the good businesses and really think very carefully about portfolio management.

Meb: We’re going to talk about both of those. You dropped about seven good nuggets and gems in there that are good jumping off points. I started daydreaming because you mentioned University of Georgia, which was the first college I ever visited. And I think within one night fell in love maybe 10 or 15 different times. Athens, what a fun city, my mom went there too so she’s a bulldog. I want to talk about these two pillars in depth. But first, just out of curiosity, what’s the general structure of what the portfolio looks like? So meaning, number of holdings you target, the maximum size any one position will be. Do you short, and is it long only? So just the broad, general approach.

John: Yeah, it’s a long only strategy. The portfolio will look very unique. And what I mean by that is, it’s very concentrated. So I typically will have 5 or 6 stocks that represent 80% to 90% of the capital. That’s sort of just an overview of how I think about the portfolio. And when you do the math, and again, just to not to harp on this too much, but when you do the math on this type of an approach, meaning a long-term investing strategy, let’s say, an average holding time of two or three years, or even longer is enough opportunity to have some turnover. But when you do the math on it, it’s very difficult to have 20 ideas in a portfolio and expect to earn, let’s say, 15% a year or some number. I’m just kind of pulling that number out of the air. But it’s very difficult to find enough like this that meet that average hurdle rate because you’re going to make some mistakes.

So you’re gonna have to have some winners. You also have 15 to 20 stocks, or 25 stocks that average that, you have to find a lot of ideas. And depending on your holding period, you might have to find an idea every three weeks or every five weeks. And to me, there’s just not that many ideas out there. So it leads me to a concentrated approach. And then, more importantly, just really being opportunistic. Sometimes there’s more opportunities than others. And that means sometimes you just have to wait and you have to do nothing. One of the best investors, I think, in the last 30 years is Stan Druckenmiller who runs a completely different strategy than I run. But he has the similarity, I think, is the portfolio management approach where he gave a talk, I think, four years ago where he said, “I really do nothing all year…” and I’m sort of paraphrasing off the memory here, but he said something to the effect of, “I really do nothing all year, except for the one or two times in a year where I see something and then I really go after it.”

Actually, Jim Rogers, who coincidentally also worked for Soros in the ’70s, he’s got this sort of tongue in cheek quote where he says, “I just wait until I see money lying in the corner, and I walk over and pick it up.” And so that’s obviously a sort of a general way to think about it, but it actually helps to keep that type of an idea in mind. The implication there is wait for something that’s extremely obvious. And then don’t dilute that really great, obvious idea with 10 other ideas that are just good or average. And oftentimes good ideas turn out to be average. So that’s the way I think about portfolio management.

Meb: Well, you know, it’s interesting because the vast majority of the fund industry likes to claim that they’re doing things that are different, and whatever their approach may be, I mean, the thousands of mutual funds. But most of the research shows that if you’re a $50 billion fund and you have 500, 700 positions, chances are you’re going to look just like the S&P. And that’s what happens. Bill Miller said that he estimates like 80% of the active industry is essentially closet indexing much higher fees. And we always say if you’re going to be active, you have to be weird, concentrated, and different. But that goes in direct conflict with career risk. And so people really don’t like it, particularly once they get to size because 1% of fees or 2% of fees at 10 to 50 billion, being weird and different is often not rewarded. All right, so very concentrated. How big can the biggest position be? And then last, do you short and U.S. only? You said long only, so is it U.S. only?

John: It’s not U.S. only. So I have the flexibility and the partnership to invest. And, by the way, I have the flexibility to short, I don’t short, but I have the ability to. I typically just…it’s exclusively long only. I have the ability to invest outside of the U.S., but it’s primarily U.S. based. We have one investment outside of the U.S. at the moment, but I think the vast majority of my investments will be in the U.S. just because it’s the location that I understand the best, understand the laws here. And so I’m just more comfortable investing in the U.S., but that doesn’t mean there’s not some great ideas outside of the U.S too, but that tends to be where I stay.

Meb: All right, and what’s the max on the concentration?

John: Yeah, max on the concentration is…I don’t really have any…in my fund docs, there’s no set limit. So the biggest position has gotten…today the biggest position has been probably a cost of about 25%, and it can rise higher than that, if the security appreciates. So there’s no limit to it. Obviously, I do think about certain diversification. And I think you have to have some diversification and some risk management practices in place. But I do think that the vast majority of the benefits that you get from diversification can be achieved with far fewer securities than most people realize. So that’s sort of my thought on it. But yeah, the positions can get quite big if all the stars are aligned. So I’m certain investments where everything lines up, then the position can get quite big, but not every position is obviously that large.

Meb: All right, so let’s get back to what we’re talking about before. And we’re going to talk about the two kind of pillars of your process. There was a quote I read recently in an article, and the article was about this older gentleman who was like a med device guy, and he’s now in the hundred millionaire if not billionaire. I think he’s a billionaire. But the article is a little weird, I think it was in Forbes, but there was a quote he had that is very similar to what you were talking about. And it’s kind of under this broad umbrella of compounding. I’m gonna read the quote because I can’t get out of my head.

This guy’s name was Wartheim or Wartheim. I don’t know how to say it. W-A-R-T-H-E-I-M. And he said, “You take what you earn with the sweat of your brow, then you take a percentage of that and you invest in other people’s labour.” I thought this is such a thoughtful comment about investing in stocks, and then letting other people help to compound your money for you, and trying to find these real great compounders you can hold for years hopefully. John, how do you find those? What’s the process? How do you find these 10 or 100 baggers?

John: Yeah. When you think about the balance sheet of most companies or a lot of companies, not every company, but many companies in today’s environment are, when you think about the balance sheet, there’s a reason why grandma and dad would analyse the inventory and the networking capital of a business and the book value, which would include the buildings and the property that the company owned. Those assets represented the vast majority of that company’s net worth. And the company use those assets primarily. I think labour, obviously, these companies were very labour-intensive, many of them as well. But labour, I think, was much more of a commodity. And the primary assets were these physical, tangible assets that a company owned.

And today, I think some companies still obviously use much physical capital to do its business. But a lot of companies are much more…the intangible aspect of the company is much more important. So the human capital, and that could come from a variety of things, whether it’s patents or whether it’s other intangible assets, brand value. But a big portion of that, I think, is, like I said, before human ingenuity and human know-how, an employee. Is a company an attractive place to work? When you think about what makes a good business in today’s world, there’s some simple things that we can all agree on. But the bottom line is, does the company…what you really want to know is think about that trade off I mentioned before, exchanging capital for human effort and know-how.

You ideally want to invest in a situation where the human capital you’re benefiting from is more valuable than the physical capital that you’re paying to get it. And so, in other words, does the company take the capital you’re investing and provide a high return? So high return on capital is the bottom line. I look for other things like free cash flow. Does the company have a good balance sheet and all of that? But just like a portfolio manager, the bottom line for a portfolio manager is what’s the return that you’re providing the investors who put up a capital bottom line for businesses? What’s the return on capital that the owners put up, or maybe the owners and the lenders put up? So the return on capital.

So that’s one way to think about a good business. But again, I mean, it’s an interesting thing about that because the intangible aspect of a company’s balance sheet, which doesn’t show up on the balance sheet, obviously, and the human capital isn’t listed, there’s no value ascribed to it, but it’s a very, very important part of that business. So I spent a lot of time thinking about those qualities. Another one to think about is does the management team…are they adaptable to change? One thing I spent a lot of time thinking about recently is, and this is another sort of, I think, as what you might call a secular shift or something, where in the old days used to have the technology sector, used to have the manufacturing sector, the energy sector, consumer staples, retail, all of these different sectors, and they were all siloed.

Now you have…you still have all those sectors, but the technology sector is so pervasive, meaning, if you operate in retail, you use technology, if you operate in energy, you’re using technology. And all of those industries use technology to a certain extent, I suppose. But nowadays, it touches every industry in a much more pronounced way than it used to. And so what that means is, if you’re a company in retail or you’re a company in any manufacturing, any one of these other sectors, you’re more at risk to getting disrupted, would be the common way to phrase it. But if you think about Campbell’s Soup had 100-year competitive advantage because it had shelf space, it had huge gross margins that it could use to invest in a massive advertising budget, which reinforced its brand value, the only thing on TV commercials and so people would buy it, which reinforced that gross margin, and it was sort of a self-fulfilling prophecy, self-fulfilling circle where it continued for many years that way, and they have to pay the grocery store’s placement fees for better placement on the shelves.

It’s almost impossible if you’re an upstart competitor to come in and challenge that. Technology changed the game. So now, if you’re a small upstart brand, you can, on a shoestring budget, advertise on Instagram, you can get a foothold. It’s how a lot of companies have started. I mean, Dollar Shave Club started that way. Lots of small clothing brands have made life difficult for Under Armour, for Nike, for some of these brands that were…and nothing bad is gonna happen to Nike, but it’s much more competitive now than it once was because of all of these alternative choices. So technology has changed it to where you have to think about… I guess the point I’m trying to make is a company has to be willing to embrace change because Buffett, for decades, he preached invest in companies that don’t change.

And I think now that is no longer…I don’t want to say it’s no longer possible, but I think you have to change the way you think about it a little bit to the point where you want to invest in companies that are adaptable to change, because I think change is a constant. So those are just some of the things you want to think about. I think, as a long-term investor, you want to place much more importance on the human capital, the management team. Are they adaptable to change? Can they retain talented workers? Can they attract smart people? All of those things are much more critical, I think, to a company’s future earning power than just analysing things that you might have analysed 20 or 30 years ago, even.

Meb: And so what’s the process? And, by the way, Saber, I don’t think refers to the tiger, but rather the sabermetrics, if I recall correctly. So are you a screener? Are you a government filings 10Ks and Qs guy? Are you a walk around the neighbourhood and knock on some doors? What’s the process? How do you find these names? How do you do your research? Are you down there chatting up management? What’s the process?

John: Yeah, I mean, I think about the world in terms of two buckets, I guess. And this is sort of what we’ve been touching on throughout the conversation. But to sort of summarize it, when I think about my day-to-day process or how I go about finding ideas, so many opportunities, there’s so many potential opportunities, so many publicly traded securities, that you have to have a filtering system of some sort. I don’t really use screens. I used to, but I found a couple issues with doing that. And this is, again, just based on my own experience doing it. Some people have found successful ways to utilize screens. For me, the way I filter it is, I think of the world in two buckets. I guess all companies fall into one of two buckets.

The first bucket, we’ll say, is companies that are increasing their intrinsic value over time, just to make it simple. The second bucket are eroding value over time. Or another way to think about it is two buckets. The first bucket is companies that can produce cash and the second bucket is companies that consume cash. And surprisingly, there are many companies in the public markets that fall into that latter bucket, sometimes companies fluctuate between the buckets, but over the course of the life of a company, they will fall into one of those two buckets. And so I want to avoid all of the companies in that second bucket. And again, there are many in that bucket, sometimes entire industries.

If you look at the E&P industry, the oil-producing industry, almost every company, with very few exceptions, fall into that second bucket, meaning they consume cash, their operating business consumes cash. The way they finance their operations is through issuing new debt or new equity. The only cash that comes out of some of those companies are when they sell out to another larger E&P company or a private equity firm or something. So many companies fall into that second bucket. I try to avoid those. And again, many people can invest in those and make good money doing that. But to me, it helps me eliminate, reduce some errors, mitigate the negative effects that those could cause on the portfolio.

So once I have those two buckets, I try to build a watch list. And, I guess, to answer your question, it’s a combination of reading the filings, it’s a combination of reading a variety of different material. The way I try to approach investing is to focus on the key variable. So the types of investments that I’m looking for, you’re not going to locate on page 72 of the footnotes, for example. But I like to read the filings, I like to try to figure out what the key variables are for each company, and then I try to understand how those variables will be impacted going forward in the coming years. And I feel like if you can put your finger on the 1 or 2 or 3 variables that really matter, then that’s going to get you 90% of the way there.

And so to determine that, it’s a combination of what you said, it’s reading the filings, it’s doing some door-knocking, so to speak, it’s talking to people, it’s talking to employees, a lot of the qualitative type research. And it’s just trying to gain an overall comprehensive understanding of a business and the industry it’s in and the competitors, and then forming a view of what that company looks like and what the earning power is going to look like going forward. And then, of course, the last step is figuring out what that company’s worth, what’s the stream of cash that it’s going to likely produce in the next few years’ worth, and how much you want to pay for that.

And so my approach is to build a list of these companies. I think of my process as, every day I come in and I’m trying to slowly but steadily expand my list of companies that I follow, and that I understand. And then as the list expands, your opportunity set expands and the nature of the stock market, as you know, Meb, Mr. Market gives you an opportunity to buy these things at markdown prices from time to time. And so if you have a list of, say, 80 companies in any given year, you might find 1 or 2 or 3 or 5 opportunities on that list. And so that’s really, in a nutshell, the process.

Meb: Well, you had a great quote, and feel free to expand on this. Because I feel like most people don’t appreciate this or think that this number is inflated. Someone was talking about this on Twitter the other day, but you had a piece that seeing 2014 and saying almost five years ago is crazy. But this is a note on circle of competence, fat pitches in how to become the best plumber in some town I can’t pronounce. But it says, “There’s just no logical way to explain why large, mature businesses can fluctuate in value by 50% on average in any given year. It makes no sense that the intrinsic values of large companies can change by tens of billions of dollars in a matter of months. And this dramatic price fluctuation occurs on a regular basis, in fact, every year.” Talk to us a little bit about that. I think that would be a surprise to most listeners.

John: Yeah, it’s really interesting. And I’ve done this. I have this table that I’ve put together a number of years ago, and I sort of updated every year or two just to see what it looks like. And basically it’s a table consists of the top 10 largest stocks in the S&P 500. And so these are the mega caps, obviously. At this point, it consists of a lot of the tech companies like Microsoft, and Amazon, and Google, and Facebook, and Berkshire Hathaway’s in there. Exxon Mobil was in there the last time I updated it, I’m not sure, but it’s still on top 10, but it’s in that ballpark. So these are the huge companies that everyone follows. Procter and Gamble is in there or was in there. Johnson & Johnson is in there.

You could make a good argument that there’s no informational advantage to be had in any of these companies, but yet the stock price will fluctuate. And I think, especially in a company like Johnson & Johnson, you can agree that the underlying value of the business doesn’t change all that much. So if you are a private buyer and you wanted to buy all of that company, the price wouldn’t change by 50%, between one year and the next. But yet the average gap between the high and the low of that list, and I haven’t updated it in the last year, it would remain this much because it’s about this much every year.

Again, the top 10 companies in the market, the average gap between the 52-week high and the 52-week low is about 50%. I think it was 49% the last time I did it, about a year ago. And so that was remarkable. I mean, you sort of intuitively understand that, stock prices fluctuate, everybody knows that. But when you really look at the value of the fluctuation in these mega cap stocks, like Apple, largest stock in the market, is a great example. That company was valued at close to 1.2 trillion last August, so just 9 or 10 months ago. And it went from 1.2 trillion down to about 650 billion in 5 months or 4 months.

So by early January, January 2nd or 3rd was nearly a half a trillion dollars less than it was valued just 5 months before. And then it went up, I think, another 200 billion from there, 200 or 250 billion from there. And that was a month ago, let’s say, and since then it’s up almost 200 billion. So the point is, the fluctuations of these companies are the obvious implication is that the stock prices fluctuate much more than the underlying businesses. And these are the mega caps. If you go to the Russell 2000, and I’ve done this for the small caps too, the same principle holds true, it’s just the magnitude is much greater. So the median gap between the high and the low of that list, last time I updated that spreadsheet, was roughly 80%.

So small caps are…I think, everyone probably agrees, small caps are more inefficient than large caps on average. But even among the very mega caps, I’ve made a living off of being able to capitalize on certain stocks where there’s absolutely no informational advantage, but you can capitalize on sentiment changes, or undue pessimism, or just extreme pessimism, and then selling when there’s much more optimism present. So it’s a different way to look at it, but those opportunities exist in the public markets. And the same reason why there was no…why I believe there’s no informational advantage today even in all caps in the U.S. at least, there are informational advantages in certain pockets but for the most part there’s no informational advantage.

Warren Buffett in the ’50s, this is just an interesting side note, Buffett made a living off of just flipping through the Moody’s pages. Finding stocks, he would go through 10,000 stocks and he would find these incredible bargains. And he found this one stock that was called Western Insurance, and it was priced at about $20 a share, and it had $16 of earnings. And so it’s priced at just over one PE, and this was in like 1952. And this was a company that was profitable, it was stable, it had a good balance sheet with no debt, there were very little debt. I mean, it was a well-managed business. There was nothing wrong with it, but yet it was trading at one times earnings.

I think it was like a 20-bagger for Buffett in his personal account. I’ve actually gone back and tried to figure that out. The stock appreciated significantly from that level. And it was just sort of a bargain hiding in plain sight because no one knew about it. Nobody was following it. So Buffett was the only one that found it, and eventually stock crises tend to follow fundamentals. And so it’s sort of worked itself out over the course of the next few years. But it’s just needless to say those types of situations don’t really exist anymore, at least not in this market. Maybe if you’re in South Korea or you’re in maybe some emerging market you can find certain companies like that that are under the rocks. But I think in the U.S., this game has changed.

And the game now…the reason why the informational advantage is gone is simply because information is at our fingertips. And so now, I think the edge is much more in the behavioural component of investing, which is just staying patient, being opportunistic, being very flexible, and waiting for the market to give you a chance to swing at one of these great companies that is suffering from a certain amount of pessimism right now. And, obviously, there are certain companies that deservedly there’s a pessimism for a reason. So you have to separate pessimism from actual deterioration of fundamentals. But oftentimes or there’s often enough occurrences where you can capitalize on that to your advantage. And the reason why the informational advantage is gone is the same reason why that exists, which means to say the speed of the information is so fast now. Everything, the emotion travels so quickly because information is so broad and so deep.

Meb: A good example is, if you, being a quant, everyone in the U.S., particularly the mid, large caps has the same damn databases. Everyone has the same PhDs. It’s not that hard to comb through all the literature, data mine. Anyone could probably do it in a weekend. And if you type in a multifactor stock that has some of the best characteristics, when you look at who holds it, it’s literally a laundry list of the same quant shops. It’s AQR, it’s DE Shots, Rintech, it’s LSV. And you can do it over and over and over again, the highest rated ones. And so I think a lot of what you’re talking about certainly feels very near and dear to home.

So I’d like to take a step away from the theoretical to the extent that you’re willing to. And I know you are because I read your blog and your updates. Let’s talk about a couple of names that we could use as either case studies or just ways to illustrate sort of how you think about the world, particularly in 2019. Are there any particular companies or stocks that, you think, or in the portfolio that are pretty good indications of what you think is a good opportunity?

John: What you were just talking about is sort of a preface to this. But the portfolio I have right now, Sabre’s portfolio, is unusually weighted towards a few of these mega caps. And I’ve written about this, quite a bit, to my investors. This is not something that was by design. This is not something that I anticipate going forward because I can certainly take advantage of smaller cap companies. But it just so happens that right now in the market, I think, if this was 2002, I’d be probably 100% invested in small caps because small caps were so cheap then and large caps were relatively more expensive then. I think the opposite is the case now in general. Certain large caps are expensive but certain large caps are really cheap. When I look at the Russell 2000 and a lot of stocks on that list and a lot of stocks on my watch list that are smaller companies, the valuations just seem just too rich for my liking.

So the portfolio right now is strangely weighted towards large caps. I have a few in the portfolio that I…well, one that I just mentioned is Apple. And so Apple is just a great, you mentioned case study, Meb, The case study on Apple is that, in 2016, I bought it in January of 2016. So I’ve owned it for a few years now. And it’s interesting because Apple is the largest company in the world, at least the publicly traded world, or it kind of fluctuates. But it’s either one, two, or three at any given time. And in 2016, it was trading at $500 billion. It had roughly $100 billion of net cash and it was doing 50 billion or 55 billion in free cash flow. And so it was trading at around eight times earnings, eight times free cash flow, net of cash. And so the reason for that was, again, I think 200 analysts that follow Apple, there’s no informational advantage. I’m not going to know more than Apple, than probably any one of those 200 analysts.

But the other edge is same set of facts in a different way. And I think the narrative that was taking hold at that time was, “Hey, Apple is a consumer hardware company, and its 38% gross margins are going to revert to the mean.” And you look at Dell’s margins or any other consumer hardware company’s margins, it’s not a very good business. It’s a commodity business. And so that was the worry that iPhone sales were stagnating, people can easily switch to some other product, Samsung or some other phone, and margins are going to fall. And Apple’s best days, certainly its growth days, and maybe even the best days are behind it. That was sort of the narrative at that time.

The other way to look at it is take the same set of facts, those same margins, and think about it as, well, Apple is a consumer electronics company that it’s also a consumer brand. And so, a consumer brand, the way I thought about it was Apple was much more akin to Starbucks or Nike. You know, both of those companies have huge profit margins and both of those companies take commodity inputs. There’s really no…you know, Nike manufacturers its clothes in, say, Vietnam, and Starbucks takes coffee which is literally a commodity and is able to…on Nike’s case, it has 100% markups on the commodity product that it produces because of the brand that it has. So it’s got enormous brand power.

I don’t think there’s any question there. But Apple, there was actually a question about how powerful the brand was. So you could look at that as a case study of…there’s two different viewpoints around the same set of facts. And I thought it was more of a consumer brand. When you think about Apple, you look at the lines. This was in 2016. I remember there was a…I wrote about this actually. They opened a store, their San Francisco flagship store in 2016, and there was no product release. There was no new iPhone, no new product whatsoever. It was just a new store that they were opening up. And there was a line that was about a mile long waiting to just…at 6:00 a.m., waiting to get into this store.

And these people could have come by anytime later that weekend, anytime that week to see the new store, but there was a line that wrapped around the building and down the sidewalk just to get into the store. I think that’s just an anecdote that shows how powerful the brand really is. And so when you couple that with the ecosystem it has and everything else, I think Apple is really a great business. The stock then fluctuates from pessimism to optimism. And it rose a lot and it’s fallen some, and then it goes back up and falls. So it’s always incredible to me how much that stock fluctuates. But the stock, in three years, even after the recent fall, it’s probably 20% or 25% off of the tie, but it still has compounded at close to 30% per year since early 2016, including dividends. And that’s for a stock that’s the most followed company in the world.

That’s a really good case study that it is possible to have a little bit of a varying view or just simply to take advantage of pessimism when you don’t have any informational edge. So that company still, I think, is undervalued, and still, even at the current level, remains in the portfolio as my biggest position. I think one of the things I love about Apple is they’re buying back an enormous amount of stock. And so, as the stock price falls, it actually benefits you as an owner because the company is using your cash dollars to acquire more, as stock falls you get more value for each dollar spent on the buyback.

And so if you do the math on Apple, even with no growth doing about 60 billion a year in free cash flow, which is, say, 300 billion over the next 5 years, if you think it’s a durable business that can maintain that, that’s the first question you have to answer, but I think that’s the case. You’re going to have a company that’s going to have 400 billion in cash that it will produce plus the cash it has on the balance sheet now over the next four years, which is more than half of the current market cap. So I think there’s a big margin of safety in the valuation. And I think it’s a really great company with a really strong ecosystem between the hardware and the software.

Meb: I’m mostly just looking forward to the day in the not too distant future, instead of having to buy all the different pairs of AirPods I have, which, listeners, if you don’t have the AirPods yet, you have to get them. They’re phenomenal. Now, I just want to be able to just go and implant them, just be done with it. Because I put them in the washing machine, good news is, they actually usually survive. I love my AirPods more than any probable device or purchase over the past probably 5, 10 years. I love them.

John: Yeah, it’s interesting. I was just saying on Twitter the other day to someone who was talking about how Apple is never going to have another product. It hasn’t had a home run since the iPhone. Well, that’s like…and I made this comment like…it’s like saying Tiger Woods won 3 majors in the year 2000, and so he’s never going to have another year like 2000. Well, that is true, most likely, but it doesn’t mean that there’s not going to be an awful lot of success after a year like that.

And Apple, with its iPhone franchise, it’s a world-changing… I mean, I don’t know where the iPhone ranks compared to, let’s say, the Steam Engine. Certainly not as critical as a Steam Engine was, but it did change the way…it has single-handedly transformed the way we do business. I think it is responsible for many small businesses that wouldn’t exist without it. You could make an argument that even some big businesses would not exist without it. I don’t think Uber would exist if it weren’t for the iPhone and the App Store. Companies like Instagram.

So there’s some big businesses that have been created as a direct result of, you could argue, the smartphone in general, but I think the iPhone, specifically. So yes, it’s a transformational product. But to your point, the other products have been extremely successful. The AirPods are one, but the watch is the bestselling watch in the world right now. And it’s a huge home run. It’s not when you compare it to the iPhone. But compared to any logical comparison or any reasonable judge of success, it’s a huge success. So the company has a real brand. I think it’s able to sell those other hardware products because of the iPhone, and because of software that links all of that together, which is very, very sticky, and very valuable, and very profitable for Apple.

Meb: Yeah. It’s interesting. I remember the first time I ever saw an iPhone, my buddy was showing it to me at a pool side in Las Vegas. And this goes to show you how much of a reasonable opinion I have as a tech early adopter. I was like, “Yeah, that’s kind of cool, but I just I don’t understand why anyone wouldn’t want that instead of their incredibly awesome razor phone.” I was like, “I’m not going to give up my flip phone for that thing.” Anyway, how times have changed. So Apple is an interesting company because so often by the time you get to be these massive companies, either many stocks find themselves expensive or vulnerable. I mean, the history of capitalism is that these top companies don’t maintain the top step on the pedestal for that long.

If you go back and look at a lot of the largest companies by market cap, that’s hard to maintain. But damn, if Apple doesn’t produce just ridiculous amounts of cash flow over and over again. So it’ll be fun to watch. I’m curious to see what they develop. And I think it’s also a great case study in…we rail a lot about people just focusing on dividends. And you certainly mentioned buybacks in this concept. We talk a lot about shareholder yield being somewhat holistic or agnostic as to how companies pay out their cash flows. But the whole key, of course, in the first place, is having lots of cash flows, payout in the first place. I think we got time for another idea. Anything else in the portfolio that you’re particularly fond of, or a new addition, or anything else that you think is particularly interesting?

John: Well, I think certain stocks have appreciated. So I do hold certain stocks that are not as attractive as I thought they were at one time. And then, of course, other stocks have come down some… One stock is still… I think, I probably sent you this right up, Meb, but I sent it out to my investors. I did it right up on Facebook. Facebook is still in the portfolio. I bought Facebook last year. Facebook is an interesting one from a sentiment standpoint too. And, I guess, there’s two stocks that I would group into this category, Facebook and the banks, specifically, Wells Fargo but also Bank of America.

I want to stress, these are some large caps. I also have a few other smaller companies. Well, one company is NDR, which is a home builder that has really good business model. Home builders typically fall into that category. The second category I described earlier where they consume cash, NVR is one of the unique companies in that space where they produce cash. And it’s because they have a different business model. So that’s also in the fund at the moment. The mega caps, Facebook and the banks, let’s say, Wells Fargo, Wells Fargo specifically, because Wells Fargo has gone through an enormous amount of headline-related pessimism. It’s a punching bag. It’s a punching bag to both sides of the aisle. Some are shouting louder than others. Elizabeth Warren certainly shouting louder than some.

But Wells Fargo deservedly has made some significant mistakes, but they’ve fired two CEOs since then. And I don’t think their culture is probably a lot different than the other big bank cultures. So I certainly don’t want to defend their culture. But I think from an investor standpoint, it’s a pretty cheap stock. It’s trading at about nine times earnings. And, again, the thing I like about Wells Fargo is, I think, you get an extremely high yield right now. And the way I think about yield is the buyback yield plus the dividend yield. So it’s close to a 4% dividend.

I think it’s about a 3.8% dividend right now. But you’re also getting…it’s returning 100% of its cash flow to shareholders and roughly 20% of that as a dividend. The other 80% of it is a buyback. So when you think about the buyback yield, or maybe it’s closer to 30%, 70%, but somewhere in that range, but when you think about the overall yield, you’re getting a double digit yield, 12% to 13% yield at the current price, meaning a dividend part of it is going to come in a greater percentage ownership of the company’s earning power. And that’s a pretty attractive price when you think about where current valuations are.

And I think you get the added potential kicker that, at some point the pessimism subsides. With Facebook, I thought it was the same general idea where it’s a great business. Facebook is interesting, unlike a lot of companies that go public nowadays, which are funded by venture capital and have no profits or even losses, like in the case of Uber, let’s say, for example, many of these companies’ IPO with significant losses. Facebook IPO has 50% operating margins and it’s always been extremely profitable. And it’s a business that’s still growing. It did $52 billion in revenue last year, so it’s much larger obviously now, but it’s still growing at 26% a year at the current rate. So it’s a really high quality company but it was suffering from a bout of pessimism.

And I think Wells Fargo is suffering from the same bout of pessimism right now. And I think the idea is you’re getting an attractive current yield with the potential that pessimism subsides at some point. And I think with both of those two companies, at some point, the pessimism does subside. And if it takes three years, you’re getting a pretty attractive yield in case of Wells Fargo, and a pretty high growth engine in the case of Facebook, and I think the market will respond to the fundamentals of those two businesses over time. And so right now, again, not to beat a dead horse, but that portfolio does have a few large caps. I don’t expect that to be the case forever, but I think that’s where I’m finding some value at the moment.

Meb: What’s pretty traditional sell criteria for you? Is it usually price related? Is it story changing? How do you kick these guys out with such a small, concentrated portfolio? How do you resist the temptation to just fall in love with this dude and never sell them?

John: Well, I mean, some of these companies are not…businesses like Wells Fargo might be growing its earning power at mid-single digit rates. So it’s not an exciting company to own. It’s not going to grow. It’s not a compounder, let’s say. It is a company that, just through the buybacks and through deposit growth…I mean, the business is actually restricted to grow right now, which is sort of a technicality that may or may not subside, but that’s actually not a bad thing for a bank because it forces them to be more prudent with its underwriting decisions. But it’s interesting about banking is, since 1934, there have only been three years in the U.S. where, overall, total deposits in the U.S. banking system have declined.

So what is that? Eighty-five years, and 82 and 3, 82 years of growth and 3 years of downturn. And I don’t think we’ve seen a down year in deposit growth in the last four or five decades. So it’s a very predictable business. Wells Fargo, JP Morgan, and Bank of America are three that I would kind of group into this category of they’re so big that they’re going to grow very slowly, but they’re going to get a share of that deposit growth, whatever the overall deposit growth in this country is, they’ll get their fair share of that. And so you’re going to see some modest growth. But I think through the buybacks, if you’re retiring 7%…Wells Fargo bought back 7% of its shares last year.

So you can see 10% growth just through 3% organic growth and 7% per share growth from the buyback. So when you add that plus the 4% dividend, plus the potential that the valuation goes from 9 PE to 12 PE, you can get a really effective return in, say, 2 to 3 years. You can get a return that might yield you a 20% IRR over that period of time with not a lot of risk, in my opinion. So that’s when you would think about selling a company like that, because once it reaches a more reasonable valuation level, your returns going forward are going to be much more mediocre. Other companies that are growing fast, you might hang on to them longer.

So to me, it’s just trying to discount and handicap the odds of success going forward and what stream of cash is going to look like in the coming years, and that’s hard to do. But you can approximate it and you try to invest when you have enough of a margin of safety to where you can be wrong and still things won’t work out terribly for you. And so sell discipline is really sell when it reaches a reasonable level. The other reason to sell is if you’ve made a mistake. And you sell…the thesis change, you sell if your analysis was wrong, you have to be willing to change your mind and sell. And so one of those two reasons or the third reason could be if you’re fully invested. You sell something that you might still think is undervalued to buy something that is significantly more undervalued. So one of those three reasons are typically why I would sell a stock.

Meb: I imagine we could just continue doing this for like two more hours. But at some point, I need to let you go home to friends and family. As you look around the world, I know you don’t do a whole lot of macro. As you look around, although you may have mentioned that it’s harder to potentially find opportunities. Munger, partner of Buffett, was recently quoted as saying, when people are talking to him, and they ask a similar question and he said, “Go where the fish are.” Meaning, you mentioned some areas that might be less efficient.

Like how far down the market cap scale will you go? I mean, if you saw an amazing company at 50 million market cap, is that something you could get involved in? Or is there a hard floor that you spend a lot of time? And I don’t even know what the modern version would be. It used to be Raging Bull message board. So when I was coming to…then it was Yahoo! Finance, maybe, and I don’t know what the modern is, Motley Fool. I don’t know if we will use message boards anymore, probably just Twitter. What’s the sort of market cap size spectrum you’ll weigh then?

John: I will go as small as I can, but I can go quite small, 50 million. At some point you run…given the fact that my portfolio is fairly concentrated, my firm is still quite small, but there is the firm has grown over the five years. And so there’s a level where it would become difficult to buy shares. But I think for the vast majority of stocks out there, I could invest in just about anything I want with very few restrictions. So there are no restrictions on market cap size other than the size of my fund and how much I can do.

But like I said before, Meb, to me, it’s a function of value and where are the opportunities. And right now, Munger, I thought a lot about that quote. And I heard him go on, I think I mentioned on a 45-minute rant about this in February in Los Angeles at his meeting. And it’s interesting to think about, but I think most people, I think Charlie included, often think about edge and investing as where…informational advantage. And I think there are areas of the U.S. market where you might be able to gain a small edge in small caps, but there are so many smart investors now that are uncovering those types of ideas. Writing my thoughts publicly, I get a lot of comments, I get a lot of people sending me research.

And you really realize that there’s a whole underworld of smart people out there who have already uncovered something that you thought was unique. So if you have an idea that you think you have an edge in, it’s very likely that there are hundreds of people, maybe even more, that have already uncovered the same edge, or the same piece of information, or understand the same unique insight that you think is unique. So I’m skeptical of needing an informational edge. Munger says to go where the fish are, maybe the fish are somewhere in Asia, maybe the fish are somewhere in Africa, or some other nascent market, or emerging economy, or something that, to me, I’ve found plenty of opportunities, just accepting the fact that I have no informational edge in the U.S. market and just taking advantage of the swings that we talk about, the gaps between the 52-week high and low of companies that are very stable, very durable, very profitable.

And there are enough opportunities, just capitalize on those, whether they’re small caps or large caps. And there’s more opportunities capitalized on those fluctuations in small caps. As I said before, I think small caps are more expensive right now, but that will change in time. So I think there’s a lot of opportunities in the U.S. if you’re patient, if you’re disciplined, and if you’re willing to wait for those opportunities.

Meb: I know you’re a consumer and student of shareholder letters from managers, obviously, the Berkshire crew. Any other letters or…it could be companies too. Any that you read regularly or you think are particularly insightful, whether it’s other managers or CEOs that you think are interesting?

John: I read a lot of the letters. It’s tough to, off the top my head, like single out one or two, because there’s so many of them that I read. But in terms of other managers, there are a few. I’m not unlike an email list of these letters, but they tend to make their way to the public market. I would say, one manager I really like is…his name is…and I don’t know this particular guy, but his letters have surfaced out there from time to time. And I think he’s a really smart thinker. And he’s done one or two interviews in the public domain that I thought were really sharp. And his name is Norbert Lou. He works for…his firm is called Punch Card Capital.

So he runs the sort of the same underlying philosophy that I like to employ here as you can guess by the name Punch Card Capital. But his letters are quite short. I’ve read a bunch of them. They’re very good. His underlying philosophy is really good. Another manager I like is the guy by the name of Allan Mecham. He runs a firm called Arlington Capital in Utah. And, again, his letters kind of surface from time to time. I’ve read a number of them. Actually, some my investors are investors in his fund as well. So I don’t know if your listeners can find these letters very easily, but those are two investors that I really like and respect off the top my head.

Meb: Pretty similar philosophy, I love reading these letters. And a decade ago, we used to have a website called Hedge Fund Letters that tried to aggregate a lot of these. And I wish someone would do it. And I can’t believe no one doesn’t, but it wasn’t a good use of my time to be spending doing this.

John: That’s a great service. It’s a great public service.

Meb: Well, that was the prob. It was a public service. It didn’t make any money. And then you had these hedge fund managers emailing me, telling me they’re going to sue me for putting their letters online. And our policy was we would never upload them. We just linked to them, which probably just as guilty. But I said this isn’t worth the headache. But how cool would it be to go back and read the old Soros or Robertson letters from the ’80s and ’90s. I’d love to see those. So anyway, listeners, one of you enterprising young analysts out there who wants to do this, let me know. It would be a cool site. I love reading those. It’s a lot of fun. As you look back over your career, this could include real estate, this could include high school back when you were down in Raleigh. What has been your most memorable investment? Good, bad, either, both. Anything comes to mind?

John: Well, I mean, the most impactful investment has been the investment in…and this is probably a cheeky reply. But I do believe that the biggest investment or the most impactful investment was the investment that I made over the course of years reading and spending time in real estate. I had some good real estate investments. So, I mean, the best real estate investment I ever had was an apartment building that we bought from a bank that…and this is, again, during just cherrypicking really, highly, discounted merchandise, so to speak. I mean, this is a time where we might never see a real estate market like that again.

So this was part luck, part being in the right place the right time, part just capitalizing on what was in front of me. But the best specific investment was probably that investment prior to starting my fund because we were able to lease it up and then we were able to sell it within six months. And it worked out really well. The best investment, I think, was just spending the time to having the flexibility and the autonomy to spend time the way I wanted to and maximize my learning curve at a time where I wasn’t ready to start a fund, or manage money professionally, but I had the flexibility to work on what I wanted to work on. I’m a big believer in like the Montessori Method.

My kids don’t use that method. But just in general, I think the Montessori Method is creative learning. Kids work best on tasks that they enjoy or projects that they like working on. And I think adults are the same way. So, for me, the best investment was really the opportunity cost of sacrificing what I would have earned. Going to work at a fund or potentially making a little bit more money or maybe a lot more money initially, sacrificing that opportunity cost, and spending that, advancing my own learning curve, and getting myself prepared to do what I really wanted to do, which is set up a fund and do what I’m doing now. If I had to look back again, it’s, again, sort of a cheesy reply, but that would be the answer in terms of thus far in my career.

Meb: I think it’s thoughtful. When you think about a lot of people listening to this podcast or particularly younger crowd who often will email in for career advice and think about building the skillset, and this can be nights and weekends, so many people want to become a fund manager because they’re watching billions and want to be the next Axelrod. We can see all the excitement and the compensation, but that’s really a lot of the building, the foundation for whatever maybe. I mean, I’m a quant. You’re totally similar and opposite in many ways, but finding what works for you and building the experience and the scars and everything else that goes with it.

I was smiling as you were talking about real estate and cycles and timing because I tweeted this, I think, last weekend because there’s an article in the journal about LA’s housing market where there now exists something like a dozen houses in LA. And these are just the ones that are listed there. So that means there’s more that aren’t publicly listed that are asking price of $100 million or more, including one, supposedly that wants to be listed at $500 million.

So I’m not going to make a comment on trying to time the housing market. Although I did find an old article we wrote back in 2007 that says, “You know, if you just slap a long-term moving average on the housing market, it’s actually a pretty darn good indicator.” So anyway, listeners, all that you apply that to your own market as you may. John, this has been a lot of fun. I look forward hopefully to catching up in North Carolina. Where do people find more information on what you’re up to, your firm, your writing, everything else?

John: Yeah, my firm is called Saber Capital Management. The website is Saber Capital. Saber is spelled Saber MGT for management, so sabercapitalmgt.com. And that’s where I have my writing. I used to write a blog called “Base Hit Investing.” It’s still up. As you mentioned, Meb, recently I transitioned that site. All of that content basically lives under my firm’s website at this point. So future updates will be on that site, on my company’s site. And you can go to that to read some of the old writing and also, if you’re interested, you can subscribe to that email list and get future updates going forward.

Meb: Okay, cool. John, thanks so much for taking the time to join us today.

John: Yeah, really enjoyed it, Meb. Thanks so much.

Meb: Listeners, we’ll post show notes links to everything we talked about today, including a lot of John’s writings at mebfaber.com/podcast. You can find all the archives there. You can certainly leave us a review. We love to read them, and shoot us some feedback@themebfabershow.com. We’d love to hear what you guys are thinking constructive, criticism, and also any questions for radio show. Thanks for listening, friends, and good investing.