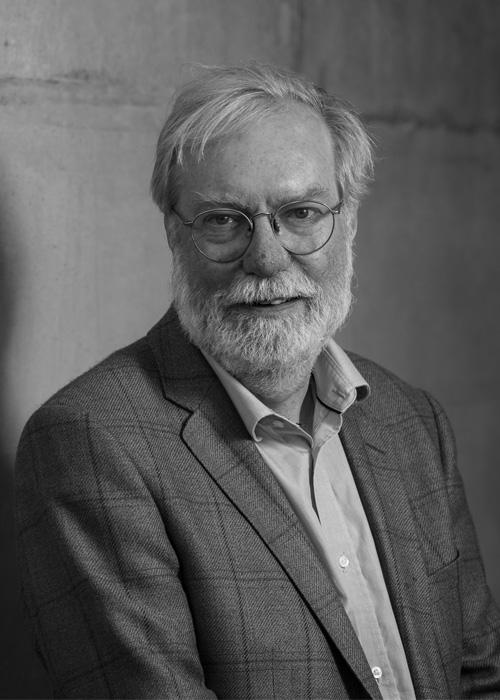

Episode #219: Paul Collier, Oxford, “What Capitalism Offers Is A Combination Of Competition And Collaboration”

Guest: Sir Paul Collier is Professor of Economics and Public Policy at the University of Oxford’s Blavatnik School of Government and a Professorial Fellow of St Antony’s College. Throughout his career, he has authored a number of publications and books. From 1998–2003 he took a five-year Public Service leave during which he was Director of the Research Development Department of the World Bank. He is currently a Professeur invité at Sciences Po and a Director of the International Growth Centre.

Date Recorded: 4/22/2020 | Run-Time: 48:16

Summary: In today’s episode, we’re talking economics and capitalism. We kick things off by covering some instances of the derailment of capitalism. We go all the way back to the mid-1800s to Bradford England’s industrial rise, the ensuing health crisis, and how capitalism responded. We walk forward to talk about the divide between metropolis and provincial cities, and the new class divide.

We discuss psychological and economic issues facing what professor Collier refers to as, “left behind countries.” We then shift to a thoughtful discussion of prescriptions to these problems, and the factors that need to work in harmony to create common purpose.

Comments or suggestions? Email us Feedback@TheMebFaberShow.com or call us to leave a voicemail at 323 834 9159

Interested in sponsoring an episode? Email Justin at jb@cambriainvestments.com

Links from the Episode:

- 0:40 – Intro

- 1:47 – Welcome to our guest, Sir Paul Collier

- 2:00 – The Future of Capitalism: Facing the New Anxieties (Collier)

- 10:11 – What influence will the pandemic have on cities and the movement of people

- 12:04 – The class divide

- 15:40 – A look at professor Collier’s course and improvements to education

- 19:08 – The divide between countries

- 20:08 – The Bottom Billion: Why the Poorest Countries are Failing and What Can Be Done About It (Collier)

- 20:23 – Countries doing well and those that are struggling

- 26:42 – Pieces about country revenues

- 29:10 – Some of the solutions to problems professor Collier sees

- 35:49 – Companies and misaligned incentives

- 40:13 – Families

- 41:21 – Our Kids: The American Dream in Crisis (Putnam)

- 43:31 – New ideas on the horizon

- 44:07 – New book, Greed is Dead (Collier, Kay)

- 47:03 – How to connect; University of Oxford, Blavatnik School of Government – Paul Collier

Transcript of Episode 219:

Welcome Message: Welcome to the Meb Faber show where the focus is on helping you grow and preserve your wealth. Join us as we discuss the craft of investing, and uncover new and profitable ideas all to help you grow wealthier and wiser. Better investing starts here.

Disclaimer: Meb Faber is the co-founder and chief investment officer at Cambria Investment Management. Due to industry regulations, he will not discuss any of Cambria’s funds on this podcast. All opinions expressed by podcast participants are solely their own opinions and do not reflect the opinion of Cambria Investment Management or its affiliates. For more information visit cambriainvestments.com.

Meb: Hey, podcast listeners. We’ve got a great show for you today. Our guest is professor of economics and public policy at the University of Oxford Blavatnik School of Government and a professional fellow at St. Antony’s College. He was also a director of the Research Development Department of the World Bank. Throughout his career, he authored a bunch of publications and books including the bestsellers, “The Bottom Billion” and “The Future of Capitalism.” And also, I think he’s our first guest that’s received a knighthood.

In today’s episode, we’re talking economics and capitalism. We kick things off by covering some instance of the derailment of capitalism. We go all the way back to mid-1800 to Bradford, England’s industrial rise, ensuing health crisis, and how capitalism responded. We walk forward to talk about the divide between the metropolis and provincial cities and the new class divide. We discuss psychological and economic issues facing what our guest refers to as left-behind countries. We then shift to a thoughtful discussion of prescriptions to these problems and the factors need to work in harmony to create common purpose. Please enjoy this episode with Sir Paul Collier.

Professor Paul Collier, welcome to the show.

Sir Paul: Thanks, Meb for inviting me and thanks for the opportunity of talking.

Meb: We have a lot of exciting stuff to talk about today. I figured we’d start with your most recent book, “The Future of Capitalism,” which none other than Bill Gates said was one of his favourite reads of the summer last year. As we talk about capitalism, which seems to be in the news a lot lately, particularly here in the U.S. and the elections and everything else going on, it seems sort of undeniable that if you look back in the history that capitalism has been a great force for good, whether you measure it by people’s lifespans getting longer, GDP, prosperity, whatever it may be. But more recently, you’ve written a lot about that it seems to have gone off the rails a bit. Love to hear you talk about background of capitalism, the evolution and why this may be a good time for a rethink.

Sir Paul: Yeah, sure. I mean, as you say, capitalism, we’ve had civilisation around the world in various forms for 10,000 years. And only in the last 200 have we hit on the system which can actually lift mass living standards. And then, it really only happened once. The first factory on earth was about 10 miles from where I was born in the North of England. And it’s spread from there. Other places imitated it, got the hang of it. And so it’s, you know, a very rare event and it’s been brilliant for most of that time.

What capitalism offers is a combination of competition and collaboration, which enables ordinary workers to work at scale, that to specialize so they can learn by the doing, firms that have long-term relationships with finance so they can fancy investments, and they compete with each other and innovate. So, it’s a marvellous package. But it doesn’t work on autopilot. And sometimes it comes off the rails.

In the last 200 years, I count 3 big derailments. And we’re living in one right now. So, it’s a wonderful system, but about 40 years ago, we got into an intellectual fallacy that it worked on autopilot, that markets just function without any public policy that, in effect, we didn’t need government. And that was a terrible, terrible mistake.

So, if you like, I’d go through the first of the derailments because the present one I’m gonna talk about in depth. The second one, the great depression, everybody knows about in some way, shape, or form. But that first derailment, people don’t know about. So, let me start off on that.

So, because capitalism started 10 miles from where I was born, the north of England, the first derailment happened all around where I was born. I’m gonna take you to the first half of the 19th century. We’re gonna go to the most booming city of the whole of Europe, so Europe’s equivalent to Chicago. That’s where my grandfather moved from an impoverished German village to the city. It’s called Bradford.

I’m gonna go homing in on Bradford in the 1840s and, actually, 1849 because people were pouring into Bradford. It was very productive. People were much more productive working in factories and all the factories are clustered together. So, in terms of productivity, it was a miracle.

But in 1849, cholera broke out in Bradford. And in fact, life expectancy in Bradford and other northern cities fell. So, the average person who’s born on those cities was dead by 19. So, life expectancy collapsed to just 19 years. It was a crisis of public health. Why? Because there was no public policy to provide clean water, sewage, separate sewage from the water, build decent housing. So that was the crisis.

But it created a response from capitalism itself so we’re gonna go…we stay with Bradford and we go to Meister Big and Meister Big was the biggest mill owner in Bradford. He’s called Titus Salt. Not only was the biggest mill owner, but he was the local mayor and he was the city’s one member of parliament. So, he really was Meister Big in every sense. And there he was in 1849, mayor, member of parliament, major employer.

And it seems to have sea of his soul because he realized he was responsible. His own workers were dying. His citizens were dying. And it may well have been the equivalent to what Bill Gates experienced with his letter from cancer-stricken mother, which turned Bill Gates into this amazing philanthropist. And so, Titus Salt did the same. He sort of pioneered big business philanthropy. He was very rich man. He gave his entire fortune away.

Partly, he recognized obligations to his workforce and so he built pretty much the first industrial-purpose real town in North. He [inaudible 00:07:10.946] Titus Salt called Saltaire, it’s now a World Heritage Site because of this. And then, he devoted the rest of his fortune to the people of the city, cleaning it up, parks and so on. And people responded. His workforce was loyal. The citizens celebrated him. And when he died, he had the biggest funeral Bradford has ever seen. There’s a statue in the middle of the city. And he’s still fondly remembered. And so that was Bradford.

We just come to go with few miles from Bradford to Rochdale, same time, 1840s, same crisis. People are dying. People have nowhere to live. People are poor. Sometimes, people lose a job or something. So, in this case, what happened was families responded by building reciprocal obligations, mutuality. So that was the birth of world’s cooperative movement. It was born in Rochdale in the 1840s. And it’s spread all around the world from there.

If we just go few miles from Rochdale, we go to Halifax and other small towns, the same problem. Halifax invented the savings loan association, created, I think, the Halifax Building Society, which became the largest bank in Britain.

So, these responses to that first derailment had in common that business and families were both sort of morally load bearing. They were able to bear obligations to others and did something about it practical. That was then.

And now, we move to this third derailment, which begins around 1980. And it’s a slow derailment, but it’s the two new divides that opened in society. It happens in Britain. It happens in America. Just the same intensity. And one is the new divide between booming metropolis like Los Angeles, New York, San Francisco and so on, and broken provincial cities. And that reverses 200 years of economic history in which the spatial differences between places has been narrowing. So, for 200 years until 1980, they narrow. And for the 40 years since, they’ve been widening.

And my own hometown of Sheffield, you may even know about because there was a very funny poignant film called “The Full Monty,” which described the economic collapse of Sheffield. It was an industrial town, a steel town. And the steel industry moved, all of sudden, moved to South Korea. And so, there’s mass unemployment. And the city’s barely recovered. And it didn’t manage to do a turnaround in the way that Pittsburgh seems to have manage to do a turn. So that was one divide, the spatial divide.

Meb: Let me pause you there. It’s interesting when we talk about that because I remember we have a lot of family that’s been on the farm business for a couple of generations, particularly in the Midwest in the United States, Kansas and Nebraska. And growing up, I remember a lot of these vibrant farm towns and even my father talking about when he was growing up, all the farmers drove Cadillacs. And of course, just like anything, when you see this boom/bust of industries and locations, but you go back to these towns now, and it’s just empty storefronts everywhere, all across the sort of plains.

And I was gonna ask you this later, but it seems more timely while we’re talking about the geography of cities. I wonder how much this pandemic may have lasting influences on reversing that trend. The thinking being as a lot of cities tend to be much more compact as far as people and density versus being able to work remotely. You and I are talking, I’m in my guest bedroom, my child’s toys everywhere in the background. It seems to be working just fine. Do you think that’s gonna any have sort of lasting impact on perhaps reversing some of that trend or not so much?

Sir Paul: Yeah. In terms of quality of life, unless you’re young, single, and pretty affluent, the big cities offer really pretty dreadful quality of life. London offers incomes about 70% above the British average. But London comes bottom of all regions in terms of wellbeing. One psychological feature in which it tops is anxiety. So, bottom in wellbeing, top in anxiety, but wage hop in income, so the conversion of income into wellbeing is really incredibly inefficient in these big cities.

Meb: Yeah. All right. Sorry to interrupt you there. Let’s move on to the next one on some of the big divides that are going on.

Sir Paul: Yeah. So, the other big divide is the new class divide. And, you know, when I grew up, Britain has a very clear class system. America didn’t, but Britain really did. It was who your father was, his social position, his social connections, that sort of thing. And now, it isn’t. Now, it’s education. And it’s, I think, very much the same in America. You’ve got this new deep cultural divide between the people with a good tertiary education and the people who never went to college.

And that educational divide then plays into the ability to be productive. Because as the production systems in the world got more and more complex, to be productive, you needed to build skills on the back of a good tertiary education. And that’s what happened to lawyers, journalists, engineers, all the rest, academics. We did well and so we got on a rising escalator of incomes. For me, it was first generation, both my parents left school when they were just 12 years old. So, I was the only person in my family to get an education. And boy, it did me well.

Meanwhile, the people who hadn’t gone to university, they’d invested in manual skills, and welders, and steel work, all that sort of stuff. And those skills started to become less and less valuable. And so, for 40 years the less educated were on a down escalator of income and the more educated were more up escalator of income. And these two divergences, the spatial divergence and the education divergence then intertwined because if you were bright from a provincial area, you got out.

That’s what I did. I left Sheffield and I never went back to work in Sheffield. My family’s still there but… And so, my family were going deeply down on the down escalator as the Sheffield’s steel industry collapsed. And I was going up and up. Ox has promoted me, Harvard hired me, and so on and so forth. So, I am sort of an unusual case where I’ve lived these two divides, the spatial divide and the education divide. That’s why the book, “The Future Capitalism,” is quite a passionate book. It’s an analytic, you know, I’m an Oxford professor of economics so it’s a serious book. But it’s for [inaudible 00:14:50.917] of passion because these rifts shouldn’t have been allowed to go on for 40 years without being addressed.

Because they were neglected, people fell into despair, the depths of despair, which we hear about in America. And eventually, they mutinied in Britain, Brexit, and mutinied in America with Trump, they mutinied with France with gilets jaunes, and so, on and so forth. All around the rich world, these divides were happening and the mutinies there.

Of course, the mutinies don’t come with a forward-looking strategy. They’re just expressions of anger. People are really fed up. And that’s a gift for, of course, the opportunist to come in cease the moment, which sometimes happens. But the underlying reason is that these divides have been neglected.

Meb: One of the things I was thinking as I was reading the book, I noticed you also do a online course and I was getting ready to sign up. And there was that said something like, 50,000 or something people had signed up. And I don’t know if that’s just for all time or current. It seems that a lot of term papers to be grading. But I wonder also, how that potentially could either slow or reverse or improve that trend. Any general thoughts? First, I’d love to hear how that course has been going for someone who’s been involved in teaching, what’s that like. But also, does that have any implications too?

Sir Paul: I think so. I mean, for example, Michael Sandel, a philosopher at Harvard, who I have great respect for my fellow communitarians. His course is just massive. It is probably the most popular course in the world. And that’s in Philosophy. So, it’s possible to make even a rather esoteric subject clear and interesting. I’ve heard, yeah, that’s way more than 50,000 on my course. It was the first online course that Oxford had ever done and I’m afraid there won’t be many more because for the moment, Oxford has decided that maybe that’s embarrassingly successful. So, they don’t want to do anymore. Don’t ask me why. I just do what I’m told.

But I knew a lot of academics in Oxford. Once they heard about my course, they, “Can I do one?” That’s why I put them in touch with the team. But anyway, such is life.

And my secretary put together a big folder. He said if you ever start to doubt why you’re still working and doing this sort of stuff, take a look in that folder. And when I’m really depressed, I occasionally look. And it’s just people who, from all over the world, what I think 111 countries saying, “Thank you. I got this. I understood stuff. And now, I want to apply for this. I wanna apply for that. I want to do this.” You know, it’s very nice. When I travel around the world, people come up to me and they speak as they are, “You know. My kid did your course. So, I did your course.” It’s nice.

Meb: Yeah. I’m hopeful. I think you’ll see some positive changes as we come out of this mess, eventually, whenever that may be. Who knows? Maybe capitalism will be the one to solve this. There is some interesting start-ups maybe they have the ability to filter and curate some of these courses were at the top professors around the world, instead of having tens of thousands of these colleges that charge a hundred grand tuition rather that some of these students have the ability to access your lectures and others but at massive, massive scale. I’m hopeful. It could be interesting.

Sir Paul: I agree with that. I mean, that’s part of the genius of capitalism is competition and innovation. And that’s what we need. I mean, the technology of standing in front of the class is really a pretty old-fashioned technology. It’s been going since about 1200. I do it because, both in Oxford and in Paris, because I enjoy giving courses. And it is something magic to be able to have an audience in front of you and making them push back straight away. Though you performed amazing things with that online course, chat groups, and that sort of thing. So, it’s feasible to simulate quite a lot of interaction even with big numbers.

Meb: That’s great. All right. So, you also mentioned another divide being at the country level. Could you expand on some of the ideas there?

Sir Paul: Most of my working life has been on Africa and in particular the sort of fragile states of Africa. So, I tend to think of that as my day job. And while this advanced economy stuff is my evening job. But clearly, what’s happened is just as they were left-behind places within countries, there are left-behind countries. So, that some countries, China, India have really, really caught up amazingly. That’s wonderful thing. And then, you got more than a billion people each, so that’s phenomenally good news.

But there are awful lot of little places that have just been marginalized and fallen further and further behind. Frankly, coronavirus is gonna push a lot of them even further under water. This is the group I call the bottom billion. It’s hard to escape that.

Since I wrote “The Bottom Billion,” a few countries have managed it. Rwanda is managing it pretty well. Ethiopia is managing it pretty well. But most is still struggling.

Meb: Since you wrote that book, it’s been about a decade in the hopper, a little over a decade, I think, what’s changed, if anything? You mentioned a couple of counties that have done it well. Are there any great examples and maybe we’d love to hear you unpack even more about why they’ve been successful? And what are some of the main reasons that countries struggle?

Sir Paul: Yeah. This is not a two-minute answer. Countries can only be changed from within. I mean, we can’t save Africa. Either Africa saves Africa or nobody saves Africa. And what will happen in Africa is, I think, the same has happened in Asia, which is to say… In East Asia, four little countries got ahead: Singapore, Taiwan, South Korea, Hong Kong. In the 1980s, they started to pull away decisively from others. And then, they got imitated.

Deng then was the ruler in China went and had a look at Singapore and thought, “Oh, my God. We better learn from this.” And he got the model of Hong Kong right there, right next to it. And so, that I think will happen in Africa. You get three of four countries really getting ahead and others will then emulate that, learn from it. Countries don’t learn from examples that are very distant. They learn from a successful neighbour. So, I think that’s what will happen.

But why is it hard to turnaround? I think there’s two things. One is sort of psychological problem and the other is there’s a brutal economic problem. And the psychological problem is that failure, persistent failure tends to produce a mental outlook, which looks backward and tries to allocate blame. And it produces a sort of mentality of victimhood. Either one part of society in Africa, one tribe, is a victim of some other tribe or everybody is a victim of foreigners, colonialism, or whatever.

And so, whether true or false, those are not useful psychological ideas. What matters is to get some common purpose, some shared sense of “We’re all in this together.” So, you can use a “we” and then look forward. So, forward-looking common purpose around some sensible looking strategy, which you start and you learn as you go, so that’s what success looks like.

But you get into these traps of sort of victimhood and the persistence of failure seems to vindicate the story of victimhood. “We’re poor because of somebody else or because of enemies within.” There’s nothing we can do about it. Outside Africa, Argentina has been in that trap throughout the century, I think.

So that’s the psychological trap that you got turn around to forward-looking common purpose. And both Rwanda and Ethiopia have done that brilliantly. If we go back 26 years, both these societies were in total meltdown. But now, they are really hopeful places. So, that’s the psychological trap.

And then, the brutal economic trap. These countries, all poor countries, desperately need modern capitalism. Modern capitalism comes with firms, proper firms, not two kids standing on a street corner trying to sell things, but proper firms that can organize people, scale specialization, borrow money, invest, innovate. Africa was just desperately short of proper firms. Two thirds of the population work solo, or in twos or threes, no scale, no specialization, nor formalization, just doomed to poverty.

Here’s the catch. Africa needs firms but firms don’t need Africa. Nobody wants to go and pioneer the sector because pioneering is really very risky, full of unknown unknowns, and it’s pretty lonely. If you fail, you lose everything. And if you succeed, guess what? You get imitated. That’s great for the country, but it’s not good for the firm.

The first firm in the sector will have to train skilled labour. Since there won’t be skilled labour in the country in that sector, it’s very expensive to train. You have to bring thoroughness into training. And then, if it works, and a second firm comes in. Where are they gonna get the skilled labour? From your firm. And so, nobody wants to be first. There’s a first-mover disadvantage in these countries. In Silicon Valley, there’s a first-mover advantage. Get to the idea first. But in very poor markets where you’re just setting up not enough new idea, but a sector, there’s a first-mover disadvantage. And that’s what we need to overcome.

And we’ve got public organizations that can do that. They’re called developed finance institutions. The World Bank got one called IFC, Finance Corporation. America’s got one, OPIC, just been renamed. Donald Trump, when he came in, “OPIC was a waste of time.” He was gonna close it. And then, thank goodness somebody explained to him what it did and he decided instead of closing it, he double it.

And so, Africa needs business, you know, the danger is it just attracts…the only people who know they can make money are the crooks. But Africa needs decent firms to go in and decent firms need to be helped in that pioneering role. So, the psychological battle is the leaders within and the economic struggle is something we can help with.

Meb: And you alluded to it. I mean, one of the biggest struggles with Africa, in general, has been corruption at the sort of the despot level where many of these leaders end up billionaires, whether it’s siphoning money off or what not. But the beauty of the internet and having more and more transparency is it kind of acts as a giant disinfectant. And I think I was reading in one of your pieces about one of the countries just started publishing all of the revenue and tax information in the newspapers.

But any other, before we hop back over to the capitalism book, on “The Bottom Billions” stuff, any other just general thoughts? As 10 years on as this, I think, one of the big developments in Africa certainly has been involvement of China, big state sort of influences. Any other just general takeaways, any thoughts? And you mentioned that first-mover advantage. And I’ve actually seen some interesting start-ups developing in Africa. Any other just general thoughts before we hop back over.

Sir Paul: The internet and mobile phone, all this sort of stuff, really is a gift force for Africa. It’s a leapfrog technology that Africa really, really needs. So, in deed, you know, you got a country like Kenya and young people are really, really innovative. Google went to Kenya not to teach Kenyans, but to learn from Kenyans because Kenyans, young Kenyans, have innovated, innovated, and innovated on all of this new technology. And so, there’s lots of innovative energy. It just needs to be tapped.

And the corruption is there because, on the whole, politicians haven’t built this forward-looking common purpose. And so, there’s a psychology of always “me against them, it’s my turn to eat.” My turn to eat means it’s my turn to put my nose in the trough, you know. And so, that’s the, as you say, it’s a really two solutions here. One is transparency and technologies really helping us there. And there’s a lot that we can do to promote transparency. And the other is this domestic, the political agenda or common purpose.

Rwanda is not corrupt because the leadership is determined that it would be cleaned up and there’s a sense of absolutely forward-looking common purpose to get out poverty. And they know it’s gonna be hard and so they know if anybody steps out of line and behaves corruptly, they’ll come down on him like a ton of bricks. So, there are hopefuls. And what will happen just around that’s all of these, as these countries get ahead? Ghana is starting to get ahead as well as Senegal’s starting to get ahead. As this happens, they will get imitated within Africa. They’re the role models.

Meb: All right. So, one of the things I like about your books is…You chat with a lot of economists, it’s been 99% of the time talking about the diagnosis, but don’t often spend as much time talking about prescriptions. But you do a great job of talking about not just the problems, but lots of ideas on how to work through and kinda suggestions and fixes and ideas. I’d love to hear on some of those on all the different levels you talked about: global, state, company, family. Maybe walk us through what are some of the things we can be thinking about and doing.

Sir Paul: Yeah, happy to. So, let’s start with the spatial divide and then the skill divide.

So, spatial divide. It doesn’t have to be a scenario – a booming metropolis and broken provincial cities. If we look around the rich world, Western Germany isn’t like that. Western Germany widely distributed successful regions. In the northwest, you got Hamburg. In Northeast, you got Berlin. At South, there you got Stuggart, you’ve got Frankfurt. And Southeast you got Munich. And so, widely distributed, highly-productive regions. And the city within its region, that’s I think is sort of the right concept. Britain is just very, very belatedly trying to develop that, this called combined city region authorities that is just a few years old. Britain is way, way, way too centralised.

But what do you do when you got these city regions? It’s still not easy. It’s a little bit analogous to how you get the bottom billion country to turnaround. If you’re Detroit or if you’re Sheffield, what do you do having been broken as a city? There’s no magic bullet, but there is, if you like, a magic cartridge. In the case, there’s things you’ve got to do. As the weakest-link problems, you need to do all of them.

One is try to get some devolved political powers so that you have leaders who can actually do something. The second is to have a local finance industry. In America, you used to have a very widely-distributed finance industry. And over the last 40 years, it’s become much more centralised. Britain has been highly centralised for over a hundred years. Germany, it’s never got centralised. You’ve got banks with the power of autonomy. The power of taking their own decisions about who do you make a loan to in each of the city regions. And that’s really important because finance needs local knowledge. You gotta know the firms in the city and you only know that by living there, working there for years, knowing the firms, knowing which ones you can back and which ones you can’t.

When it gets centralised in New York or whatever, then all that happens is you fill in a form. That’s what happens in Britain. You fill in a form and it’s sent off to London and it’s then put in a risk model, and the answer comes back, “No.” And there’s nobody there with the local knowledge to override that decision and say, “Actually, this is a good firm: the loyal workforce, good management, good ideas. It’s worth backing.” And indeed, only when you got local finance is there so much stake in the locality that the local finance knows it’s got to work.

So, local political power, local finance, when you got those two, you get a locally-organised business community. In Britain, the business community is organised in London. That’s where the money is. That’s where the political power is. So, that’s were the lobbying is. You need locally-organised finance. In Germany, it’s all organised city by city.

Then, you need serious organised civil society that creates a sense of the brand in the city. In Britain, the one city that’s got all this is Edinburgh, outside London. Edinburgh has a festival, world-famous, half a million people fly in to Edinburgh each summer. It’s cool to be in Edinburgh, not just for foreigners but the young people. My own 19-year-old has been two years running and when I quizzed him, he said, “Ah, you know, it’s really cool.” And that’s great because that means young bright people, well-educated people, are willing to go and work there. If I try to get my son to go and work in Sheffield, he needs, yeah, it takes some persuading [inaudible 00:33:55.749].

And finally, element that matters, universities. You need a good university that’s connected in with the local city, connected in with local firms, and connected in with the local workforce so it could deal with training. And that cluster of five things, they all needs to work together for a common purpose.

To give you an example, in Edinburgh, they did. The city worked out a strategy, saying, “Where are the jobs gonna come from in Edinburgh in 10 to 20 years?” And then, they weren’t massively imaginative, but they decided, “Let’s get the IT industry to come to Edinburgh.” Well, that’s what they did. They plugged away at it for 10 years. They have over 480 IT firms. It’s the biggest cluster in Europe. When they started 10 years, they have 2. So, forward-looking common purpose with all these different entities: the universities, the finance, business community, civil society. If they work together, they can achieve a lot. And that’s what happened in Germany.

And then, you get into a sort of happy state of affairs instead of a sad state of affairs where people sense their failing because of others, and they aren’t to take blame. So, you could think of a society, it’s like a…well, a community is like a dinghy with two equilibria. One equilibrium is very, very stable. And it’s when dinghy is upside down. And it’s hard turning it the right way up again. The thing with equilibrium is when it’s the right way up. And then you can sail the way you wanna go. It’s a bit less stable than the bad equilibrium because you get pass the winds, so you need an active management from the crew. But it’s hard to get from an upside-down dinghy to a right-ways up dinghy. And that’s kind of the problem that we’re facing in these air-broken provinces.

Meb: What are some of the general thoughts in the company level. There’s a lot of discussion in the U.S. about companies and misaligned incentives particularly, there’s a lot of discussion right now in the headlines about Disney, who’s apparently laying off a ton of workers, but a lot of execs and leadership, etc. still getting huge bonuses. What is the general thoughts on the company’s purpose? You’ve written a lot of this concept of the ethical firm. How is that evolving over the years?

Sir Paul: I’m amazed at how much success we’ve had. I teamed up with a colleague of mine called Colin Mayer, who is the director of the Business School of Oxford. He got a companion book called “Prosperity.” And so, we’ve done a lecture tour around…we lectured in New York and District of Columbia. And our common message is that the purpose of the firm can’t be profit. That’s what Friedman said, and it was just plain wrong.

Nobody anywhere gets up in the morning just saying, “What am I going to do today? I’m gonna maximize shareholder value.” And it’s not a worthwhile purpose. Of course, firms are gonna make profit, otherwise, what they do isn’t sustainable. And that’s not the purpose, all firms need a purpose beyond profit that motivates the entire workforce of the firm to behave collaboratively as a team.

And amazingly, that message, when I wrote the book, I thought this is gonna take years. But we’ve got, Larry Fink coming out with, “Every firm needs a clear statement of purpose, which can’t profit.” He’s sitting as head of BlackRock, which is the biggest investor in the world pretty well. And then in August, the America Business Forum of the top 180 chief executives in the country came out renouncing, rejecting that Friedman Doctrine. As they said, they’ve been publishing that on their websites 30 years, “Our rationale is to maximize shareholder’s value.” And they finally faced up to the fact that that’s not what any of them are doing. It’s not that they’ve changed what they’re doing away from that. It’s just that they were never doing it. Nobody but nobody could be motivated by that sort of purpose.

The whole initiative to get these 180 chief executives to face up to the fact that in truth they weren’t trying to maximize shareholder value. [Inaudible 00:38:28.000] was the chief executive of Johnson & Johnson, which had a long history of being a fine and purposeful firm. That’s why Johnson & Johnson is one of the very few firms that’s been around for such a long time, for a century. Very few firms achieve that. And the more uplifting purpose you have and the more your staff all buys into it, the more successful your firm will be in every dimension. I’m very hopeful in that.

Coronavirus had way been a tragedy in that it happened too soon for that change of heart to consolidate. And so, indeed, we’re seeing shameful behaviour. Firms have got a choice. They either take the long view and recognize that staff really matter. Or they take the short-term profit, snatching people. And unfortunately, to date, the financial sector, with its emphasis on quarterly profits is encouraging that. Warren Buffet has never behaved in this sort of worldly-profit way. And it’s not done him any harm, has it?

So, I don’t know how coronavirus will play out. I do know that there’s been a groundswell of change of opinion. I was invited to Davos to speak there on this stuff, January. Klaus Schwab, the guy that runs Davos, wrote me saying, “Best book I’ve read in years. This is exactly what we’re trying to do.” And so, there was a lot of talk at Davos about purpose beyond profit. But whether it’s going to play out under this stress of unprecedented pressure on firms’ balance sheets. I don’t know.

Meb: What about the family? How is that play in all of these?

Sir Paul: Well, I can talk about my family and I can talk about families. In my family, my wife got coronavirus quite badly. And that was pretty stressful. And I’m juggling… Well, the 19-year-old teenager, he’s self-sufficient up at the top of the house. He’s been a plus. But a 12-year old and a 13-year old, homeschooling is not easy, you know. So, juggling a sick wife and hyperactive kids has being a fun challenge.

But more generally, if we turn to the families, the families in the poorer half of society, the ones that didn’t go to university, and probably shouldn’t go to university, they’ve been stressed increasingly over the last 40 years. And so, you’ve seen this increase in divorce rates, single parenthood, really failing children in the widening divide between the educational attainment of the kids with successful parents and the kids with parents who didn’t have good education. There’s a brilliant book by Robert Putnam, Harvard, called “Our Kids,” which describes the situation in America, and my God, it makes you want to weep. It makes you want to change things.

And if starts with the family and go all the way through to vocational training. We know how to do vocational training. And we know that Britain and America are doing it really badly. The best in the rich world is Switzerland. And Switzerland isn’t a semi-Marx, this socialist society, far from it. It’s a very, very wealthy society that is an epicentre of capitalism. But it’s got very responsible business that knows it got to put a lot of money into training. And it’s all run locally. And the vocational training is three and four-year courses. It’s as prestigious as going to a university. And Zurich University is one of the top 10 in the world. So Swiss have got a lot of choice to be in really good universities. But 60% of the Swiss choose to go to vocational training route because they know they will come out of that with a really productive job and a supportive local employer who’s put money into all that vocational training. So, these courses are paid, three and four years, half the money is coming from firms. So, firms have got a lot of skin in the game in building those skills.

Let’s start with better treatment of families and with much bigger investments, my firms in vocational training run at the local level. That would close the gap between the educated and the less educated. If we combine that with this much better approach to the building viable city regions, we can heal these vicious divides. I wrote the book because those divides, although they’ve been horrible and produced these very damaging mutinies, they are avoidable and they are correctable. And we need to rise to the occasion to do it.

Meb: I love it. Paul, I’ve kept you for an hour so I’m gonna start to wind down to a couple of shorter questions. From someone who’s worked in so many different parts of economics and has been through different crises and geographies, as we turn the page on a new decade, as you look out on the horizon, what’s on your brain today? Any new ideas, papers, books, thoughts that you’re working on? Anything searing the frontal lobe of your brain that keeps you up at night or you’re really curious about?

Sir Paul: Yup. Sure. So, two big things. One is I just today finished a new book.

Meb: Wow. Congratulations.

Sir Paul: And it’s joint with my colleague John Kay, who’s one of the most brilliant economists in the world. And it’s called “Greed is Dead.” So, it picks up on that idea greed is good and demolishes it. So, I hope you’ll be able to get a copy of “Greed is Dead” in America very soon. In Britain, it’s being rushed out because it seen as very, very pertinent to the present situation. So that is my evening job.

And then, my day job is to try and work on the poorest countries and how the coronavirus crisis is affecting them and what we can do about it. And the answer is, we need to do quite a lot. We need to pony up some money. This is an unprecedented situation. Paul Kagame, president of Rwanda, the place has done so well, quite aptly said a couple of days ago, “This would set Africa back 25 years. And it needs help.” Rwanda’s made a big play on tourism. It’s the second most popular place for tourists to go in Africa because it’s really well run, it’s safe, it’s interesting, it’s fun. And of course, there are no tourists.

Very sensibly, Kagame closed the airport very promptly. But with no tourists, no money. Do we let Rwanda go backwards or do we keep it afloat until we get a vaccine of this awful crisis is a memory and not current item?

Meb: What’s the preview of sort of any suggestions that have to be sort of international organizations step in or what’s the…?

Sir Paul: The best vehicle is probably are the international organizations. That’s what got them for. IMF is there to finance crisis management and is needed now. The World Bank is there created for the same reason. It’s first loan ever was to France in 1947. And in 1947, France was a fragile state that could have collapsed into the Eastern Bloc at any moment. And so, very sensibly, the world thought, “No. We better keep France afloat.” And so, we did. France got a $402.8 billion to get on with infrastructure.

We need to take that same long-term view now. And I’m confident that the IMF will do that. But they would need support. They’re both undercapitalized for the present crisis. They need the big countries to pony up with money, unfortunately. Although it’s big money for Africa, it’s actually very small money for us. It’s the rounding error in the cost of the crisis. We need to pay up that rounding error.

Meb: Well, we keep an eye out of for both of those new pieces as they come out. Where are the best places to follow, Professor, what you are writing about? Do you have suggestions, homepages if people want to keep up with what you’re up to?

Sir Paul: I don’t blog. I have to admit. I publish things. But I guess, if people Google around, they’ll find stuff. So, I’m not a one to…I’m very wary, if you like, it’s not about me, really isn’t about me. It’s about ideas that matter. And if somebody else could have these ideas, I’d be very, very pleased.

Meb: Good. We’ll add all the links to the books and white papers to the show notes. Professor, I’d love to keep you for five more hours. I love to have you back when the new book comes out. Thanks so much for joining us today.

Sir Paul: You’re welcome. Thanks very much. Bye.

Meb: Podcast listeners, we’ll post show notes to today’s conversations at mebfaber.com/podcast. If you love the show, if you hate it, shoot us feedback@themebfabershow.com. We love to read the reviews. Please review us on iTunes and subscribe to the show anywhere good podcasts are found. Our current favour is breaker. Thanks for listening friends and good investing.