Can adding some complexity squeeze out some more performance?

In my paper, I examined how a simple timing method on 5 asset classes could improve the returns vs. a passive buy and hold allocation. I want to explore an additional area of research – timing the components of each asset class.

The 5 asset classes used in my study were the Standard and Poor’s 500 Index (S&P 500), Morgan Stanley Capital International Developed Markets Index (MSCI EAFE), Goldman Sachs Commodity Index (GSCI), National Association of Real Estate Investment Trusts Index (NAREIT), and United States Government 10-Year Treasury Bonds.

Instead of timing the entire asset class, it is possible to dice each asset class into smaller segments. Below is an example of the timing model on just the MSCI EAFE Index:

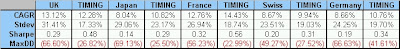

Instead of just timing the MSCI EAFE Index, why not apply to model to all of the constituents of that index? Japan, UK, France, Switzerland, and Germany make up roughly ~80% of the index. Below are the results of the timing model on the constituent countries:

Now, what do the results look like at the portfolio level? I equal-weighted each of the constituents, and the results are below for the passive equal-weighted buy and hold (B&H), and the timing applied to the constituents (Timing).

As you can see, the equal weighted portfolio approximates the MSCI EAFE Index fairly closely. Both of the timing models have similar return figures. Most important is that the timing model applied to the constituents is superior to the timing model on the index for the risk measures of volatility and drawdown, resulting in a higher Sharpe ratio.

This study could be repeated for the constituents of each asset class.

ETFs corresponding to the countries discussed in this column are:

Japan, EWJ

UK, EWU

France, EWQ

Switzerland, EWL

Germany, EWG