No, it’s not a good idea, which should surprise no one.

The fact that it is a GREAT idea, well, that should surprise everyone.

Most investors fret when markets hit new highs, but should they?

The below is inspired by our friend Jake @ Econompic, who examined the following query:

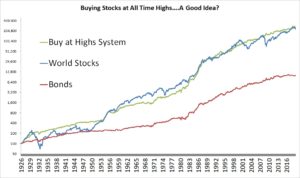

“What if you bought stocks at all-time highs, otherwise you sat in the safety of government bonds?” Jake found that it turned out you actually OUTPERFORMED just sitting in stocks all the time. Say what?

So, we decided to take the study all the way back to the 1920s.

And it turns out, it’s a pretty damn good strategy. Better returns than just stocks, lower volatility, and WAY lower drawdowns…again, all you do is check at the end of each month…if stocks are at all time high, then you invest in stocks for the next month, and if not, then bonds. That’s it!

UPDATE:

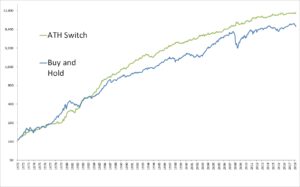

After lots of disbelief on the intranets, I went and checked my code (entirely plausible I could’ve messed something up) and it looks fine to me. So, I wanted to check it against lots of other assets such as commodities and real estate. The results below are confirming…and the best part is you’re only invested about a third of the time in each asset.

(The average portfolio is an equal weight across stocks, foreign stocks, real estate, commodities, and gold.)

Click to enlarge

I don’t think the takeaway is really that this is a system anyone would want to implement, but rather, an acknowledgement that all-time highs are nothing to be afraid of…and if your reaction is “that equity curve looks a lot like trend following with moving averages” then you’re probably right, they definitely look like siblings or close cousins!

Here’s older study here with World stocks to 1920s…

(PS Here’s two older posts as well: Buy High, Sell Higher? and Buying the Highs vs Buying the Lows)