When was the last time you had an idea that resulted in the threat of your torture?

In the early 1600s, Galileo was expanding upon Copernicus’ idea that the earth revolves around the sun. The easy-going church was slightly less than enthused.

In short, things escalated… The Pope got involved… There was a trial… The threat of torture…

Eventually, Galileo was found “vehemently suspect of heresy” and sentenced to imprisonment. And just in case he wasn’t sure how the church really felt, Galileo was required to “abjure, curse and detest” his own heliocentric opinions.

Friends, I’m about to share an investing idea that many of you will abjure, curse and detest.

Why? It calls into question one of investing’s most sacrosanct ideas.

Just as the church couldn’t fathom the notion that the earth revolves around the sun, many readers will reject what I present. That’s because it suggests a beloved investing strategy – the center of the investing universe for many – might actually be shortchanging you. Even worse, research reveals if you exchange this sacred cow for the replacement strategy I’ll share, it could increase your returns by nearly 50%. And that’s just the start. This replacement strategy also carries huge tax benefits. The effect? Possibly an additional 1% a year in post-tax returns.

I can only hope this does not end with the threat of torture, or the modern equivalent, lots of grumpy email hecklers and anonymous comments across the financial blogosphere.

Killing Our Sacred Cows

The idea that might label me an investing heretic involves the beloved dividend-focused investing strategy.

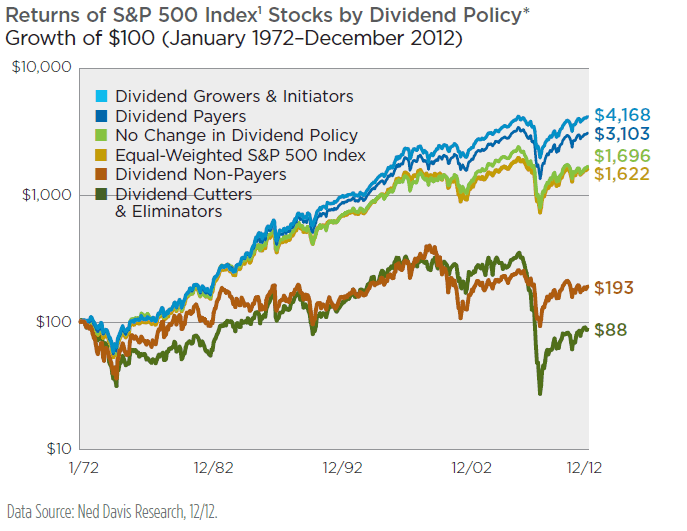

There is an abundance of research supporting the outperformance of dividend investing. I’m not calling that into question. A high yielding dividend approach has historically outperformed the broad stock market. (Although my focus has always been on cash flows as you can read about in my Shareholder Yield book.) If you Google “dividend stocks performance” you will find hundreds of charts demonstrating the historical outperformance of investing in dividend stocks. Below is one such chart going back to the 1920s.

Chart 1: Dividend Stocks Beat the Broad Market

But from time to time, I’ve had a question…

Research shows that a significant portion of the total return of a dividend strategy comes from the dividend payment itself. But over the years, dividends have been subject to various tax treatments. At times, high tax rates have substantially reduced this portion of returns. While currently taxed at 15%, at times dividends have been exempt from taxes, but at other times taxed at the individual’s income tax rate up to, and I’m not kidding, 90%.

Given this, I was curious whether we could create a strategy that replicated a dividend strategy’s total return – but without the actual dividend. If so, we could sidestep injurious tax treatments altogether and actually increase our after-tax returns.

In essence, I wondered: Can we create a superior dividend strategy…by avoiding dividends?

Building a Better Mouse Trap

Historically, dividend and value stocks share many similarities. So in my effort to find a “non-dividend dividend” strategy with similar returns to a normal dividend strategy, we used traditional value factors.

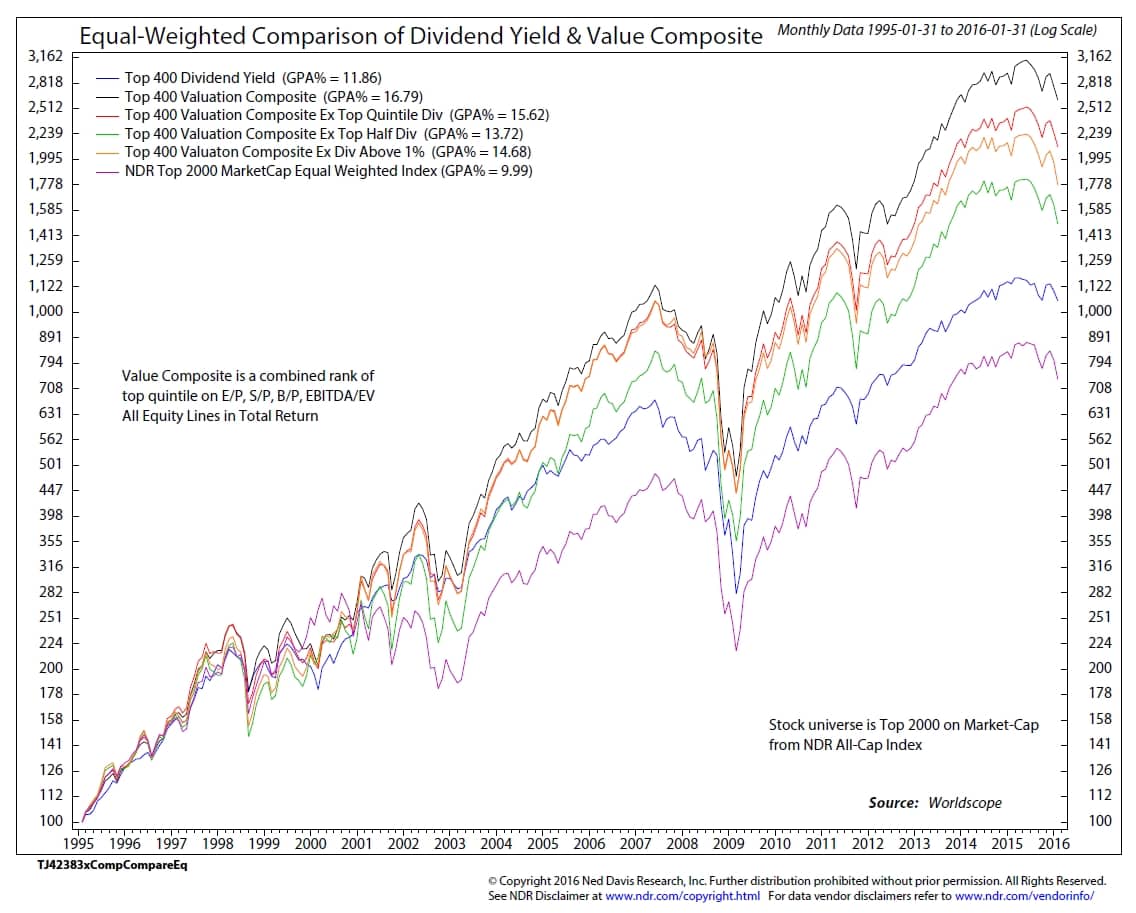

We had our friends at Ned Davis Research help us examine performance of the top 2,000 stocks (from the NDR All-Cap Index) since 1995. We then sorted the data into the following groups:

- Top 2000 stocks market cap weighted

- Top 2000 stocks equal weighted

- Top quintile dividend yield (400 stocks equal weight)

- Top quintile value composite (ranked by P/E, P/S, P/B, EV/EBITDA) (400 stocks equal weight)

- Exclude any stocks in top quintile dividend yield, then run value composite and select top 400, equal weight.

- Exclude any stocks in top half dividend yield, then run value composite and select top 400, equal weight.

- Exclude any stock with dividend above 1%, then run value composite and select top 400, equal weight.

(You can define “value” any number of ways. For our purposes today, we constructed our value composite by taking the top stocks by a combined rank of price-to-earnings, price-to-sales, price-to-book, and EBITDA-to-EV.)

As expected, the dividend strategy performs quite well. Since 1995, it beats the market return of 9.99% per year with an annualized return of 11.86%. But that’s where things go south for dividend-lovers….

Group 4, the top quintile of our value composite, crushed dividends. It returned 16.79% per year. As you can see in Chart 2, the other three value-based strategies outperformed dividends as well.

Chart 2: The Value Strategy Easily Outperforms the Dividend Strategy

Copyright 2016 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved.

See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/.

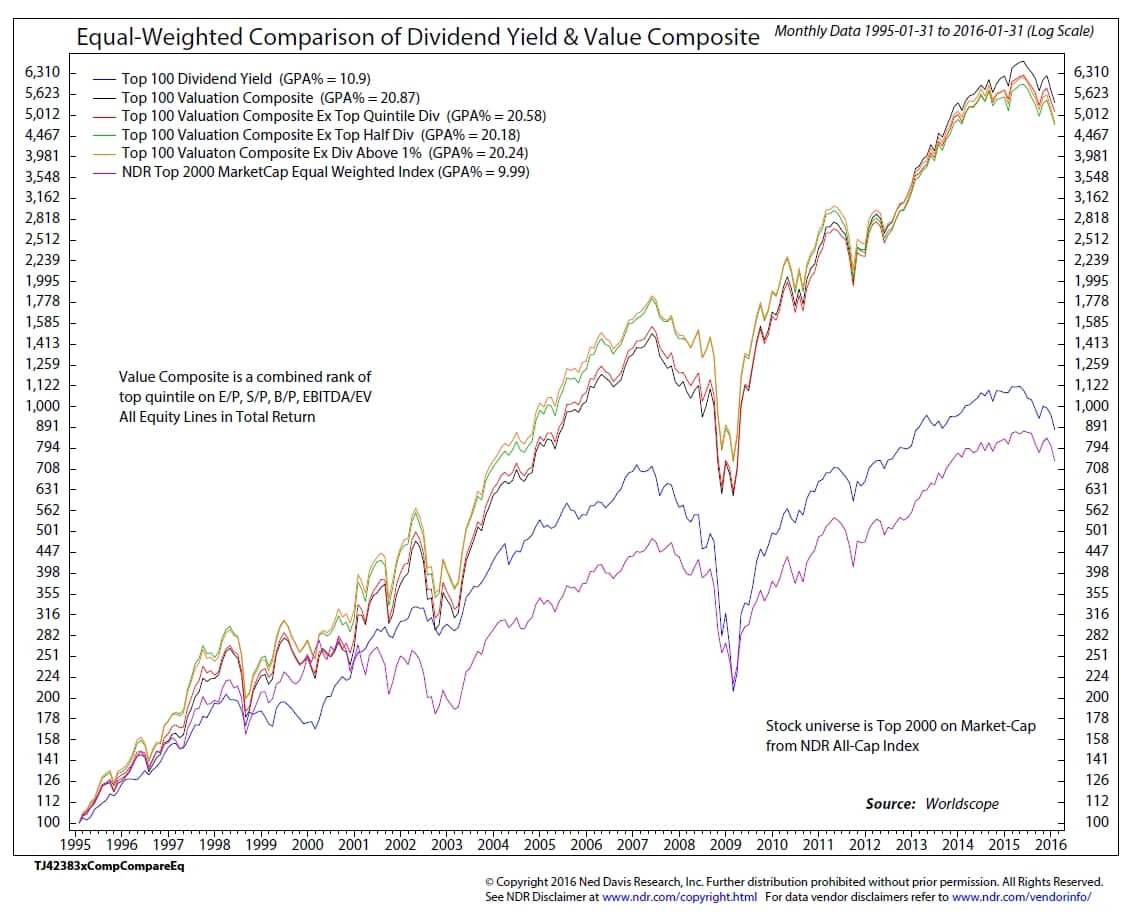

We also reran this study with 100 stocks versus 400 stocks. This is instructive for a few reasons.

First, this provides us a much tighter grouping of the value strategies and their performance. When you remove the dividend stocks it reduces your universe size, so at 400 names the 400 stock strategy is a bit diluted vs the more concentrated 100 name portfolio below.

Second – wow, look at that performance due to higher concentration.

And lastly, look at how much worse the dividend strategy performed than all of the value strategies. Recall that the top decile of dividend stocks is the highest yielding for a reason – they are junky companies that often have lots of debt and high payouts. So despite the fact that dividend stocks beat the market, there were much better choices if you wanted to find “value.”

Copyright 2016 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved.

See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/.

I was hoping to find a strategy that might approximate the returns of a dividend strategy as a starting point. As it turns out, by focusing on value and avoiding or eliminating dividends entirely, we were already miles ahead. But it was about to get better…

Remember, this is all pre-tax. When we account for Uncle Sam, the outperformance of the non-dividend dividend strategy is even more pronounced.

We ran some simulations and found that, depending on your tax rate and investment returns, avoiding the tax effect on dividends would have added somewhere between 0.33% to 1.5% per year to your after tax returns. And if dividend taxes ever go back up, that number can only get higher. But for practical reasons, we assume a 0.3% to 1.0% after tax benefit for avoiding dividend stocks. (This simulation also assumes a final long term capital gains tax of 15%.)

So if you are a taxable investor, and have a choice of two indexes with similar returns, you should prefer the one that pays low, or no dividends.

Why Hasn’t This Been Done? It Has…

Warren Buffett’s Berkshire Hathaway has never paid a dividend. Actually, that’s not true – they paid one single $0.10 dividend in 1967 and Buffett later joked, “I must have been in the bathroom when the decision was made.”

He later punctuated his no-dividend stance with a colorful quote, “All you get with Berkshire stock is that you can stick it in your safe deposit box, and every year you take it out and fondle it.”

So why does Buffett – someone who regularly invests in dividend-paying companies – avoid paying dividends to his own Berkshire shareholders?

In answering, let’s start with a different question – what does Buffett actually seek?

Buffett’s focus is on creating “value” for himself and his shareholders. His letters to shareholders are filled with practical advice on how managers create value – and destroy it. (They create it by buying mispriced, quality assets… They destroy it by repurchasing company shares at prices above intrinsic value, and so on…you can read one of his, and my favorite investing books on managing cash flows in The Outsiders.)

Through this “value” lens, dividends appear different to Buffett than they do most investors. It results in an interesting contrast: While the common opinion is that dividends are always valuable, to Buffett they can fall into the value-destroyer camp if there is a better use of that capital elsewhere.

The reason largely reduces to “opportunity cost.”

As we addressed earlier, dividends are highly tax inefficient. That’s the Achilles heel. So when compared with the other ways a company might use its free cash flow to generate greater value for investors (buying back shares, acquiring a cash-generating business, reducing debt and its carrying costs…) dividends can come up short.

(Here is a discussion summarizing Buffett’s thoughts on dividends in his 2012 letter to shareholders.)

So What’s a Dividend Investor to Do?

It starts by identifying an investing belief so common, we seldom even think to question it…

All dividends = value

As we’ve been discussing today, that’s not always true. So the first step is simply recognizing that dividends and value – while similar – are unique strategies.

Dividend stocks are often seen as value stocks. And that has historically been the case. But it’s not always the case.

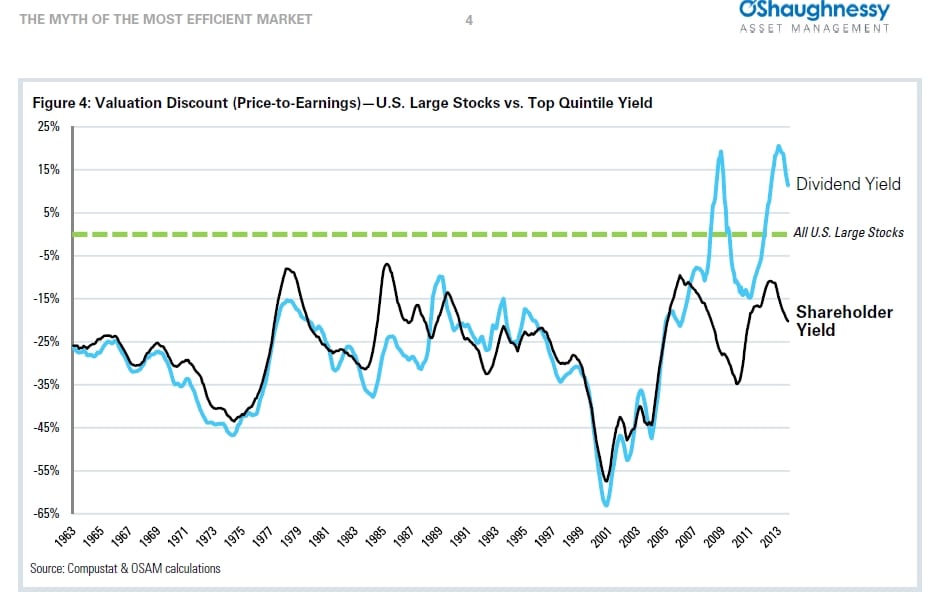

Below is a chart from our friends at O’Shaughnessy that demonstrates how high-dividend stocks have historically traded at roughly a 25% valuation discount to the overall broad stock market. Notice how dividend stocks move in lock-step with the shareholder yield strategy (more representative of the “value” strategy we’ve been discussing) most of the time. It’s this parallel movement which leads most investors to assume the two are the same.

But starting around 2007, these two strategies diverged. Multiple years and billions of dollars flowing into “high yield” investments caused dividend stocks, which are normally a value substitute and trade at about a 25% discount to the overall market, to now be more expensive than the overall market. Meanwhile, the shareholder yield strategy is trading far closer to its long-term average.

Not convinced dividend and value strategies are unique?

Below is a table from from Morningstar that shows the S&P 500, the largest dividend ETFs (VIG, SDY), and the large value category. Across most metrics the high yield strategies are more expensive than the S&P 500 and the large value category. Why would that be?

I’ve written before on how flows can change factors, and Patrick weighs in here too. Over time investing in dividend stocks works, but due to investor demand and flows, it doesn’t always work.

Source: Morningstar, as of 3/6/2016

So back to the question from a moment ago, “What’s a dividend investor to do?”

If you’re going to go for value, go for value – recognizing that a dividend-strategy alone does not always equal value.

Conclusion

I had started with a hypothesis: by avoiding dividends might we actually improve “dividend investing”? But by removing the dividend, it inadvertently refocused the selection methodology on pure value. My research turned out to be a backdoor way of reminding myself that value investing and dividend investing – while often confused as the same thing – are actually distinct strategies. And more times than not, value wins out.

Quick takeaways:

-

Dividend yield investing is rooted in value investing.

-

Historically, focusing on dividends rather than value, has been a suboptimal way to express value.

-

If you have to focus on dividends, you MUST include a valuation screen or process to avoid high yielding but expensive, junky stocks.

-

Since dividend stocks are expensive, we prefer a shareholder yield approach combined with a value composite screen.

-

Once you have a preferred value methodology, AVOIDING dividend stocks in the strategy could results in additional post tax alpha of approximately 0.3% to 4.5% for taxable investors.

Next step? We’re going to work with Wes and the crew at Alpha Architects to take these tests back to the 1960s. Stay tuned!