Welcome to the third and final installment of our latest series.

(Part I “Get Rich” and Part II “Stay Rich“)

In the first two pieces, we discussed strategies for generating riches and then preserving them.

Our third and final piece today attempts to provide an illustration of how to combine these strategies in a real-world, real-time portfolio…my own.

This is an extension of a piece I’ve been writing for years – namely, how I invest my own money.

I began noticing an interest in this topic from readers years ago, usually as December rolled into January of a new year.

I suppose some investors found it useful to see how someone whose career is in investments allocated his money. Others perhaps found the process instructive for application to their own portfolio, or perhaps they just like to watch from the stands so they can cheer or throw tomatoes (virtually, on Twitter).

What’s important is that you find an approach that works for you. For the late, great John Bogle, that was low cost index investing…

“To repeat, while such an index-driven strategy may not be the best investment strategy ever devised, the number of investment strategies that are worse is infinite.”

Will my strategy be the best strategy devised, or the best strategy for everyone? Absolutely not. But is it the best strategy for me? I think so…

With that in mind, today, let’s pull back the curtain.

Of course, there’s nothing too dramatic about what’s behind this curtain. As I wrote a moment ago, I’ve been publicly detailing what I do with my money for years and am happy to continue doing so.

But a couple disclaimers before we launch in…

First, the reality is this information shouldn’t matter to anyone outside my family (and to be honest none of them will read this). However, I recognize that many investors appreciate the thoughts behind the process, either as a “template” for their own portfolio or just to stir up some questions.

That said, please understand I’m not offering this information as a recommendation for how you should invest personally. My situation is not yours – and even if it were, there are a million different market approaches that work just fine (the challenge is avoiding the 10 million approaches that are terrible).

Second, the numbers are not exact – and forget about decimal points! Attempting to provide that degree of specificity would be pointless. Furthermore, the most instructive part of this exercise is simply understanding how the big financial pieces fit together to create a holistic financial portrait, so specifics aren’t that helpful.

Third, this post tends to be a bit anticlimactic for some investors, since I’m aware that most investors looking to get a read on how to position their portfolios are thinking about their stocks, specifically. I’ll provide you with 100% transparency about how my investments are positioned, but you’ll see that this doesn’t materially change from one year to the next, as most of the funds do all the work and the adjustments for me. So, unfortunately, I have no “hot stock tips” for you in this post. Though if you was to gossip about investments and ideas over a meal I’m always game!

Finally, you’ll see that I’m somewhere “in between” when it comes to wealth-generation and wealth-preservation strategies. I have a young family with plenty of financial needs, so I’m still trying to generate wealth. On the other hand, I’m trying to be thoughtful about my family’s financial future, so that means certain preservation strategies as well. And as I mentioned before, I really like to sleep soundly.

Again, this is what works for me – at the moment…which will change over time – and I don’t hold it out as a suggestion for any specific reader to follow. It’s merely an illustration.

Enough intro, let’s jump in.

The Biggest Pieces of My Net Worth

The vast majority of my net worth is concentrated in entrepreneurial ventures I founded, namely in my asset management company, Cambria, and my research company, The Idea Farm.

While the exact percentage is open to debate, it is likely somewhere between 50% and 99%. While not quite as extreme as Elon Musk’s “If Tesla & SpaceX go bankrupt, so will I. As it should be.“, the ownership stake in my companies are the largest determinants of my net worth. This is likely true for many business owners around the world.

Echoing our prior essays on “Getting Rich” and “Staying Rich,” I think it is useful to bucket my holdings into these two categories.

Being a founder and owner of Cambria and The Idea Farm fall into the “Get Rich” bucket.

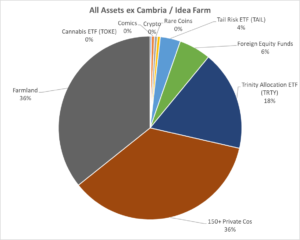

That having been said, if you exclude Cambria and The Idea Farm, my largest holdings are about a third each in farmland, investments in 150+ private companies, and my public investment portfolio. All you historians will recognize this allocation as approximating the 2,000-year-old Talmud portfolio that is spread equally across real assets, businesses, and “safe” reserves.

(You can download our free Global Asset Allocation PDF here with chapters on various asset allocations, including the Talmud portfolio. Be on the lookout for a 2nd Edition in 2020!)

The farmland is a pretty stable income producing asset and is about as non-correlated as you can get to the rest of the portfolio. (Stay Rich bucket.)

It also offers very real sentimental and emotional value for me due to some family roots in the area. Plus, if you ever want to seriously disconnect with some quiet time, there is no better place. (Or if you want to shoot guns, drive around on an ATV, or just not be bothered by anyone…) So, if you guys ever want to do a meetup in Kansas, let me know…

I’ve also detailed my private angel investing journey over the years on the blog and podcast. (Get Rich bucket. Though depending on the outcome could also be the “Get Poor” bucket…)

The long (indefinite) holdings periods and big tax breaks are major benefits of this approach. Plus, it’s a lot of fun, incredibly engaging, and you wake up every day a lot more optimistic. (Contrast that with the consistent negative geopolitical news flow in public markets!) I’ve considered my investments so far as “tuition,” and while the performance hurdle for me is the US stock market, the hope is the portfolio will do much better. Yet if it is a big fat zero, I would be ok with that.

As to the performance of my angel investments, of the 150+ deals in which I’ve participated to date, most are still in their infancy. However, there have been 10 exits (2 bankrupt zeros, 6 acquisitions, 1 IPO, and 1 secondary liquidity). Together, these deals have produced an average total return of 125% on dollars invested, or ~ 42% compound returns including time held.

In my still-open investments, there’s lots of follow-on rounds and even a unicorn or two on paper. While these results so far are incomplete, and produce a rosy view of angel investing, I’m very aware this period has been incredibly favorable for private angel equity investments. What’s important in this endeavor is seeing it through a full cycle over the next decade. Believe me, I lived in San Francisco during the early 2000s decimation. I’m sure I’ll see a range of winners and losers.

The biggest cash return so far was a 16-bagger, which provided a good lesson in power laws of private and public markets. (Worth repeating and sharing these good papers here on public markets: Bessembinder, JP Morgan, Vanguard, Longboard. Check out the Chris Mayer podcast for more on public 100-Baggers.)

It’s a bit different mindset when you can’t sell an investment. Had my money been invested in a public stock, what are the odds I would have sold after a double, or a triple? (I’m going to say “high” to “very high.”) While the concept of buying and holding a stock for the long run is a nice theory it can be hard to implement in practice.

I will likely start sharing some private investments in the coming year, and you can follow along and join my syndicate on AngelList here.

Public Investments

Okay, let’s turn to my public portfolio now.

First, just a note to anyone reading this who has money in various funds or ETFs, which is most of us…

Ask any mutual fund manager why you should invest with them, and you’ll likely find yourself met with a barrage of sales points, all of which will underscore one takeaway—their fund deserves lots of your money.

But when you ask said manager what they do with their own money – it may surprise you…

Often, many managers have $0 invested in their own fund!

Below is the percent of managers that have nothing, zero, zip, invested alongside the client money they manage (thanks to Russ Kinnel at Morningstar FundInvestor for this info):

If you’ve followed my blog or podcast for a while, you know where I’m headed…

This is absurd.

But I guess it shouldn’t be surprising. The mutual fund industry has long been an area dominated by high fees, tax inefficiencies, sales loads, 12b-1 fees and other investor unfriendly practices. Maybe these fund managers are smart enough to not invest in the funds they manage! But the world is wising up and investors are voting with their checkbooks, and the fund flows tell the story.

I think it’s important to have skin in the game. If I don’t believe in Cambria’s funds enough to invest my own money here, why should anyone else?

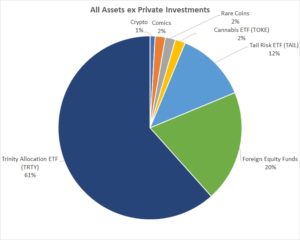

So, for better or worse, I invest all the public assets I can into funds I manage. Then, I leave it on autopilot. (Stay Rich bucket.)

Even though the right portfolio is whatever lets you sleep at night, I prefer a moderate risk portfolio that targets higher returns than buy-and-hold with lower volatility and drawdowns – quite a tall order!

So, that translates into my current allocation of market-sensitive assets, what I have described many times before as “buy and trend”, or, the Trinity strategy.

This Trinity approach invests roughly half in a global strategic buy and hold asset allocation that is allocated across stocks, bonds and real assets. The strategy includes tilts toward value and momentum instead of standard market capitalization weighted portfolios.

The other half of the Trinity approach is invested in various trend following strategies. The goal of these strategies is to reduce volatility and drawdowns, while still targeting similar returns to buy and hold with low correlation.

This works for me because, if you’ve read my blog for a while, you know I’m a trend follower at heart, yet also a value investor. This approach lets me scratch both itches.

As a trend follower, I like the idea of having half of my portfolio available to move to cash or hedges if markets trend down.

But as a value investor, I want exposure to assets that may be cheap over long horizons (like I believe foreign stock markets are now).

I get both with this approach. I want all my public investments totally on autopilot. I don’t want to have to make trades or think about buying that cheap country when my emotions are arguing against it, therein likely tripping me up. I don’t want to have to think about selling that amazing market as the trend ends.

In fact, I don’t want to think about it AT ALL. But I do want the funds and strategies to make all the adjustments for me, and in an objective, automated, and tax-efficient manner.

This allocation includes what I consider to be my “cash” account. This has been one big change over the years in my thinking – namely, that you should be investing at least some or all your “safe” money (hat tip to Dan Egan of Betterment pushing me here).

The earlier piece we did on the Stay Rich Portfolio demonstrates what many believe to be the safest portfolio, isn’t. I believe, when measured on a “real” after-inflation basis, a cash account is as risky as a nice asset allocation, with much less return potential…so, I invest nearly all of the cash type investments I would have in a broad allocation ETF, and only retain a small amount for short-term living expenses

The next slice is the foreign funds category which represents my 401k and 529 plans, both of which (sadly) only offer me mutual fund options. So, I just toss them in the best low-cost best investment I can find which, as I write, are foreign stock markets and emerging markets. (You can see Twitter peeps lose their mind over that revelation…) We are trying to get access to our own funds here with Cambria’s qualified plan offerings, in which case I’ll move my funds over at that time.

Next, you’ll see an allocation to tail risk strategies. I consider this a hedge against my career beta as well as a hedge for all my private stock holdings. I’ll look to add a lot more if the stock market ever enters a downtrend again!

(Meb note: this piece was written in early 2020….)

There’s a smidgen in cannabis, a theme I’m bullish on over the next decade. I detailed my plan here last summer, and plan on adding more (and more, and more) as cannabis stocks decline (and decline, and decline). I’m also bullish on Africa as a theme and will look to make an allocation in the coming years…I would also like to add to my farm allocation as the asset class is somewhat depressed in recent years.

Lastly, there are tiny amounts in rare coins, comic books, and cryptocurrencies. The rare coin allocation goes back to our Van Simmons podcast episode, and this fits in the Stay Rich bucket (and “Fun” bucket.) Comics I’ve probably held for 30+ years (thanks Mom!) and fit into the “Fun” bucket too. Crypto, well, that falls into what I’d call the “regret minimization” bucket. I’m not really attracted to crypto as an asset class, but I’m willing to make an allocation in line with their market cap in the global market portfolio (about 0.05% currently) mainly to avoid regret if the space ever goes up in value 100x (and to quiet all my friends from badgering me if they do – well worth the sunk cost!).

That’s about it! Feel free to shoot me any thoughts, and best of luck with your own investment journey…

But let’s end on an important note that is often overlooked in the countless hours we all spend on our investments.

What’s the point?

Remember that money is only a means to an end. It’s there to help you achieve your life goals and happiness.

Does it help you fulfill your dream of travel? What about putting your grandkids through college? Perhaps it’s there for you to support a local charity or social cause that is dear to you. Or maybe you want to help establish the next generation of entrepreneurs though capitalism. Or maybe you just want to fish with your friends. Whatever. Let the investments help get you there.

Or, the shorter version my Mom and Grandmother had a habit of saying, “You can’t take it with you.”

And below is the longer version we’ve had on the blog since inception over a decade ago…

“People ask me, ‘What is the use of climbing Mount Everest?’ and my answer must at once be, ‘It is of no use. ‘There is not the slightest prospect of any gain whatsoever. Oh, we may learn a little about the behavior of the human body at high altitudes, and possibly medical men may turn our observation to some account for the purposes of aviation. But otherwise nothing will come of it. We shall not bring back a single bit of gold or silver, not a gem, nor any coal or iron… If you cannot understand that there is something in man which responds to the challenge of this mountain and goes out to meet it, that the struggle is the struggle of life itself upward and forever upward, then you won’t see why we go. What we get from this adventure is just sheer joy. And joy is, after all, the end of life. We do not live to eat and make money. We eat and make money to be able to live. That is what life means and what life is for.”

― George Mallory, Climbing Everest: The Complete Writings of George Mallory

Meb Faber is the Co-Founder and Chief Investment Officer of Cambria Investment Management, L.P. (“Cambria”), a registered investment adviser. The information set forth herein is for informational purposes only and does not constitute financial, investment, tax or legal advice. Please see the appropriate professional advisor for advice specific to your situation. There is no guarantee that a particular investment strategy will be successful. Opinions expressed herein are subject to change at any time. Past performance does not guarantee future results. All investments are subject to risks, including the risk of loss of principal.