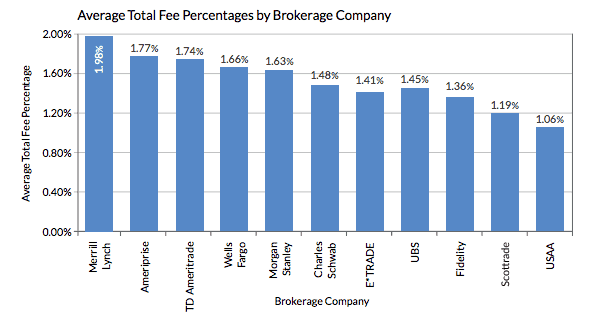

Personal Capital has a cool report called “The Real Cost of Fees” demonstrating just how much people lose to fees over a lifetime (it’s staggering).

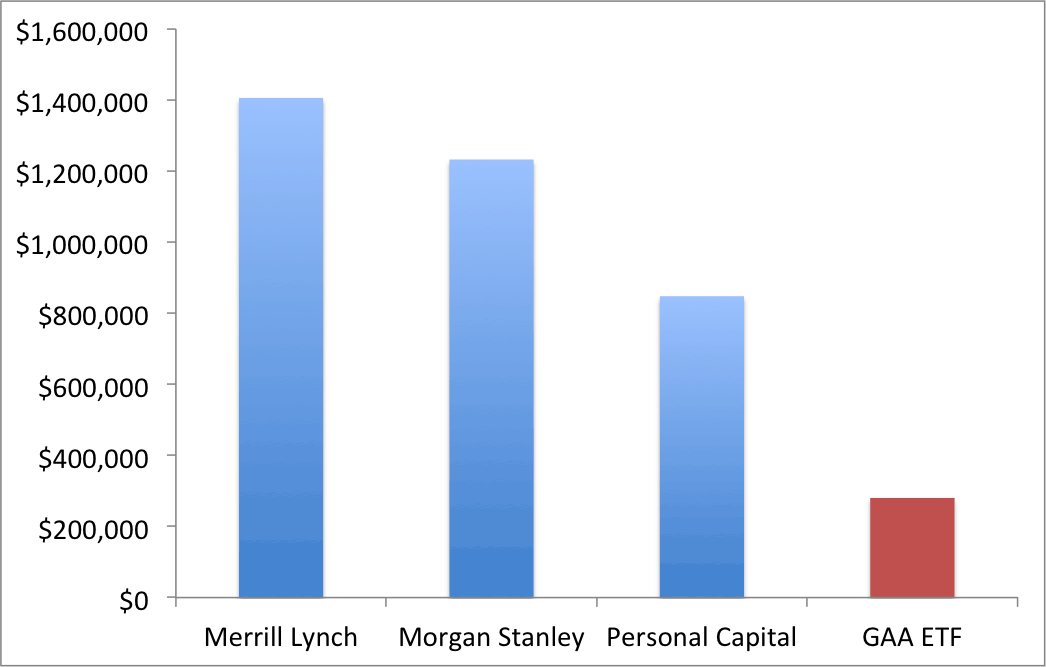

Assuming a $1 million portfolio – growing at 7% over 30 years – you would have paid Merrill Lynch $1.4 MILLION DOLLARS. (This includes management and underlying fund fees, some of which would be Merrill products and some not likely.)

Most people don’t think about this since the fees get skimmed off the top.

But what if you had to go deliver a briefcase full of $86,000 to your advisor in person? (Those are the fees that would be generated in year 30. Year 1 is “only” $19,800.)

Would you do that?

So, as you think about your lifetime investing goals, consider what you pay in fees. The example we used in my book demonstrated that by paying average fees (1% to advisor and 1.25% to mutual fund), then you would transform the TOP asset allocation strategy in the book into worse than the BOTTOM strategy.

This is the reason that my firm Cambria was the first to launch an ETF with a permanent 0% management fee, and total cost of only 0.29%. This is also one reason I’ve been so positive on the automated investment space, which has raised some nice assets in the past few years . (Vanguard $20B+, Schwab $4B+, Betterment $2.8B, Wealthfront $2.6B.)

If you’d like some more reading on the subject, I’ll even send you a free book.

I’d also be remiss to say that this doesn’t mean that an advisor isn’t worth 1-2%. If the advisor brings that much value to your life and financial situation then I have no problem with that. But ask yourself as you review your investment portfolio, is it $80k worth of value?

Total hypothetical amount paid in fees over 30 years at above fees percentages (GAA ETF is represented by 0.29% per annum)…