Episode #324: Edward McQuarrie, Santa Clara University, “Sometimes Stocks Beat Bonds, Sometimes Bonds Beat Stocks”

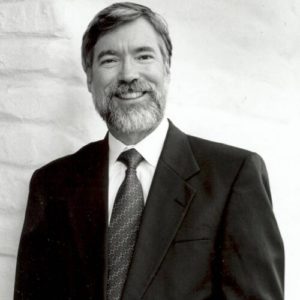

Guest: Edward F. McQuarrie is a Professor Emeritus in the Leavey School of Business at Santa Clara University. He received his Ph.D. in social psychology from the University of Cincinnati in 1985.

Date Recorded: 6/2/2021 | Run-Time: 1:16:52

Summary: In today’s episode, we hear why the ‘stocks for the long-run’ thesis may not be so true. Dr. McQuarrie found digital archives and older data that gives a different conclusion than what Professor Jeremy Siegel found. We walk through how stock and bond returns have changed over time and learn that bonds have outperformed stocks for decades in countries like France and Japan. We hear about Dr. McQuarrie’s ‘regime thesis,’ which says the risk/return profile of both stocks and bonds depends on what regime we’re in, both capable of outperforming or underperforming over any time horizon.

Sponsor: Bitwise – The Bitwise 10 Crypto Index Fund is the world’s largest crypto index fund. It holds a diversified portfolio of cryptoassets, including bitcoin, ethereum, and DeFi assets. Shares of the fund trade under the ticker “BITW” and are accessible through traditional brokerage accounts. Shares may trade at a premium or discount to net asset value (NAV). For more information: www.bitwiseinvestments.com

Comments or suggestions? Email us Feedback@TheMebFaberShow.com or call us to leave a voicemail at 323 834 9159

Interested in sponsoring an episode? Email Justin at jb@cambriainvestments.com

Links from the Episode:

- 0:43 – Intro

- 1:29 – Welcome to our guest, Edward McQuarrie

- 3:39 – Overview of Edward’s Market History paper

4:41 – Stocks for the Long Run (Siegel) - 10:54 – Unearthing the differences in hundred year old data

- 16:37 – Hamilton’s Blessing (Gordon), The Birth of Plenty (Bernstein)

- 17:56 – What inspired Edward to look back at data predating the roaring ‘20s

- 23:36 – Main insights from Edward’s research

- 24:36 – Why Edward’s conclusion differs from Professor Siegel

- 26:33 – Overview of bond data comparatively to their stock findings

- 34:31 – Sponsor: Bitwise

- 35:21 – What Edward’s main thoughts are as he looks back over all of these data sets

- 42:17 – Oscillations of poor performance from managers to asset classes

- 47:13 – The Case for Global Investing (Faber)

- 48:21 – Thoughts on negative yielding bonds

- 53:54 – Unpacking more of his concept on regime changes

- 1:04:54 – Introducing the Carb-Sharp Ratio (McQuarrie)

- 1:07:02 –The Investment Pyramid; and how much public opinion can change over time

- 1:12:07 – Edward’s most memorable investment

- 1:15:37 – Learn more about Edward; New Lessons for Market History; SSRN.com

Transcript of Episode 324:

Sponsor Message: Today’s episode is sponsored by Bitwise. You’ll hear more about them later in the episode.

Welcome Message: Welcome to “The Meb Faber Show,” where the focus is on helping you grow and preserve your wealth. Join us as we discuss the craft of investing and uncover new and profitable ideas, all to help you grow wealthier and wiser. Better investing starts here.

Disclaimer: Meb Faber is the co-founder and chief investment officer at Cambria Investment Management. Due to industry regulations, he will not discuss any of Cambria’s funds on this podcast. All opinions expressed by podcast participants are solely their own opinions and do not reflect the opinion of Cambria Investment Management or its affiliates. For more information, visit cambriainvestments.com

Meb: What’s up you all? We got a great show for you today. Our guest is professor emeritus at Santa Clara University. In today’s show, we hear why the “Stocks for the Long Run” thesis may not be so accurate. Our guest found digital archives and older data that gives a different conclusion than what others have found.

We walk through how stock and bond returns have changed over time and learn that bonds have outperformed stocks for decades, both here in the U.S. and in other countries like France and Japan. We hear about our guest’s regime thesis, which says the risk-return profile of both stocks and bonds depends on what regime we’re in, both capable of outperforming or underperforming over any time horizon. Please enjoy this episode with Santa Clara University’s Edward McQuarrie.

Meb: Professor Edward, welcome to the show.

Edward: Thank you, Meb, honored to be here.

Meb: Where do we find you today? Somewhere right up the coast from us with a town that’s got a little relevance to what we’re up to? Where in the world are you?

Edward: Who knew? I’m in Cambria, California.

Meb: You actually mentioned it and the name preceded me. My partner, his heritage was from the Welsh part of the world. And as you mentioned that some sort of derivation as few Cambrias dotted throughout the land. Does that sound right?

Edward: It’s originally Latin, Cumbria or something like that.

Meb: I’ll tell an embarrassing story. Get it out of the way early. I’ve been in California since 2000. But at one point, was driving up and down on the coast. And don’t ask me why I got this in my head, but a little town up the Central… I love the Central Coast, California. There’s a little town called Pismo Beach, listeners.

And I don’t know why I got this in my head that I thought it was a place you could go clamming. And I don’t know if they were just famous for clams or not even or there’s just a restaurant randomly with a clam on the side of the road. I have no idea. I get some of these weird ideas in my head.

But I remember stopping and trying to go in the grocery store, in the fishing store. And I was like, “Where can you buy clamming equipment?” And every single person is like, “What are you talking about?” And this may be in early 2000. So, I don’t know if my Motorola Razr or whatever I had was useful in googling it. But I tried like three or four times before eventually giving up.

Edward: Your instincts are well formed. Pismo did make its reputation as a beach resort from the 1880s as a place to go clamming. And you know, the beach was covered with clammers. And they fished it out just like the abalone. So, there probably hasn’t been a clam found in Pismo for decades.

Meb: Wow. Okay, I don’t feel so dumb now. I’ve always wanted to go abalone diving. I have a couple of buddies that do that up north of San Francisco. And I think of all the sports or activities that are sport like, it has like one of the highest casualty rates of anything, of any activity. It’s like abalone diving, I think is top three, up there with skydiving and who knows what else?

Edward: Not my cup of tea. I’m a safety seeker.

Meb: Yeah, I know. Oh, I’ve never done it. It’s just on the to-do list. Okay, so we’re going to get into all sorts of fun things today. I thought we’d start off. I’ve been doing this asset management/investing job for about two decades. And if you were to ask me, if you were to grab me in a bar, a coffee shop, right on the water up there and Cambria, great wine by the way down the road, and you were to say, “Meb, what is the single most universally held investment belief in all the land? So, of all the dozens or hundreds of maxims out there, what is the single number one?”

And I would tell you, I would say it’s that stocks outperform bonds, just kind of universally. Like that’s probably the number one most held truth I can even think of. And you published a lot of research, a lot of interesting papers that I love and one of the reasons we got you on today. Why don’t you walk us back to when you put out your probably most famous paper, at least to me, about market history and what was the inspiration and let’s walk through it and let’s get deep.

Edward: So, you know, your listeners will be familiar with Jeremy Siegel, Wharton professor, author of the book, “Stocks for the Long Run.” And basically, Siegel ratifies, if he isn’t actually the source, of that maxim that you just uttered.

In fact, Siegel made two arguments in that book. Number one, in the long run, stocks must beat bonds and stocks have beaten bonds. And number two, if you hold on to stocks long enough, you will double your money in real terms every 10 or 11 years.

So, stocks are great for the long run and stocks are better than bond for the long run. That’s Siegel’s sort of double maxim if you will.

I’m not exactly sure why, but at some point, I started thinking, “Is that really true?” And as I mentioned to you, I retired a couple years ago. One thing you have to do if you ever retired, Meb, is you need a big project. First of all, you got time for a big project. And second, you got to fill that time.

So, I made it my business to go back and reinvestigate what Siegel did. Everyone knows the maxim, stocks beat bonds. But of course, not everybody has read Siegel’s book. And in particular, not everybody understands Siegel’s sources and the problems there. In fact, I would say that most of your listeners, when they think of stock market history, all they’ve ever seen in “The Wall Street Journal” will be since 1926…

Since 1926, these assets have behaved this way. And you just pick up your annual copy of Ibbotson Stocks, Bonds, Bills, and Inflation Yearbook. And there you have it, since 1926. The naïve listener, that’s only a small fraction of your listeners, but the naïve listener could be forgiven for thinking, “I guess the stock market only got itself together in the United States maybe in the early 1920s. That must be why I always see since 1926.”

But then you still read “The Wall Street Journal” and you find yourself remembering, “No, no, it must have started in 1896 because that’s when the Dow Jones Industrial Average started.” But then, a few listeners will have read Robert Shiller’s book on market history. And they’ll say, “No, no, the stock market must have started in the United States about 1871.”

But that too is false. Stock market in the United States goes back to the early 1790s. The bond market in the United States goes back to the early 1790s. It starts with Alexander Hamilton’s refunding of the debt in 1797.

So, when Siegel started his work in the early ’90s, it was in some ways a breakthrough. He was the first one to try to string together stock and bond returns, in his case, from 1802 forward. And his results, I think, found a place in the investor mindset, if only because finance theory tells us that stocks must outperform bonds because stocks are risky, and investors will demand optimization for bearing that extra risk.

And then Siegel came along and said, “Well, that’s the theory. I’ve got the data. I can show you that since the dawn of time, if you will, stocks have beaten bonds.” And so, the combination of the theory which everybody learns in school, and this seemingly breakthrough historical data just became an iron lock on the investor imagination.

That’s why, you know, if you were sitting in that bar, and someone said, “What is the one thing you know, Meb, about investing?” You would say, “Well, I know that stocks will beat bonds.” It turns out, it’s not true.

It’s more correct to say sometimes stocks beat bonds, sometimes bonds beat stocks, and sometimes they perform about the same.

Meb: I imagine people listening, their first reaction to anything is like, “Wow, my gosh, how do you even find the data from 18th century? And how relevant is that to today?” I imagine those are two of the kind of main… You go dig these out of old copies of “The Wall Street Journal.” Like, how accurate and how much of a project is this? Talk to us a little bit about the structure of what was behind all of these studies.

Edward: There are really two questions you just asked. And the second one, which is why should I care what stocks and bonds did in 1843. That’s what we’ll have to come back to, and I invite you to hammer on that, because it is going to be a concern for your listeners.

But the first part is something where I have some expertise in so let me kind of start peeling the onion. You need to understand that Jeremy Siegel has blue chip resume. He has a PhD in financial economics from MIT, taught at Chicago for a while, and went on to become a chair professor at Wharton. And gets one thing that gives half to his thesis. Let me read you a couple sentence here.

“It’s mostly the 19th century where Siegel went astray. And it wasn’t because of any error of his own. But because of limited sources available to him three decades back, who’d be faulty. The sources for his thesis for 1871 republished over 18 years ago. They were the best available at that time. But they are no longer the best available.”

And basically, a combination of digitization of everything and some fresh data gathering by Richard Sylla at New York University gave me my opening to take apart Siegel’s series and reconstruct a better version.

Meb: Did you just go break into the library in DC and comb through the archives? Was this something on like microfiche? How does one go about unearthing the differences in the data 100 years ago?

Edward: First, you become acquainted with Richard Sylla, as I mentioned, and his vast project. Because, basically, what they did starting in the late 1990s, they had a grant from the National Science Foundation. And this is before the age of digitization. They sent the poor research assistants into the dusty archives. Because, you know, newspaper publishing is even older than the 1790s in the United States.

And it turns out that from the beginning, one of the things that newspapers did, was they posted the prices for stocks that traded yesterday. So, once they sent the folks back into the archives, and I think at that point, I don’t know if they hand enter the original tallies or into a laptop.

But basically, you know, “Here’s the bank in New York. It’s the February 1794 edition of blah, blah, blah, New York newspaper, high 95.5, low, 94.75.” So, they put that into a spreadsheet. And your listeners, if they want, these spreadsheets are freely available. They’re at EH.net, Richard Sylla historical stock prices. A couple of other sources I’ll mention in passing.

But basically, by the time I came along, in the mid-2010s, I can go EH.net, and I could download this spreadsheet or set of spreadsheets. Because it turned out, a lot of your listeners will have heard of the Buttonwood Agreement, the dawn of the New York Stock Exchange in spring 1792. The stocks traded in Boston, stocks trade in Philadelphia. Another 10 years, stocks traded in Baltimore. Another 10 years, stocks traded in Richmond, stocks traded in New Orleans. And Sylla’s team has spreadsheet for each one, down to about 1860.

That part was easy. I’ll get to a harder and more tedious part in minute. But that part was easy. Download the spreadsheets. Oops, weekly data, lots of missing data. Well, that part was still simple, create a monthly average, take the midpoint to the high and the low. After a year or two of this, I said, “You know, 200 years, I think I can make do with annual data. I don’t think I need monthly data.”

So, now, all I need is the average price for January 1794 for the six banks that were trading then, the January price of those for 1795, adding in a couple of insurance companies. And a voila, I have a stock index. I managed to push it back to 1793 for stocks. And by the 1830s, Sylla’s 200 different stocks trading in the United States of America. By the 1820s, there’s dozens. So, it’s a bona fide index.

Now, great, you might ask, “Why didn’t Siegel do that? And how is this any better than whatever Sigel had to work?” Well, first, you know, the Sylla data wasn’t around when he got started. And second, the only thing that was around, published in 1935, Harvard guys named Smith and Cole, and they did “Fluctuations in American Business.” And they created a 7-stock index from 1802. And that was Siegel’s original data from 1802 to 1871, 7 stocks, 7 banks.

But what I don’t think Siegel ever understood was how different Smith and Cole’s purpose was. They weren’t trying to build an index of total return. First of all, they left out the dividends. Not everyone understands that in Siegel’s stock series, put a finger up to the wind and said, “Ah, I’m thinking a dividend yield of 6. 4%. Yeah, that’s what I’ll put in here.” No data, just a guess. So, he’s got seven stocks and imputed dividend returns.

But the real problem is, you know, how Smith and Cole selected those 7 stocks from the roughly 30 or 40 that were trading? They took each stock’s price chart, monthly price series, used your crayon to draw it on a transparency, stack the transparencies on a light table. And they threw away the discrepant price series. Like, the ones that went down when everything else was going up. They recycled figures. They wanted indicators. Can the stock market predict the economy? Can the economy predict the stock market?

Unlike modern STEM statisticians, they were looking at prototypical stocks. So, they threw away all the ones that looked different, including the one that plunged from $120 a share to $1.50 a share, the Second Bank of the United States of America, equal as a share of market capitalization to the Fang stocks, plus Tesla, plus a couple of others.

So, the biggest single stock that traded between 1819 and 1843, the biggest single stock, the one that went from 120 to 1.50 in 1840s, it was left out of Siegel’s standard. His sources left out the bad stuff.

Meb: Two quick comments for listeners who want a good introductory book on the early stages of that time as far as the economy you’re talking about. There was a great book called “Hamilton’s Blessing,” that talks about the life and times of our national debt. It’s a really fun book on the topic. And I was going to say another one and I’m blanking on the name of it. William Bernstein’s got a couple really interesting books about economic history, and I’ll throw into that same genre, if I can find it.

Edward: “The Birth of Plenty” is one. I’m looking at the shelf here. He’s got another one too, that’s a history, and he goes back certainly before U.S. markets. No, Alexander Hamilton, he’s the father. We have securities markets, the United States, because of him.

Meb: The only time I’ve ever been useful in trivia in Los Angeles, they have some of these trivia nights, you can go to this Irish pub, Irish Times, where it’s like all the Jeopardy winners. And I have some friends that are experts on sports. And then, obviously, in Los Angeles pop culture and entertainment. And my only real contribution, on rare occasions, is just very esoteric knowledge.

But I remember the question once was, “Where was the world’s first Stock Exchange?” So finally, I got to contribute. You could have even argued some points on this one too, by the way, depending on a rabbit hole that you wanted to get. But I finally got to contribute.

As a quant, we all know that quality data is everything. And like you mentioned, selection bias of taking out the bad performers.

You know, I used to always laugh when I would talk to people that would start their option trading Saturdays in 1988. I said, “Well, you’re kind of missing a big event about a year earlier.” Or they exclude certain countries from history because they say, “Well, no, you know, Japan was obviously a crazy bubble in the ’80s, we can’t include that.”

So, using the data that existed is tough. And so, what eventually drew you to the inspiration of starting to dig deep into this sort of idea and look back into this sort of pre-Roaring ’20s dataset?

Edward: I don’t know why, but I had a hunch that Siegel was wrong. And as I got into it, again, I needed this post-retirement project, it became apparent how slim and scanty the sources were that he’d strung together. We haven’t even got to the problems with his bond market data. We’ll come to that a little bit later.

But basically, it was easy enough to look at Richard Sylla’s spreadsheets and say, “Wow, Smith and Cole and Siegel, they left out dozens and dozens.” And then as I got into it, you know, learn more about the history in … like the Second bank of the United States. We have a functioning Central Bank in the United States and President Andrew Jackson decides it’s his enemy. And Jackson had all the populist chops of our most recent president.

So, basically, he said, “Yeah, I know it’s a Central Bank. Yeah, maybe we need a Central Bank to have a functioning national economy, but it’s my enemy.” So, he basically destroyed it. And when he destroyed it, he destroyed about 45% of stock market capitalization in the United States, the Panic of 1837. That’s the one for listeners to remember. The Panic of 1837 was one of the worst market pratfalls prior to 1929.

And so, basically, step one, was to get the stock price. It actually started with old railroad stocks, not sure how many people know that Standard & Poor’s came about as the merger of the Standard Statistics company and the Henry Varnum Poor publishing company. Henry Varnum Poor being one of the first market statisticians working in the 1860s for railroads. Poor get all the dividends. You know, so I have real dividend data, you know, just printed in a table.

And so, from about 1830, when railroads take over the stock market, I had the dividends that Siegel just guesstimate. But the problem was before the 1830s and before the railroads because banks and insurance companies dominated the market in 1790 to about 1840. Where were their dividends?

This is actually probably my most significant data contribution. I found where the dividends were. They’ve been there all along. But until archives got digitized, odds that you would find them were very low.

Here’s how it works. Not sure if anybody’s ever looked at a newspaper from 1810, or 1795, or 1830. But we’re talking six point-type at best, six, seven, eight columns, and all advertising is what we would call these people my age would call classified advertising. Six lines of six-point type house for sale or this, that, and the other.

And the other thing you would find way back on page 7, column 5, 12 inches down, “The Bank of Pennsylvania announces its May dividend of 3% of capital stock payable to shareholders on X.” You never find them if you were limited to print. Siegel didn’t even try to collect dividend data.

But with the digitized newspaper archives, there’s several out there now, I just start entering the word dividend in the search box. It turned out that when they distributed a bankrupt’s estate, when the estate was settled in bankruptcy, they called those payments dividends too. So, that’s where it got tedious because they had to get rid of them and find the Bank of Pennsylvania, the Bank of Boston, the Bank of New York, Chase Manhattan’s predecessor, etc.

But bit by bit, still scratching my head why I underwent the tedium, I don’t have a good answer for you, but I was on the hunt. It was like collecting Easter eggs, bit by bit, where the couple dozen largest banks, I got the dividend work. And I was able to complete it. A new source that Siegel started using in recent editions, it comes out of William Goetzmann at Yale. Goetzmann and Ibbotson have a 19th century data set. It’s more flawed and limited. They, I think, first understood, but they have a pretty good selection of dividends for the 1800s up until 1870.

And so, between my own data grabbing, downloading their spreadsheets, and selecting dividends, I finally a had total return index, observed dividends, weighted by share account from 1793 through 1871. And that’s the foundation of my challenge to Siegel’s stock market thesis.

Meb: And so, tell us the results. I mean, first of all, I mean, I was hoping you could say you just sent a bunch of poor grad students on the task, a kind of lower cost wage. But it sounds like you did a lot of this work. So, God bless you. But what were some of the takeaways once you started compiling it? What did you start to draw out as far as insights?

Edward: We’ll eventually, I have to segue back to the bond history, too. But long story short, stocks didn’t do as well before the Civil War as Siegel would lead you to expect. And bonds did rather better after the Civil War than Siegel would lead you to expect. In the net of all that, is that as of 1942, if you invested in stocks or you invested in bonds, you had the exact same portfolio return. The first 150 years, stocks and bonds were at parity.

Meb: And that’s a pretty significant conclusion. If you had to attribute it to just any sort of main data points, is it estimated dividend yield they used or what were sort of the main muscle movements on why the conclusion is somewhat different than what others have found?

Edward: Somewhat to my surprise, Siegel’s finger-to-the-wind dividend estimate wasn’t that far off. Now, for supplying a constant yield to what was in fact fluctuating yields is dicey in the abstract. But in the end, that was not the problem in Siegel’s thesis. The problem with Siegel’s thesis was that prior to 1871, his sources left out the bad parts, the stocks that went down in price, canals that never made a penny, the railroads that never paid a dividend and went bust, the Second Bank of the United States, and the other banks that went bust in the Panic of 1819, the Panic of 1837.

So, most of the change or most of the challenge to Siegel’s stock market quotient is prior to the Civil War. That period in U.S. stock market history is different than what came after. People did not make as much money as stock investors are accustomed to make today. Returns were lower.

Now, the parity performance through 1942 is an amalgam of the newly discovered poor stock performance prior to the Civil War and the newly discovered shining bond performance after. So, it is putting those two together that creates the shocking-to-some finding of parity performance through 1942. At some point, we’ll have to talk about what changed and how different the post-1942 period was. But I don’t think we’re there yet. Meb, help me out here.

Meb: Yeah, we’re still laying the foundation. I mean, this is fascinating to me. You mentioned the bond data. Was that sort of a similar inquiry? Or was that something totally different?

Edward: Again, the source for bond prices is the Sylla spreadsheets. He got bond prices as well as stocks, and pretty much has the coupon on most of those two. But let me step back a little bit.

And I think what most investors are trying to process Siegel’s thesis about stocks and bonds is, you know, it’s easy enough to say, “Oh, yeah, we had stock market trading since 1790s. Hey, we had Alexander Hamilton that means we had treasury bonds trading since the 1790s.” Okay, a couple of consistent series down through 200 years, end of story.

But that drastically underplays the changes in the bond market, all the way through 1918. It may come as a shock, not to you but to some, the treasury market was reinvented and established anew in 1918 with the Liberty Bonds.

From 1860s to 1918, no finance theorist tries to use federal bond prices as a meaningful indicator of the return for owning a default-free, fixed-income instrument. The reason for that is, after 1865, national banks were chartered. And the only way you could function as national bank was if you bought a bunch of treasury bonds, held them in a vault, and then the government lets you issue your own bank notes based on those treasure bonds.

So, trading dried up, interest rates plunged to whatever a bank was willing to pay. So, they could go make profits in the normal way by, you know, issuing bank notes and making loans. So, the treasury prices are unusable from a sort of long-term investment returns history from the 1860s to 1918, problem number one.

Problem number two. Andrew Jackson paid off the debt in 1835. There were no treasury bonds, unsuitable or suitable. There were no treasury bonds at all for seven years. So how do you find the risk-free instrument for calculating the equity premium if there aren’t any treasury bonds? Or if the treasury bonds are unusable?

Siegel found an answer, by the way. I’m giving the listeners a minute to guess. So, if there’s no treasury bonds, and theoretically committed to calculate an equity premium, what do you use?

So, basically what Siegel said was, “Hey, if the treasury bonds aren’t there or if the treasury defaulted in 1814, which is really hard calling it a risk-free instrument, I know, I will use Boston and Massachusetts municipal bonds, rock solid, rock ribs, you know, granite, northeast New England. What could be more solid than that?

Using Sidney Homer’s History of Interest Rates, he went and got the yields on Boston and Massachusetts bonds, available pretty much from 1800 on. When there were no treasury bonds or treasury bonds were unsuitable, he backed out the price appreciation from the changes in yields. And then after the Civil War, he had a New England municipal bond index created by one Frederick Macaulay to use for the government the government bond.

And so, that’s very important for listeners to understand. Siegel’s thesis about stocks and bonds is the theoretically driven equity premium thesis, which entails not an aggregate bond index, no corporate bonds, just the closest thing to risk free that you can find.

Next problem. I went back, of course, in my way and said, “New England municipal bond index.” And I grew up outside of Boston. So, was it just Boston? Did they use Lowell near where I grew up? It turned out that most of the towns in that bond index had debt sizes of $150,000. That was the total issue. In an era where an ordinary railroad would have $15 million. It didn’t trade very often, prices weren’t liquid, towns were small. But it gets worse.

It turned out the index that Sidney Homer used to get, well, what’s a risk-free interest yield in 1875? It wasn’t an end. It was a theoretical construct. Macaulay, who invented the idea of duration, by the way, he was the first one that introduced that, Macaulay said, “I’m not holding a portfolio of municipal bonds from the fragmentary faulty data that I have. I’m trying to intuit what the best possible bond available in 1876 would have paid in terms of a yield? So, I’m not taking the average of these municipal… Yeah, I’m thinking 2.86. That’s probably about the bottom.”

And it still gets worse because the same thing happened in New England has happened at the federal level. If you wanted to be a savings bank, you had to take your deposits and put them in the safest thing you could buy. And no bank in Massachusetts got in trouble if it bought Massachusetts bonds, put them in the vault and then, you know, paid out interest to their depositors.

So, the yields were again depressed below what a profit-seeking bond investor would have sought. That investor would have owned railroad bonds. Now, it does get even a little bit worse. Some of your listeners will remember The Greenback Era, 1862 to 1870.

Up until 1862, the dollar was as good as gold because the dollar was gold. It had yay many grains of gold and that was one U.S. dollar. Now, it’s the Civil War. Wars are expensive. I don’t think we’re going to be able to maintain that “tied to gold” anymore. And they broke it. And of course, the Civil War inflation was one result.

But here’s the other wrinkle. You could buy a bond, a federal bond or whatever, with a greenback, but the federal bond paid interest in gold coin. At the worst, one gold coin bought 2.3 greenbacks.

So, clearly, the interest paid on federal bond is not the nominal 6%, it’s 6% times 2.3. Because you could take the gold coin, those 6% of gold coins, turn around, and buy $15 worth of new federal government bonds, and pyramid from there.

So, basically, Siegel used a flawed municipal bond index for bonds that didn’t reflect market interest rates or market yields, didn’t allow for the gold premium Civil War era, didn’t use corporate bonds, which dominated fixed income market at that point. And when you correct all of that, bonds look a lot better in the 19th century than in Siegel’s.

Sponsor Message: Now, a quick word from our sponsor. The Bitwise 10 Crypto Index Fund is the world’s first and largest crypto index fund. With nearly a billion dollars in assets, the Bitwise 10 Crypto Index Fund offers diversified exposure to the 10 largest crypto assets, including Bitcoin, Theorem, and rapidly emerging DeFi assets.

The Bitwise 10 Crypto Index Fund was created by experts to help financial advisors and other professional investors allocate the crypto. The fund rebalances monthly, so it remains up to date with the fast moving crypto market. Shares of the Bitwise 10 Crypto Index Fund are now trading under the ticker symbol BITW. Shares may trade at large and variable premiums and/or discounts at net asset value. For more information, check out www.bitwiseinvestments.com and ticker symbol BITW. And now, back to the show.

Meb: Kind of putting this together and you think about it, I have my own interpretations. But I’d like to hear yours, certainly of someone who had their hands super in the weeds on all this data. You know, as you look back and kind of extrapolate from these different periods, what are your kind of your main thoughts when it comes to stocks, bonds, bills, inflation with your data set? What’s the main kind of weight points?

Edward: I’m glad you mentioned that word inflation because that’s going to be another part of the story. And let me start with the conventional wisdom as always.

Everybody knows that when the United States broke the link to gold in 1934, it was like someone rang a bell and unleashed the inflationary hounds. Until that hero, Paul Volcker, finally slayed the beast. That’s right. See, fiat currency is a phrase that some of your listeners will be fond of, “Oh, it’s just paper money. How do you stop inflation?”

If you go back and look at the record year by year of the whole 200 years, that story is just, it’s practically a bedtime story. It’s just not very good sculpture. So, what you actually find is that through the end of World War II…

And Milton Friedman had a 1952 paper where he thought World War II inflation had peaked in 1948, he didn’t know what was going to happen. And he showed graphically that World War II inflation, and World War I inflation, and Civil War inflation, and I added War of 1812 inflation, during wartime, prices double. That’s just what they do. That was the historical record.

And then the missing piece, not emphasized by Friedman and known to very many folks is that prices doubled during wartime. And then, they fall all the way back over the next few decades until the next war. And then, they don’t.

Because, you know, Siegel again expressed the conventional wisdom when he said that, you know, basically all the inflation that there’s ever been in the United States postdates World War II. Prices were flat through 1942. That’s like saying prices were flat from July 1987 to July 1990.

Yeah, sort of, in the end. Because what had actually happened was inflation had gone up, gone down, gone up, gone down, and ended flat there at World War II, and didn’t really start what we think of is the fiat currency stage until after 1965. Great inflation postdates both break with gold link and the end of World War II by far too long. Something else is going on there.

I try not to give too many explanations at this stage of the work because it’s more important to simply say, “Did you know the 19th century was a period that saw bouts of inflation followed by bouts of deflation?” You had deflation of 50%, makes Japan look like a piker. And yet you still had economic growth. You still have stock market returns. But during those deflationary years, you had terrific bond market returns.

The takeaway might be, in the absence of deflation, can you make any real money in bonds. In the 19th century, when there was plenty of deflation, people made really good money in bonds, but as much as they made in stocks. Of course, deflation is not very good for pricing power and company profitability.

Now that deflation has been banished from the shores by government dictum, bonds may never return again what they did in the 19th century, except after they’ve plunged. You can show, graphically, invite the reader to try this, you can do it with Stocks, Bonds, Bills, and Inflation Yearbook data. In 1982 to 2013, great stock rally, you might remember most of it. Great bond rally too. They performed about the same over those four years.

So, the exceptional error, the thing that Siegel’s entire thesis really rests on was the 1946 to 1982 era. You graph that, stocks go up, up, up, up, up. Bonds go down, down, down, down, down. And average in those 40 years with the remaining 160 days in, stocks beat bonds. Everybody knows that.

Meb: I mean, we’ve kind of been talking about this for a long time, even with sort of the modern data set. And others, I feel like I’ve been sort of, in this similar camp that you discuss. But to me, I talked to a lot of advisers, and often you see this investing literature talking about, well, if you have a long enough horizon, stocks don’t lose money. If you just say 20 years, stocks aren’t going to ever lose money, to which I take a pause.

And also, if you frame it as stocks versus bonds, just how long these things can go when you start to talk about decades and decades? Maybe talk a little bit about even if you come to the conclusion that stocks beat bonds. How long do you have to wait for that to be true, necessarily? And how many times in history do you go periods of, God forbid, 2021? We’re talking about hours and days, not even quarters and years, but longer than that. How long can the follow-up periods be?

Edward: What did the Lord King say? Longer than you can stay alive or solvent. Let’s go back to Japan. Siegel’s used to having Japan thrown in space. Okay. You know, if you’re looking the said book, he’ll give you his response to the post-1989 bubble collapse in Japan, “It is just an exception. You know, I don’t have to pay any attention to it really.”

What he doesn’t tell is that from 1960 to 2020, 6 decades, bonds beat stocks in Japan. There are prejudiced people everywhere. Not everybody wants to accept Asian data as, you know, kind of, “We have a different kind of economic system here in the United States, young man,” blah, blah, blah.

In France, from 1960 to 2020, bonds beat stocks. So, if you broaden the lens away from the United States, there does not appear to be any necessary limit on how long things can go before stocks come back into the weight. You know, if I’m lucky, I might have a 60-year investment horizon, although I think I’ll be in the old folk’s home by the end of that period. But 60 years, and you would have been better off in bonds rather than stocks, if you were a French investor.

Meb: You got a good chart. We always like to talk about international investing because U.S. look, it’s only one country. And if you or I were sipping champagne in Argentina, 120 years ago, or many of the other countries in the world that were considered some of the top 10 economies or countries you’d place bets on, you end up with a very different conclusion 120 years hence. You know, Austria being a country that had poor returns versus maybe a South Africa, which had great returns. You know, U.S. is somewhere in the upper side of it.

But, yeah, like you mentioned, I mean, there’s countries you have a great table in your paper looking at the worst case scenarios outside the U.S. for 20, 30, 50 years. And, you know, many cases, you have countries that are negative in all three buckets, but particularly with the 20 years.

And so, last year, we were talking about this on Twitter, and I said, I just want people to remember this, but U.S. stocks and the long bond had the same returns last year for like 40 years. You know, I mean, it was pretty darn close. And I said, just remember, you know, as you think about investing returns and all these survey after survey after survey, that investors, do they talk about an asset class or an active manager? God forbid they hire an active manager that they’re going to judge based on one to two years.

And I say so much bad behavior, I say, even if you get a Buffet, even if you get a amazing manager, they’ll go through periods of three, four, five, six years of terrible performance or an asset class. Right now that may be, well before this year, commodities or foreign stocks or who knows what value, style, but these things have a way of oscillating over time and those oscillations can last a pretty darn long time.

Edward: Any of your listeners who have cut their teeth on the Ibbotson Stocks, Bonds, Bills and Inflation Yearbook, you want to take a look at, if you will, the international competitor, Elroy Dimson, Paul Marsh, Mike Staunton. Credit Suisse puts out an annual yearbook now. And many folks will remember that author team from their 2000 book, “Triumph of the Optimist,” that book was published just as the dotcom boom crested. And so, things look pretty good internationally as well as the U.S. in 2000.

And very important, in the 2000 book, they didn’t have a World ex USA Index. They have USA. They have individual countries. And they have all the world together with the USA about 50% of the world. But the Credit Suisse yearbooks have the World ex USA. And things look a lot dicer now that we’ve had the 2000 bear market, 2008 bear market. Last year’s bear market doesn’t show up in the annual figures. So, we’ll leave that aside.

Anyone cut his teeth on the SBBI yearbooks wants to get a hold of the Credit Suisse international yearbooks and pour over it because it isn’t the same story. Partly because it goes back to 1900. And partly because it goes on to 2020.

In the 2020 year book, you will see that the real stock return, World ex USA, was 5.2%. And the World ex USA bond return was 5.1%, an equity premium 1/10 of a percentage point over a five-decade period. Definitely, if you go on investor forums, Bogleheads, etc., at Siegel’s books, you do get a takeaway that you just get a hold on long enough and you will do fine in stocks. And you will hear the assertion, there has never been a 20-year period in the United States where a total return in real terms was negative.

I was pretty sure I could blow that one of the water. But it turns out in the U.S., on an annual basis, key to January, that little maxim is correct. There’s never been a 20-year period with a negative real total return, or a 30, or a 50. It’s just as soon as you go international that that blows up and you find negative 20 year, negative 30 year, and negative 50 year, you know, kind of returns and negative equity premium for decades.

So, again, you know to reinforce your point, investors have to stop confining themselves to United States data. That’s just silly. Come on, it’s a global market. And you take a broader view of history. The way I put it was, if you broaden the lens to the 19th century in the U.S., or to the 20th century outside the U.S., Siegel’s thesis just does not stand up.

Meb: So, many instances, think about the international examples. We did article summary last year of about five or six great pieces. It’s called “The Case for Global Investing.” Listeners, we’ll post it in the show note links. Then we touch on about five or six great research pieces on international investing. And look, emerging markets, the data is even more challenging because a lot of those markets haven’t been around that long.

But coming up with so many outlier scenarios, I mean, where you had markets that, like you mentioned, going back to the U.S. in its early days, where you have these huge levers of government policy and fiscal and monetary sort of regimes, and then you have… Sorry, going back to the 20th century of capital markets shutting down in some countries like Russia and China. You find yourself here today in 2021 in a pretty weird world.

It’s always a weird world, but over the last year or two, with so many markets around the world, particularly the sovereigns, having not just low yielding but zero and negative yielding bonds. How would you sort of mentally put that sort of world into this concept of stocks and bonds bouncing around, where the starting point for bonds in so many places is negative?

I would not want to be read as saying that bonds will beat stocks in the next 20 years. Bonds will give a satisfactory re-return in the next 20 years. I honestly don’t know. And I’m really going to stay in my wheelhouse here. I’m doing history. So, I’m trying to find the facts about what actually happened.

And the facts that I find don’t support theory in the following sense. I have a history of this in my own field. But the problem with theory, when applied to human enterprises like investment, theory by its nature is universalized. It’s meant to be general. There must be an equity premium because stocks are riskier. And investors demand compensation for that risk.

And we can show mathematically that a risk-neutral investor will demand a higher return on stocks and therefore that’s what you’re going to get. What the data shows that the history does not contemplate is that sometimes that’s true, but sometimes for longer than you can stay solvent, it’s not true. And sometimes, it’s true. Yearend, it’s not true there. It was true for 1946 to 1982.

If you diversified your portfolio bonds, you depressed your return year after year, decade after decade. And then, all of a sudden, you know from 1982 forward, if you diversified your portfolio with bonds, you have two assets returning about the same rebalancing effect, the balanced portfolio does a bit better than either stocks or bonds.

So, I call this regime change in the paper. Siegel’s work found a home because it seemed to give an empirical proof that theory in the homogeneity of theory was correct. New and better data, equally the international data says, “Nah, it’s all over the map. Things are always changing. You never seen negative yields on sovereign bonds before? Well, things are changing all the time, aren’t they?”

A little bit late, actually, one more point here. And then, at some point, we want to talk about dividends. There’s some interesting history there for stock investors. But before we leave the current topic, let’s go back to theory. Stocks give an extra return because they’re extra risky.

But, you know, it’s really interesting, I have the rolls data in paper, I look at rolling 10 year, 20 year, 30 year, 50 year, even 100-year returns. It turns out, the longer you hold stocks, the smaller the standard deviation of your returns. Okay. Everybody knows that. Stocks are risky on a one-year basis, less risky on a 10-year, less risky in a 20-year. That’s true. Data shows that in the United States.

Interestingly enough, bonds get riskier as you hold them for two decades, three decades, five decades. So, that after 20 years, the standard deviation on the bond returns is bigger than the standard deviation on the stock returns.

So, remind me, if stocks are less risky than bonds over the long run, why should stocks get higher return than bonds over the long run? What happened to risk in return? I thought that was an iron law of theory.

Meb: In my head, like when I try to think about these things, I mean, one of the biggest benefits of studying history is it gives you some expectations and appreciation also for the future being uncertain and anything can happen. The way that I think about it, both good and bad, of course, certainly thinking about trying to build a portfolio that is resilient to not just one market environment.

I mean, if you look at the last 10 years in the U.S., all the U.S. investors I know just extrapolate forever that the U.S, stock market will outperform everything, right? And I mean, it was only 10 years ago when the U.S. was one of the worst performers in the prior decade. And everyone wanted real estate and emerging markets and dividend yielders and who knows what.

But these things tend to have a way, like you mentioned, this appreciation for the long term. It’s hard though, I think, for investors to distance this daily noise and deluge of what used to be newspaper and TV, now Facebook, and Twitter, and TikTok, and everything else and still come up with a vehicle that keeps them in their own best interest.

Edward: But let me reinforce your point, Meb, which is that, yeah, I really do think that’s the best use of history, not just as input to a predictive model, generally, always ends up being extrapolation. You just gave a couple of good examples of how those extrapolations fail over and over again.

But if you look at history as a source of just how different can it make, just how much can things change, your earlier 120-year example of Argentina. To me, that’s the proper use of history to understand variation rather than the mean. The mean, once you get into these, you know, kind of 100- and 200-year things, mean is sort of it’s almost ridiculously big. It’s the fluctuations, the fact of fluctuation, the incessant fluctuation, the constant change, that’s the education history.

Meb: You mentioned a concept of dividends. You want to touch on what your idea was there?

Edward: I don’t think I’m going to keep it in the market history paper. Maybe, I’ll make it its own paper. But casting around for support for the idea of regime change. There are different regimes. In some regimes stock, the state bonds, in other regimes, they perform well.

Seeing inflation gave me my first good example. But I had a hunch that dividends might give me my second example. So, again, let’s start with conventional wisdom. I have a quote from John Bogle of Index Fund fame, remarking that since 1926, dividends have accounted for a huge proportion of totally mature. And I would think most investors who are at all historically literate will have digested that point, you know, the dividends report, a big chunk of return comes from dividends.

Now it turns out the particular metric that Bogle and later Siegel used is highly sensitive to how long the timeframe you’re looking at. I took Bogle’s numbers as in he had an over an 80-year frame since 1926. And if you look at it over a 40-year frame, it’s not the same proportion. If you look at a 20-year frame, it’s not the same proportion. If you look at it over 200-year frame, dividends are 99.9% of all total return, not because they are, but because of the funny math of compounding, particularly, we use exponents greater than 100.

So, basically, I had to go back and kind of relook at metrics and invent a couple. But let me tell you what I found. The pre-1926 relationship between dividends and total returns is very different from the post-1926 relationship. So, anything you would gather from the Stocks, Bonds, Bills and Inflation Yearbook, wouldn’t apply in earlier times. In fact, even since 1926, and I think folks like yourself, who are investing and managing investments for a living know this, the contribution of dividends to total return has gone down, and down, and down, and it’s near a post-1926 low point at present.

It used to be that dividends accounted for more than 100% of total return. What does that mean? There was a dividend return, and there was a below-zero price appreciation return. So, total return might have been five, dividend yield was 5.5%. Because price appreciation is consistently negative.

Basically, before the Civil War and even before 1900, everything was a kind of super real estate investment trust, reached today by law, payout 90% of your earnings as dividends. And that was the concept back among banks, insurance companies, railroads. If you made a profit, that belonged to the shareholders. The notion of reinvestment, maintaining reserves, etc., hadn’t entered the CFOs mindset. So, companies paid out everything in dividends. And sooner or later, they’d get in trouble. Stock price would go in half, dividends suspended for a couple of years, eventually, if all went well, reinstated.

And so, what you had really from 1793 to about 1960s, 1980s, the overall price appreciation on holding a portfolio of U.S. stocks was precisely zero. Made nothing on price. And that would astound today’s investors, this notion that you need the dividend to actually make a total return. That used to be true. Now, it doesn’t seem to be so true.

Meb: I seem to be a voice in the woods about this. Although a lot of kind of the bigger quant asset managers are talking about this topic of valuation certainly and people can either be price agnostic or incorporate it. It doesn’t really necessarily matter to how they implement what they’re doing. But at least having it in the back of your mind, to me, it increases the chances of a big fat 5, 10-year period of lower returns.

But we’re not there yet. Valuations keep climbing, market keeps going up. So, we’ll see what other areas of the investment landscape have you curious, confused, interested? Any other ideas, papers you’ve worked on that you think are particularly interesting that we should chat about?

Edward: We’ll dial it back about a year or so. I found these fascinating results for stocks before 1871 and bonds before 1897. And I’m rubbing my hands and thinking, “All right, well, let’s continue.” I satisfy myself that the stock data after 1897, I might be able to hammer that someday but there was no point in collecting any new data. But the bond data. Again, everybody’s stuck on Sidney Homer’s “History of Interest Rates.” And it’s all basic yields and risk-free yields.

And I thought, whenever bonds dominated the bond market all the way through, you know World War II, I wonder what a fresh data collection on bonds after 1897 will do. Let’s pick it up to 1926. We’ll let the Stocks, Bonds, Bills, and Inflation Yearbook take it from then. And sure, enough fresh data collection showed that fixed-income returns from the first two decades of the 1920s, about 70-basis points per year better than you could get out of the Sidney Homer or Braddock Hickman bond market history.

“Great,” I’m thinking. I’m edging those stock and bond lines closer and closer. You know and then I started looking into the corporate bond index that you see in the Stocks, Bonds, Bills, and Inflation Yearbook. It turned out to be built on just as much sand as Siegel’s 19th century stock index.

And you’ve begun to see some articles in the scholarly literature, you know, scratching their head about the SBBI corporate bond index. And so, I said, “All right, I got my sources.” And again, for the true history buffs among your listeners, Federal Reserve has put online every issue of the quotation in bank record from the 1865 through 1963. You have to go deep in the weeds.

But if you’ve ever heard of Center for Research into Security Prices, CRSP as it’s called, Fisher and Lorie 1964, they put the database together that eventually became the SBBI. And they use the quotation in bank record. So, all that data is online. It’s weekly price quotes, bonds, stocks, American Stock Exchange, New York Stock Exchange. It’s all there.

And just as a shout out to Bryan Taylor of Global Financial Data has huge archives of both U.S. and international data. I wouldn’t go about trying to reinvent the wheel until I familiarize myself with his work again. Again, listen, who want to go down the rabbit hole that I went down here? Anyway, so, all those bond prices were there. You got the Moody’s Manuals, rubbing my hands thinking, “Okay. I’ll go from 1926 to 1946. Because I don’t trust that SBBI Corporate Bond Index. I’ll go recollect the data and see and see what I found.”

I did find something interesting there. The SBBI Corporate Bond Index, same problem as I’ve said before. They left out the bad parts.

Meb: How come they never get revised up? I feel like all the data sources are like, “Here’s our back test. Here’s our data series. Oh, just kidding. We were too conservative. It’s actually double the returns, we thought.” It’s always the other way around, it seems like.

Edward: If you have any sort of journalistic inclination, if you’re an advisor trying to build a practice, what’s the point of telling investors that they’re doomed to disappointment? You tend to accentuate the positive.

Look at this. You know, the New York Stock Exchange, we’re going to leave out the American Stock Exchange, and leave out the over-the-counter stock. Look what it did between 1926 and 1963? Be amazed. Okay, look what we got, if we only invested in the 90 stocks in the S&P 500 predecessor instead of the 1200 New York Stock Exchange, some of which were definitely dogs. Yeah, because the S&P Index committee, it’s never been total market index, it’s always been a selection. Its tendency is to select profit-making companies, “Can’t let Tesla into our index right away, you know, got to see if they’re good enough yet.”

And that’s why the historical data always gets revised down. There’s an availability bias and a survivorship bias. The good ones last and show up in the indexes. The losers, as I call them, do not.

Coming back to bonds after 1926, it turned out, guess what? The 1930s were a really bad time to own corporate bonds. The railroads got decimated. Some listeners will recall that the Dow Jones Transportation Index did worse than the Great Depression, than the Dow Jones Industrial because the railroads stuff.

Airlines last year, talking about fixed income, fixed-cost base and revenue goes away, corporate bond returns were lower. They’re also lower than the SBBI in the 1960s. And again, the same problem, they used the hand-me-down the index that left out the bad stuff.

Final point on the new bond data. In the course of doing this, I kind of recollected long government bond data after 1926. It’s pretty good. It wasn’t too much change from what Ibbotson found. But very interesting, 10-year period, well, you’re in a premium for holding corporate bonds rather than government bonds? Answer, sometimes, sometimes not, and it fluctuates. I have a chart with 10-year periods. Sometimes the government line is on top, sometimes the corporate bond line is on the top. And in fact, for the 100 years in January 1909 to January 2009, corporate bond investor made exactly the same as the government bond investor.

So, another example of regime changes. There was always a yield between them. Corporate bonds always yielded. But there was not always in earned yield.

Meb: So many things as you take a step back and started to think about, I mean corporate bonds, particularly the higher yielding, it’s some of the yields in history now. If they’ll continue to crank, who knows? I don’t know. But it started to get into weird territory.

I want to hear now, we can bridge from markets to half markets. Do you ever publish on the Carb-Sharp Ratio? Or is that just a blog post? You’re still following that world?

Edward: It’s a blog post. I get into the nutrition literature, just as… The reason I started that blog, which I haven’t kept up as much in the last year, was I was newly retired from academia. And not sure if you have any close friends that live the academic life, but when they say publish or perish, they mean publish or perish.

And it’s all about peer review, which normally, if you’re not an academic, you think, “Oh, well, that’s got to be good, peer review.” The peer review in most social science disciplines today, in my humble opinion, it’s a gauntlet. Everybody knows that word.

But I was doing some reading on what the real gauntlets were like among Native Americans, even before the Europeans came. In a real gauntlet, you weren’t supposed to survive. Clint Eastwood always survives. But, you know, in a real gauntlet, in real history, it was no exit, it was a chance for the captured warrior to show how brave he was, how many blows he could take before falling.

So, unfortunately, peer reviews become a little bit the same. “Yeah, maybe you’ll survive, but it’s not set up.” So, the beauty of the blog was to be able to publish anything I want, whenever I want, without having to ask anybody say so.

There’s a variety of topics in there, then, you know, once I get into this historical research, I realized that I’ve never had a Twitter account because nothing I’ve ever wanted to say fit within 140 characters. And I realized that most of what I want to say wouldn’t fit into a blog post either. I’m a 30-to-100 page kind of guy. That’s what I do.

But anyway, the nutrition stuff, I’ll answer your question if you like on it. But let’s just an example, the freedom of blogging.

Meb: I use this analogy. We published a paper maybe a year or two ago. And the concept was trying to make some analogies to the old food pyramid. And I said, you know, for the listeners, who are on the younger side, as I was growing up, the USDA had or FDA, I don’t even remember who’s the government organization that put this out, but there’s an educational resource about what foods you should eat.

And like the base of the pyramid was like pasta, grains, all of these heavy carbohydrates that probably most of the literature today would have a heart attack about, literally. And so, we were trying to make this narrative about, “Look, what’s the most important foundation you should do with investing, but go back 50 years in that entire process look different.” And not to be too judgmental about it too because most of us simply are extrapolating from our history and what we grew up, and what we knew.

And so, I grew up eating Fruit Loops. Sorry, mom, just throwing you under the bus here. But I love Fruit Loops, Apple Jacks, corn pops, I mean, on and on and on, right. And even the thought of feeding that to my son now is like, “Oh, my God.”

But at the same time, you can see how some of these ideas, you’ve mentioned Japan, an entire generation of investors have not had the same experience that investors in the U.S. had. And then the U.S. investors in the U.S., depending on the decade, have had totally different experiences too whether buy and hold is brilliant or really foolish, whether inflation is 15% or near zero. And I think your research, I think goes to really talk a lot about that.

Edward: Certainly, what we’ve seen, and the food example is a nice analogy here. And we started the beginnings of a pandemic here. All of us college educated audiences have developed a respect for expertise in, you know, respect of science. And we tend to forget, you know, that science is infinitely revisable knowledge. And it’s not truth. This is our best guesstimate of what’s going on.

And it’s particularly true with younger errands in scholarship, like nutrition, like investing. Again, part of what I hope to contribute is, I sort of take Siegel’s work apart and put it back together. The story he told was a much more reassuring story. It really was just hold on and you’ll be fine.

That wasn’t true for the Japanese investor that started in 1990. That market is still behind in real total with dividend returns. Things change….if I didn’t massacre the pronunciation there.

Meb: There’s a great book I read recently (Everybody Lies: Big Data, New Data, and What the Internet Can Tell Us About Who We Really Are by Seth Stephens-Davidowitz). It was from … a guy who had access to Facebook data that run some stat experiments. And the concept was, you know, and this is obvious when you think about it, but when you were born and where had a huge determinant on what sports you’d liked and what teams you liked.

Not surprisingly, and it’s usually around when you’re like 10-year-old, it’s talking about boys, I think, specifically. And I certainly remember running up and down the hallways when the Mets won the World Series. And I was in Colorado, for God’s sake. I wasn’t even in New York.

And so, thinking about the formative experiences as investors go through the experiences they’re going through now, with cryptocurrencies, with a lot of these meme stocks, and how that plays out. For me, very formative market that left a lot of scars, was certainly the internet bubble. And now, I love those scars. They’re my favorite. I’m proud of them. But it just is a good example that the different paths we all take have a huge impact on how you view the world, not just with investments, but sports and everything else, too.

Edward: I get my start in investing in just about 1982 to 1983. And too much market timing to have maximize returns of, you know, as I started getting interested in market data, market history. I was reading the yearbooks, the SBBI yearbooks in the ’90s. Or you might remember a magazine called “Smart Money,” they were very much into, you know, historically-guided expectations.

And of course, many of today’s opinion makers in investment scholarship or investment kind of messaging, they cut their teeth on the 1982 to 2000 period. And you know, it’s like, yeah, stocks go up, stocks go up, and buy and hold, and don’t dare sit out.

And then 2000, then after 2000, I think a lot of investors figured, “Huh, well, that was bad. That was just as bad as 1972, my uncle told me. Yeah, when 1972 came, let’s see, 40 years after 1929 and 2000, came 28 years after ’72. So, I guess we’re safe for a couple of decades.” And then, of course, 2008, 2009 happened. Things change.

Meb: As you look back on your personal experience, which you just referenced starting in the ’80s and others, are there any particularly memorable investments that stand out – good, bad, in between – over your career?

Edward: I think the smartest thing I ever did, this is a middle-class truth, if your investors or your listeners are wealthy, this doesn’t really apply. But the smartest thing I ever did was maxing out my 401k contribution every year, most of it in a mix of stocks, etc.

And, you know, it turns out that if you are married and your spouse is employed just as you are, and you make the maximum contribution every year for 30 years because, you know, professors have tenure, software engineers have been a good position to be in, you make the maximum contribution for three decades, you’re going to have to start worrying about your tax rate in retirement. That was the best decision I made. The current paper is on, what you didn’t know about Roth conversions for another time.

Meb: We spend so much time in investing, talking about the really sexy stuff. But that’s what everyone wants to talk about. But I say, look, some of the most important drivers are what you just alluded to, how much you decide to save in the first place, and when you start investing, and the consistency. Like that trumps everything else in my mind.

And then, tax is such a massive one that people don’t like to talk to about because it’s boring. And sometimes, it’s not only boring, but it’s also complicated, and involves the government. So, it’s even worse and it’s just on and on.

But then it also gets complicated because you have history. And then, it’s a potentially unknown, uncertain future where tax rates may be higher or lower in the future when you retire. And your tax rate may be higher or lower. And so, it gets complicated quick for all sorts of those types of analysis.

Edward: Which of course exactly why I found it to be my next fascinating topic because, yeah, you got to dig into the details. Average tax rate versus marginal tax rate is just idea I’ll plant in everyone’s head. A CPA in Manhattan, since deceased, named Danny Madden, who knows maybe the listeners might know him, he liked a Barron’s piece I put out in 2006, 2007 about Roth accounts.

And he explained to me how the world really worked in Manhattan. I said, “Why is there so much pressure? So much such an urge to recommend Roth conversions? It makes no sense to me. I can’t make the taxes pencil out.”

He said, “You don’t understand. The advisor is seeking to build a business. He finds a wealthy client, who is not in a Roth account. And he pitches a Roth conversion because tax-free forever. What’s not to like? And wins the account.” Because obviously, the existing advisor had been too stupid to recommend the Roth conversion.

So, that opened my eyes to games advisors play, which is that, “Hey, I got this hot new idea of converting to a Roth account, did your current advisor not tell you about this? Then you might want to kind of switch some of your assets over here, I’ll help you handle the conversion.” He actually starts setting up the spreadsheet. And conclusion of the current paper is Roth conversions almost always payout, as long as you live past 90 and never touch them.

Meb: Well, what do you mean? You’re not planning on living to at least 120?

Edward: It’s a good planning horizon that Roth conversion will pay off more at 120 than 100.

Meb: Professor, this has been a lot of fun. We didn’t even get into about 10 more topics, ancient DNA evidence, all sorts of other fun topics. But where do our listeners go if they want to read some more your papers, your blog? What’s the best spot to keep up to date with what you’re up to?

Edward: Hopefully, you’ll put it on the webpage, Meb. I would simply start with the “New Lessons from Market History.” That’s the wrap on the four years of effort into 200 years of financial market data. There’s a link to the blog post somewhere in that paper, if you will put a link up too. And then, the other thing is if you go on ssrn.com. So, it’s Social Science Research Network.com, you can search on author, last name. All the stuff I put up there is free to download, and I would welcome more readers. That’s all I’m going to say.

Meb: Awesome, Edward. We will add those all to the show note link, listeners. Thanks so much for joining us today.

Edward: Meb, thanks for having me.

Meb: Podcast listeners, we’ll post show notes to today’s conversation at mebfaber.com/podcast. If you love the show, if you hate it, shoot us feedback at feedback@themebfabershow.com. We love to read the reviews. Please review us on iTunes and subscribe to the show anywhere good podcasts are found. Thanks for listening, friends, and good investing.