If we allow ourselves to let go of appearances, we’re all here for one simple reason…

More money.

“More money” of course is always relative. $100,000 in net worth places you in the global top 10%, but for many that would not last a hot minute. $1,000,000 vaults you into the top 1%, but for some, only Tres Comas would suffice. Research has shown that regardless of how much money people have everyone always says they want more.

Now, what you plan to do with that money can be noble and altruistic…or ignoble and self-serving. That’s not the point, and I’m not judging either way.

I’m merely noting the reality that what unities us here is a desire for more wealth.

The challenge is accomplishing this goal; we often lose sight of the forest for the trees… or the flip side is true – we stay so “big picture” that we don’t implement our strategies well.

I realize those are contradictory problems, yet that’s the point – investing is challenging. Before you judge that comment as banal, really think about why it’s true…

The market environment itself is always changing. The return potential of any individual investment is always changing, our individual resources and financial pictures are changing, our specific goals are changing.

Not only is the target moving, so is the platform you’re standing on…and then there’s potentially other targets you might want to shoot at…

Investing is a bit like golf – you don’t really “win,” you just try to improve your entire game, bit-by-bit, while avoiding a massive blow-up.

Today, we’re beginning a three-part series that’s humbly offered to try to help you improve your overall game.

It’s an attempt to address our collective quest to make more money – but now, on a holistic level. I’m talking wealth generation, preservation, and finally, a “rubber-meets-the-road” example of strategic implementation.

In our first essay today, we dig into wealth generation.

After all, whether your goal is to be a philanthropist, an inconspicuous millionaire-next-door, or a flashy big spender who lines the kitty litter box with hundreds, you need to amass some wealth first…so that’s where we have to start.

Enough introduction. Let’s jump in.

Getting Rich Through Luck

The quote “I’d rather be lucky than good” allegedly comes from Yankees player, Lefty Gomez. Of course, if that’s misattributed, there’s also “I do not want a good General, I want a lucky one” from Napoleon.

With this in mind, let’s start with what many want – wealth the easy (lucky) way. Obviously, this section will be short since this luck is largely out of your hands.

At the top of our “luck” list are inheriting it, winning the lottery, or marrying into wealth.

Not much we can say about any of these. Although, if you Google “strategies for marrying rich,” you’ll be met with a shocking number of humorous entries.

Let’s get more serious. The good news is most millionaires don’t inherit their wealth; they create it themselves

Fidelity Investments found that 88% of millionaires are self-made. (The great Thomas J. Stanley’s book, The Millionaire Next Door: The Surprising Secrets of America’s Wealthy, found a similar result at 80%.)

So how did all these millionaires get there?

Many of them did it through what’s next up on our Get Rich Strategies list – becoming a high-earning executive. Think a doctor, lawyer, or upper-level manager in a company.

Get Rich as a Professional

While, historically, this is a traditional path to wealth, there are two issues with it.

First, rather than a path to real opulence, today, this is more a means of reaching mere financial security. In other words, while the salaries from these jobs are far greater than average U.S. salaries, and are likely to insulate you from the “can I pay this bill?” financial pressures that plague so many Americans, today’s typical doctor isn’t likely to generate obscene wealth from salary alone.

Kayee Tong from the University of Texas Medical Branch recently explained it this way:

“Remember that the doctors today could start off with a negative net worth of sometimes even $500,000 if they took private college and medical schools!! Note half of medical schools are private. Doctors generally are in the 99th percentile for student loan amounts.

The average doctor makes about $50/hr when accounting for opportunity costs, loans, taxes, insurance etc. Don’t be fooled by the absolute amount in terms of salary. The average doctor is underpaid and overworked IMO.

You spend 7–12 years initially like you’re working two full time jobs as a student, studying 80 hours a week, many residencies are essentially a less than minimum wage job with much more than 80 hours a week (even though 80 hours is supposedly the maximum you clock in).

By the time you’re a doctor, the average Doctor spends even more time (than clocked in) with documentation, compliance, and insurance. Not to mention continuing education. Of course, there are options to do better lifestyle type of specialties such as dermatology and you might become a millionaire relatively quicker. But those are reserved for the top of the top students because it is highly competitive!”

Now before you feel too bad for these high earning professionals, consider that a $250,000 annual salary vaults them into the top 0.04% richest people in the world by income.

There’s a second problem with going the route of the doctor/lawyer. Not only does this path typically lead to mere financial comfort (rather than obscene wealth), it’s also a very long path.

Tong also hits on this point:

“If we are purely discussing a millionaire in terms of net worth, including real estate and retirement, probably it would take 12-20 years if that doctor lived very frugally and had the average amount of student loans and expenses…”

So, if you go the executive/doctor route, you’re likely in for financial comfort eventually (depending on your spending habits, obviously) but for most individuals who fall into this group, there will be a ballpark cap to the riches you can generate. Also, be prepared for your journey to take a while.

However, if you can combine any amount of savings with enough time, regardless of income level, you can still amass a fortune. The key words here: savings and time.

And that’s a good reminder of the difference here between “being a millionaire” and “spending a million bucks.”

Most self-made millionaires aren’t living a life of conspicuous wealth. According to The Millionaire Next Door, the average millionaire lives on less than 7% of his or her wealth, wears inexpensive suits, and drives cars that are not the current year’s model.

But returning to our point, savings and time are important for building wealth. But when you add in a specific third variable to that equation, that’s when the wealth-building begins to carry its own weight, do some of the lifting for you, and come a bit faster. And that dovetails us into our next wealth-generation strategy…

Getting Rich Slowly with Prudent Investing

Okay, let’s turn to the topic that unites all of us – investing.

It’s really a simple formula (that supplies the missing variable we just referenced) …

Saving + investment + time = wealth.

By adding the essential element of investing, your hard-earned and saved cash harnesses the power of compounding over the long-term.

To see the real-world power of this, look no further than Ronald Read, a janitor from Vermont who died in 2014 with an $8 million fortune.

Obviously, a janitor’s salary isn’t going to go far, so this fortune came about through saving as much paycheck as possible, then routinely investing those savings into quality stocks.

The CNBC article which detailed Read’s story quoted one of his friends as saying, “I’m sure if he earned $50 in a week, he probably invested $40 of it.”

It turns out Read owned at least 95 stocks at the time of his death, many of which he’d held for decades. The list was filled with blue chips including Procter & Gamble, J.P. Morgan Chase, General Electric, Dow Chemical, CVS, and Johnson & Johnson.

The US stock market has historically returned about 10% per year. If you compound your money at 10%, in 25 years you 10x your money.

That means $100,000 savings turns into $1,000,000.

If you were smart enough to start saving and investing early, then 50 years at 10% means your 100X your money.

Seriously pause and think about this for a minute.

That means $100,000 turns into $10,000,000.

This mathematical magic trick requires zero brains and zero effort. Anyone can do it – and it’s a reminder to all you parents and/or grandparents about the huge potential favor you’re doing for your little ones by putting even a modest investment amount into an account where it reinvests dividends.

Many reading this will respond, “Well, sure, that’s easy if you have $100,000 to start with! I don’t have anything saved.”

Do you think you could follow Ronald and save $40 a week? Most of us could find a way.

Well, if you graduated college, saved $40 a week for ten years, and invested that money in stocks, you’d be a millionaire by retirement.

Note: you don’t even have to contribute anything after the initial 10 years. You only saved about $20k in total, yet eventually, even that modest amount turned into a million bucks. That’s the power of time and compounding. Now, had you been thrifty and continued to save money and invest, that final amount can be much, much bigger.

Now, if you think this is easy, it is…at the same time, it’s not. So, let me try to prepare you for the biggest challenge ahead of time – the monotony.

You have no hot stock to talk about, usually no explosive market gains happening in just a short-period; instead, it’s just boring, low-cost funds and ETFs slowing grinding higher – the investment equivalent of watching paint dry.

The other challenge is it requires (for most people) some degree of penny-pinching in order to fund your growing nest egg. Obviously, the amount of that pinch is a function of your active income and lifestyle. But this ties in a quote from Morgan Housel, which touches on the same point we made above:

“When most people say they want to be a millionaire, what they really mean is ‘I want to spend a million dollars,’ which is literally the opposite of being a millionaire.”

So, if we’re being honest, most of us harbor the fantasy of spending lots of money. But in order to do that, we need to have that money now…not wait decades for it, scrimping and saving. After all, the fantasy isn’t paper wealth while living a pauper lifestyle.

The truth is most of us aren’t excited by slow investment riches. When we imagine wealth through investing, we’re likely fantasizing about putting money into Bitcoin at the start of 2017 when it was trading around $1,000, then selling it around one year later as prices approached nearly $20,000. A 20-bagger in one year!

Most of us are not willing to forgo next week’s vacation so that our future self may enjoy greater financial security. To be fair, that $2,000 you’re about to spend on spring break in Cancun or Ibiza may be better spent on your vacation rather than in an investment – it could bring you a lifetime of good memories. But, just be intellectually honest about the opportunity cost. You could sock away that money, or go on a cheaper road trip, and turn that cash into a nice, starter nest egg for retirement.

Would the 70-year old you value that $200k more than the 20-year-old you values $2k? Can you even empathize with “old you” at 20? (Perhaps easier in 2020 now that we have Russian iPhone photo aging apps…)

Again, this is the simple path. It takes no brains. It takes only the effort of living within your means and investing and time. Investing in a global portfolio of stocks and bonds can be implemented today for almost zero cost. And you could then put the portfolio on autopilot, allowing it to compound away without any fiddling or interventions from you. (We’ve demonstrated in an old article that almost everyone would be much better off spending zero time on their portfolio decisions.)

But there are those reading that are not here for the slow, dependable path. They want the keys to the kingdom much faster. The truth is most of us aren’t excited by slow investment riches. When we imagine wealth through investing, we’re likely fantasizing about putting $100,000 into Bitcoin at the start of 2017 when it was trading around $1,000, then selling the position one year later for over millions when Bitcoin closed at highs of nearly $20,000.

So, what’s realistic in terms of getting wealthy with investing faster than Ronald Reed?

Below, I’ll outline a few ways you can make big gains happen.

Get Rich Fast with Concentration and Leverage

To get rich quickly, you need to compound your wealth with highly-outsized returns. If you doubled your market returns to 20% per year, you 10x your money in 13 years instead of 25. You hit 100x in only 26 years versus 50 for the slow, zero-effort route.

Keep in mind, that’s still 13 years and 26 years. If you want to get rich in just one or two years, you can do the math on just how high your returns would have to be.

Either way, how do you generate these outsized returns if your principle economic engine is going to be public stocks?

First, you could be the world’s best market timer.

Let’s say you had a crystal ball and a time machine. You traveled back to 1920 with your time machine. Then, each year, with your crystal all, you predicted – accurately – which asset class between stocks and bonds would perform best over the coming year.

What would your returns be?

The answer is “only” 17%.

The funny part to me is the opposite. If you were the world’s WORST market timer, your return is -0.9%. It’s almost impossible to lose.

But people still find a way….

So, not even perfect market timing will get you to 20%. What about stock picking?

To even attempt to get big returns you need to move away from market capitalization weighted indices into more concentrated exposures.

Think “Warren Buffett’s portfolio containing only a handful of stocks.”

The first problem is it’s hard to devise strategies in public markets that historically generate 20% returns per year. (And this includes the benefit of hindsight bias.)

The second problem is these portfolios end up looking super weird, concentrated, and different from the broad indexes.

As an example, a basic, highly concentrated, small-cap value and momentum stock allocation gets you to about 16%.

We all want this beautiful equity curve! To the moon, Alice! I’m already thinking about sitting courtside at the Lakers and sipping champagne in the Mediterranean…

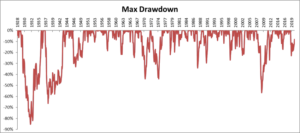

But still, this is just 16%, not 20%. And guess what? Even if you could concoct this equity curve, at one point you will lose 85% of your money (in the Great Depression) then 60% multiple times over the years. Ouch.

That is the painful path of the public market investor. At some point on your quest for big returns you will likely experience a massive loss. Can you handle getting daily updates on how fast you are losing all your hard-earned money? Probably not. (Our buds at Alpha Architect talk about how “Even God Would Get Fired as an Active Manager”.)

But is it possible to have the wherewithal to endure the pain it takes to outperform?

Sure.

Buffett’s been through rough patches many times.

Dunn’s been through big drawdowns over a dozen times. Bezos has been through a 95% price loss on his AMZN stock on the way to building a trillion-dollar company.

But it is vital to be honest with yourself – do you really have the resolve of a Bezos, Dunn, or Buffett?

All investors eventually have drawdowns, but it is even harder for most to sit through periods of underperformance versus a broad stock market index like the S&P 500.

Even worse is underperforming your neighbor – that’s likely the hardest psychological challenge to overcome.

Remember, to outperform the indexes you need to be different, which is fine when you’re winning, but impossible when you’re losing.

“I’ve heard Warren say a half a dozen times, ‘It’s not greed that drives the world, but envy,’” says Charlie Munger.

I asked my Twitter followers the following question, “What stretch of underperformance by a portfolio manager would you be willing to tolerate before selling the allocation?”

53% said less than three years. 93% said less than 10 years.

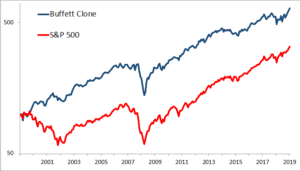

How would you react if I told you Buffett’s stock picks have underperformed for the past 17 years? What if I said he underperformed 11 out of those 17?

Yet, had you invested in Berkshire at the turn of the century, his picks would have outperformed the S&P 500 by three percentage points PER YEAR. (Top 10 stock holdings, equal weighted and rebalanced quarterly, via AlphaClone.)

In fact, his performance would have beaten over 94% of all mutual funds during that period. (And the best part is he didn’t even charge you any management fees.) This incredible, basic strategy has crushed the market, but also gone through underperforming periods where 93% of investors would have capitulated and sold.

That’s what it takes to outperform over time. Long periods of being weird, different, and wrong.

But let’s say you are really in the “nerves of steel” camp of Buffett and Bezos, can handle big drawdowns and long periods of underperformance, what then?

Well, if I had to put on my portfolio manager hat with the goal of generating 20% returns using only public markets, I would expand from just stocks and apply the theories that underpin the Trinity portfolio, but with some leverage.

That means I would include highly-concentrated tilts to global value stocks and global momentum stocks, but I would also pair it with an aggressive global trend following strategy. Then I’d leverage the entire allocation to around 1.5x. I think that potentially gets you to 20%.

However, as you’ll see in the third part of this series, I don’t do that.

Why? Because I don’t think I could handle it. (Munger famously says there are three ways to go broke: liquor, ladies, and leverage.)

I’m looking at one such simulation that just went through a painful 30% loss during the Global Financial Crisis and another 66% drawdown during the Great Depression. And again, that is an idealized portfolio that benefits from hindsight bias! Reality would likely be worse in line with the old investment saying, “Your largest drawdown is always in the future…”

Most couldn’t sit through that pain, or if they could, it certainly wouldn’t be enjoyable, and isn’t that really the point at the end of the day? To find an allocation that lets you enjoy the benefits of compounding returns but doesn’t cost you your sleep at night?

And I really, really love to sleep. Anything else we could try?

Get Rich Faster

Entrepreneurialism embodies the truly American ideal of the self-made person. It’s also one of the fastest ways to get incredibly wealthy (or bankrupt).

So, next on our list is “being the boss.”

There’s no need to describe the basics of starting a business. There’s also no real need to explain the financial benefit – everyone is aware that big dollars come through ownership of a thriving business that enjoys significant growth, whether that’s hypergrowth over a short-period, or slow-and-steady growth over several decades.

But the bottom line is that the life of a founder is brutally hard, and even then, the business may fail due to forces outside your control. Success is not guaranteed.

But for those founders who do find big success, the payoff can be extraordinary.

All you must do is look at Forbes billionaire list to see that the top echelon of wealth is inextricably tied to business ownership – Bezos, Gates, Buffett, Ellison, Zuckerberg, Page, Koch… By the way, who’s not on this list? Athletes… rock stars… actors…… and pretty much everyone besides business owners.

The celebrities, singers, or athletes that do make the list often do so not for their singing or pass-catching abilities, but rather their business acumen. Take Jay-Z. He was one of the most successful rappers of all time, but it wasn’t before he expanded his empire to include a music streaming service, liquor, art, real estate, and stakes in other companies that his net worth topped $1 billion.

So, rather than patronize you fine readers with the standard platitudes, I’d rather just make one point about starting a business.

The common lament of would-be entrepreneurs is “the risk/reward is too high for me.”

I’m going to suggest this may not be accurate. But let’s break this down on a numerator/denominator basis and compare it to that of being an employee to be intellectually honest about it.

The kneejerk reaction is to focus on the “risk” associated with starting your own business. Yes, the failure rate is high. There are no guarantees, of course, but the massive (potential) financial reward from starting a business (the denominator) does level out the high “risk” level of the numerator. As a result, the overall proposition of starting a business isn’t as downright crazy as many timid entrepreneurs may believe.

And what about the risk/reward ratio of working for someone else? After all, to be fair, you must evaluate how this looks if you decide to remain an employee.

In this case, the kneejerk reaction is “I remain an employee because I have low risk” ergo, it’s the better option.

Really?

Two problems with this. One, look at the denominator – “reward.” Barring the abnormal situation in which you continue to make huge paycheck leaps due to repeated, consistent promotions, then you’re probably locked into the standard 3-5% “cost of living” salary increase each year.

Translation – your denominator “reward” is massively capped. So, while the “risk” numerator of being an employee might be lower than that of being an entrepreneur, the “reward” is so drastically lower that the quotient of the ratio itself is basically the same (or worse) than that of being an entrepreneur.

Second point – is being an employee really safer? By now, I’m sure you’ve read articles that basically strike the fear of God into you as they point toward a coming reality…

The robots are coming for our jobs.

And don’t make the mistake of thinking these robots will be limited to your standard “production line” machinery roles. They’ll be replacing pharmacists, lawyers and paralegals, drivers, astronauts, store clerks, sportswriters and other reporters, soldiers, even your 13-year old daughter when she tries to babysit. Oh, and for our business, how about computerized trading and robo-investing? It’s only a matter of time before you’re reading automated blog posts from the cyber-quant, MEB 2000.

The point is: just because you have a job today does not mean you’ll have that future-proof job tomorrow – even if you’re good at it. So, toss out the belief that this is the safe, better option.

So, do you want to get rich? Starting your own business is one of the best ways to do this. And before you say, “it’s too risky,” really consider the opportunity cost of what you’re giving up by remaining an employee, as well as the risk you’re actually accepting by remaining in that “safe” job.

Now, let’s say you are devoid of any business ideas. Or perhaps you are just too lazy to be a founder.

This points us to our second “faster” way of acquiring big riches faster…

Invest in other people who have taken the risk of starting businesses.

In other words, be an angel investor. Take some of your capital earned by your sweat and toil and invest it in other people with great business ideas.

If you’re going to go to the effort of investing in early stage private companies, you’re looking for ideas that have the potential to massively scale. (We’ve covered angel investing quite a bit on the podcast, and the appendix lists over a dozen episodes focused on the topic. A great intro book would be the book Angel by Jason Calacanis.)

To “Get Rich” you need outliers on the return distribution scale. Doubling your money isn’t going to cut it. You’re looking for a true 100-bagger where a $10,000 investment turns into $1,000,000.

While power laws dominate both private and public markets, the lower starting point of angel investments with a $10 million market cap allows for a potential moonshot to occur perhaps more easily than a public stock trading at a $10 billion market cap.

(Good papers on return distributions in public markets: Bessembinder, JP Morgan, Vanguard, Longboard. This is also one of the reasons investing in broad stock market indexes work – you’re guaranteed to own the small minority of big winners which generate all the return. Check out the Chris Mayer podcast and book for more on public 100-Baggers. )

But this “size” issue isn’t the only reason why private investments can get you rich faster (and perhaps, easier) than our “20% from the public markets” route…

Private investments help you sidestep one of the biggest threats to your money…you.

Letting a public investment compound to reach 100-bagger status is all-but-impossible. Why?

Because every single day you can pull up your brokerage account on your phone or computer and check the stock price…which puts you at risk of selling to lock in gains, or selling to avoid prospective losses.

Do you think you’ll still let 100% of it ride after it makes you five-times your initial investment?

If you say “yes,” then, okay, well, what about when it goes down 50%?

While the concept of buying and holding a stock for the long run is a nice theory (like the “Coffee Can Portfolio”), it can be hard (or impossible) to implement in practice given our behavioral blind-spots.

But with a private investment, it’s different – your money is locked in.

It’s interesting, without even thinking about it, many people do this already with their largest financial asset – their house. Others do it with annuities that lock you in, but most choices here are way, way too expensive (average is around 2.25% a year). My fried Paul Merriman talked about his unique long term solution to gifting annuities and wrapping them in a trust in our podcast.

Most people don’t think twice about the illiquidity of their home, yet see the illiquidity of private companies as a problem. But given our discussion so far, it may just be a positive feature. Cliff Asness recently talked about this topic in “The Illiquidity Discount”.

There are other benefits of investing in private startups that many people don’t talk about. Buried in the recent tax legislation was the Qualified Small Business (QSBS) tax treatment. Investments that qualify allows investors to exclude 100% of capital gains with a cap of $10 million, or 10 times the adjusted basis of the stock—whichever is greater. That’s a monster tax hack!

Investors can also place private angel investments into retirement accounts to avoid capital gains hits on massive wins. PayPal mafia alumni Max Levchin utilized his Roth IRA to invest in Yelp, and Peter Thiel did the same with Facebook stock as well. Opportunity Zones are another tax opportunity for long term private market investors, and you can find more depth information in a few of our podcasts with Steve Glickman.

There are many platforms that allow for angel investing but by far the best deal flow is concentrated on AngelList. I may start sharing some deals in the future and you can signup here. Other platforms include Republic, WeFunder, SeedInvest, and Bioverge.

When you think about it, starting your own company or investing in other founders are extensions of what made Ronald Read rich. Different paths of course, yet whether by your own sweat, or investing your labor in the sweat of others, both are great ways to Get Rich…if you can behave along the way.

What’s the takeaway?

Though it’s hardly illuminating, there is no single path everyone should take to safely generate wealth.

After all, what is “safe” anyway?

Can your money “safely” compound in any asset class? No, and we’ve written many times about how all asset classes have suffered huge double-digit losses on a real basis in the last 100 years. Even diversified portfolios go through losing periods.

Plus, to outperform the indexes and hit the big returns you need to be weird, concentrated, and different. Most simply can’t handle that feeling for years on end when they’re losing out to a basic index.

And what about the “safety” of starting a business? Well, the statistics suggest you’ll fail – so your seed capital and your blood, sweat, and tears are at risk.

The bottom line is huge riches don’t come both fast and safely. So, as much of a letdown as it is, we’d all be far better off holding Ronald Read as our investment hero. Not because he invested in stocks, or blue chips, or anything like that – the reason Ronald Read is our investment hero is because he had a game-plan and he stuck to it.

Do you have a plan to generate wealth? That’s number one – and most people don’t. But even if you do, are you consistently following it with discipline, or are you allowing shifting market conditions, and your changing personal finances to push you around?

But let’s make a leap and say you’re one of the lucky investors who has made it to the promised land.

You’ve won the game.

You’ve saved, invested, and made your nut, and now you’re looking to preserve your wealth rather than grow it.

What strategy is best for you? Likely it’s not what you think.

We’ll tackle this topic in the next part in this series with the “Stay Rich Portfolio”.

Then, as mentioned earlier, in our third and final installment, we’ll look at how I put both elements together into a cohesive portfolio with specific examples of exactly how I manage my portfolio.

Appendix